We developed a revolutionary blockchain payment platform that transforms cross-border transactions through multi-chain architecture. The platform enables seamless peer-to-peer transfers, fiat currency on/off ramping, and merchant payment processing with 99% uptime. Within 18 months, we achieved remarkable growth with 2.1 million users and 15,000+ merchant partners, processing $890 million in total transaction volume across 47 countries.

Project Overview

Implementation Overview

Implemented a chain architecture that facilitates peer-to-peer transfers and enables fiat currency on and off ramping alongside merchant payment processing with an impressive 99% uptime.

Within the 18 months of operation we successfully brought in 2.1 million users and partnered with over 15,000 merchants handling a transaction volume totaling $890 million.

Transform Your Payment Experience

Join millions using next-generation blockchain payment solutions.

Market Problems

Cross-Border Transaction Challenges

Cross border transactions are burdened with high charges and sluggish processing times due to intricate regulations in place. Legacy financial systems heavily depend on banking networks that tack on 2 to 4 steps per transaction leading to fees and delays at each juncture.

Transferring funds across remittance channels poses added difficulties when dealing with emerging economies:

- •Limited banking facilities

- •Unstable currency rates

- •Uncertain regulations

Current Market Statistics

Market studies have shown that around 1.6 billion individuals worldwide don't have bank accounts yet the current digital payment platforms impose fees ranging from 6% to 9% on transactions. Small enterprises encounter difficulties in entering markets owing to complex payment procedures and stringent merchant account prerequisites.

Merchant and User Barriers

Merchants encountered constraints when accepting payments due to:

- •Need for extensive documentation from conventional processors

- •Geographic limitations

- •High fees ranging from 2% to 5%

The fluctuating nature of cryptocurrencies hindered acceptance as wallet management complexities posed security threats for individuals with limited technical expertise.

Settlement delays lasting 3 to 6 business days with transaction fees around 6% significantly impact low-income individuals sending money to family members overseas.

Solution Architecture

Core Infrastructure

The foundation structure focused on a multi-chain blockchain system that supports:

- •Ethereum

- •Polygon

- •Binance Smart Chain networks

This architecture enhances transaction efficiency and speed while ensuring affordability and overall performance optimization.

Security Implementation

Implemented a multi-signature wallet system with integrated hardware security module to reduce security vulnerabilities and eliminate the risk of a single point of failure in managing funds.

Fiat Integration

Integrating fiat on/off ramps with money service businesses and banking partners in key markets while using automated liquidity management protocols to uphold ideal reserve ratios and reduce exposure to cryptocurrency volatility through dynamic hedging strategies.

The custody model balanced security and user experience effectively by decentralizing its approach to accommodate both advanced users' needs and ensuring recovery options are available.

Platform Benefits

Improved Settlement Times

The time taken for transfers to settle has been significantly reduced from 3-6 days to 15 minutes thanks to blockchain settlement rails. This improvement not only benefits recipients by enhancing cash flow but also instills greater confidence in senders.

Reduced Transaction Costs

Transaction costs have been decreased by reducing remittance charges from 6,500 basis points to 1,400 basis points through the removal of correspondent banks and the optimization of blockchain transaction fees.

Enhanced Merchant Access

The obstacles hindering merchants from accepting payments have been eliminated. Now they can easily adopt cryptocurrency through an API integration. This streamlined process reduces setup time significantly from weeks to hours while ensuring adherence to compliance standards.

Financial Inclusion

Financial inclusion has been broadened by allowing unbanked individuals to create wallets and access payment services with a simplified approach and minimal paperwork.

