Traditional methods of raising funds have often built walls between startups in their early stages and potential local investors. This has restricted the flow of capital and reduced investment opportunities for both parties involved.

Project Overview

Platform Structure and Compliance