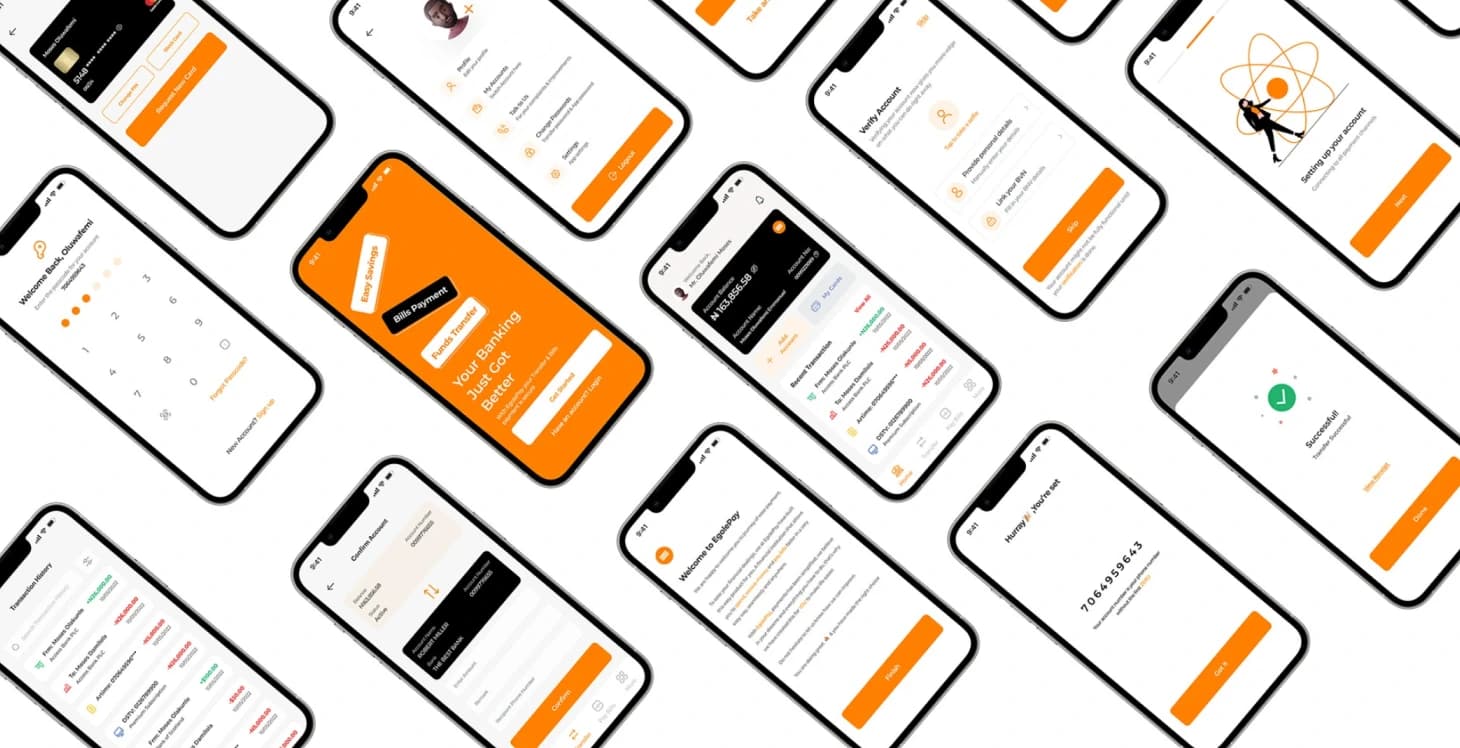

Deployment Strategy

The project advanced through a three-stage deployment plan giving precedence to security and regulatory adherence before expanding operations.

Stage 1: Infrastructure Setup (Months 1-6)

Blockchain connections established securely with wallet features and strong security measures in place. Smart contracts were rigorously tested and verified before being launched on the network.

Stage 2: Beta Testing (Months 6-9)

Integration tools developed and tested with select merchant partners and early adopter users.

Stage 3: Market Rollout (Months 9-12)

Launched comprehensive tools for merchants to integrate and mobile apps for consumers. Expanded KYC/AML processing capabilities with features like:

- •Recurring payments

- •Invoicing

- •Bulk transfers

Performance Results

User Adoption

The adoption by users surpassed expectations with:

- •2.1 million registered accounts

- •890,000 active users per month at the 12-month mark

- •Users spread across 47 countries

Highest numbers concentrated in Southeast Asia and Latin America as well as the remittance corridors in Sub-Saharan Africa.

Transaction Volume

The total transaction volume hit $890 million with:

- •Average of $240 for peer-to-peer transfers

- •Average of $85 for merchant payments per month

Transaction breakdown:

- •Remittances: 45%

- •Merchant transactions: 32%

- •Peer-to-peer payments: 23%

Merchant Growth

Merchant acceptance grew due to simplified integration methods and competitive fee structures:

- •More than 15,000 merchants successfully incorporated payment processing services

- •Average monthly transaction value of $12,500 per merchant

- •E-commerce transactions: 67% of total merchant transactions

- •Point of sale payments: 33%

The KYC verification processing time at the 95th percentile is less than 24 hours, specifically around 18 hours.

Key Success Factors

Regulatory Compliance

Prioritizing regulatory compliance from the start was crucial as investing in compliance frameworks and infrastructure was key to sustainable growth. Proactive engagement with regulators not only shortened approval timelines but also helped prevent service interruptions in important markets.

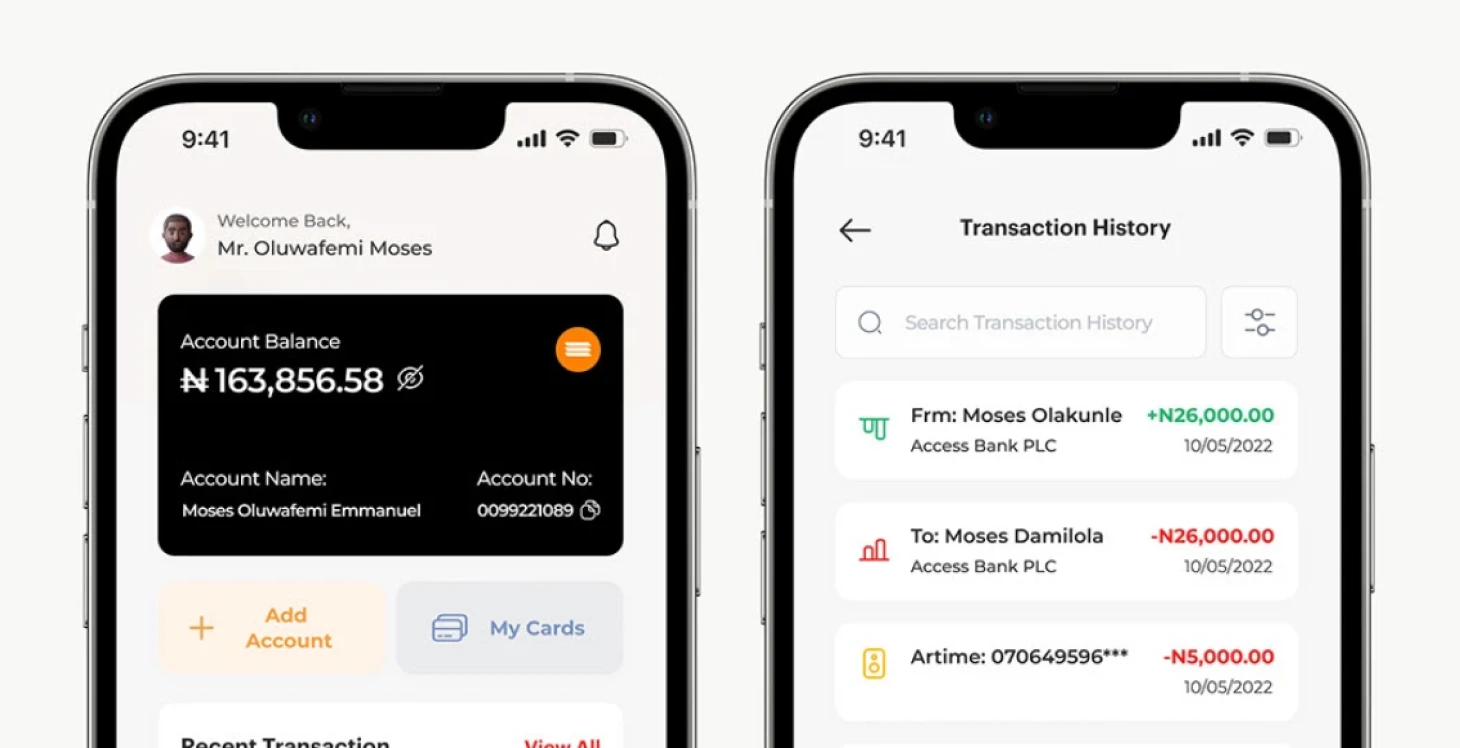

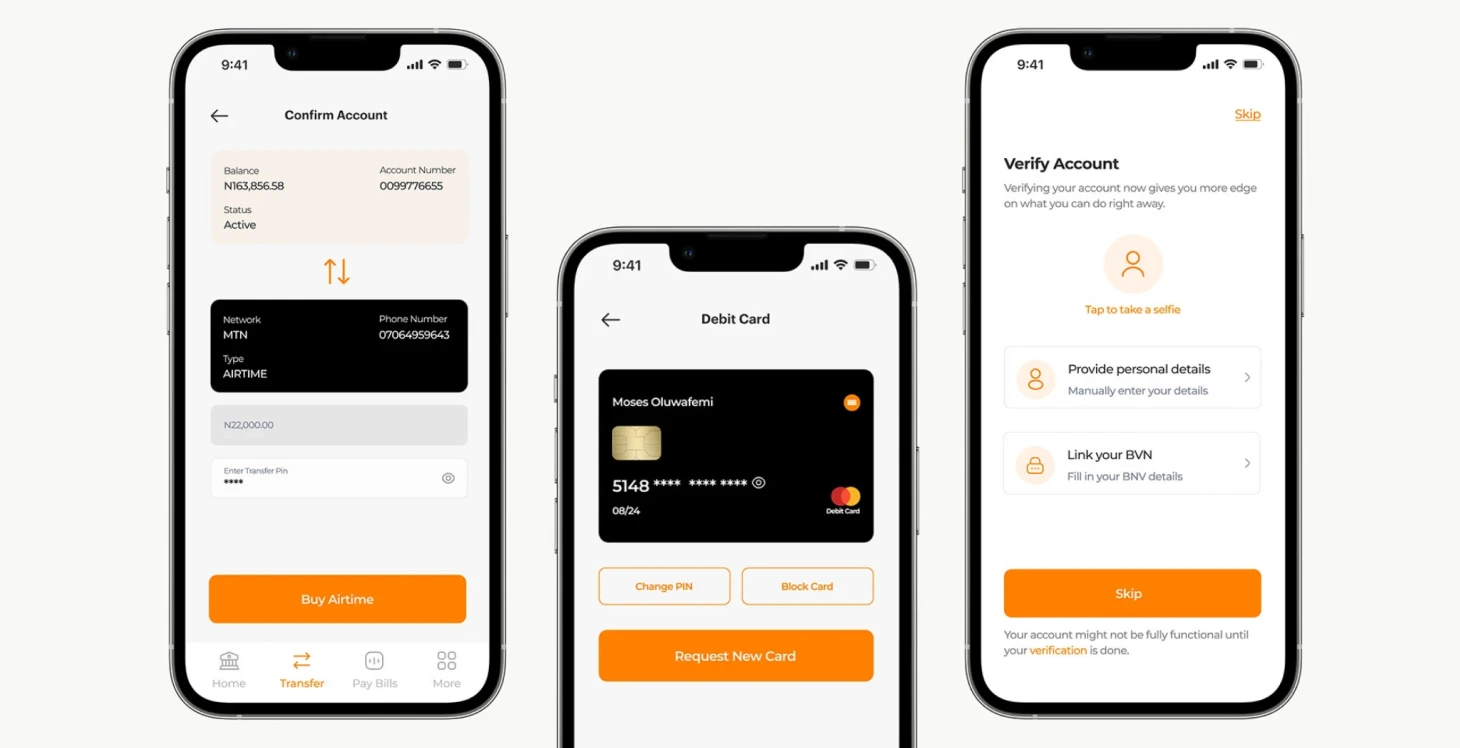

User Experience Focus

The simplicity of user experience saw wider acceptance thanks to progressive feature revelation. Beginners found value in managed services while seasoned users had access to advanced functionalities. Mobile-first design strategies led to a 340% boost in engagement rates compared to desktop-focused approaches.

Multi-Chain Advantages

Diversifying networks led to a 63% decrease in transaction expenses alongside enhanced throughput capabilities. Cross-chain bridge protocols achieved optimal routing by considering transaction attributes and urgency.

Security Architecture

The strategy of using multiple security measures in layers, known as defense-in-depth architecture, effectively prevented vulnerabilities at single points by incorporating various security controls. No major security issues occurred during the deployment phase.

Technical Infrastructure

The platform demonstrated significant enhancements in efficiency and financial performance after complete implementation while improving user experience across all dimensions. Continuous monitoring systems provide real-time threat detection and response capabilities, ensuring platform security and reliability.

Technology Stack Overview

| Component | Technology | Purpose |

|---|---|---|

| Backend Services | Node.js + Express.js | API and business logic |

| Message Queue | Apache Kafka | Event streaming and processing |

| Blockchain Networks | Ethereum, Polygon, BSC | Multi-chain transaction processing |

| Security | HSM + Multi-sig | Secure key management |

| Testing Framework | Hardhat | Smart contract development and testing |

Project Results

- 2.1 million registered users across 47 countries

- $890 million total transaction volume processed

- 15,000+ merchant partners integrated

- 99% platform uptime achieved

- 63% reduction in transaction costs vs traditional methods

Key Performance Metrics

Transaction Volume

Total processed volume

User Base

Registered accounts

Merchant Partners

Active merchants

Platform Uptime

System availability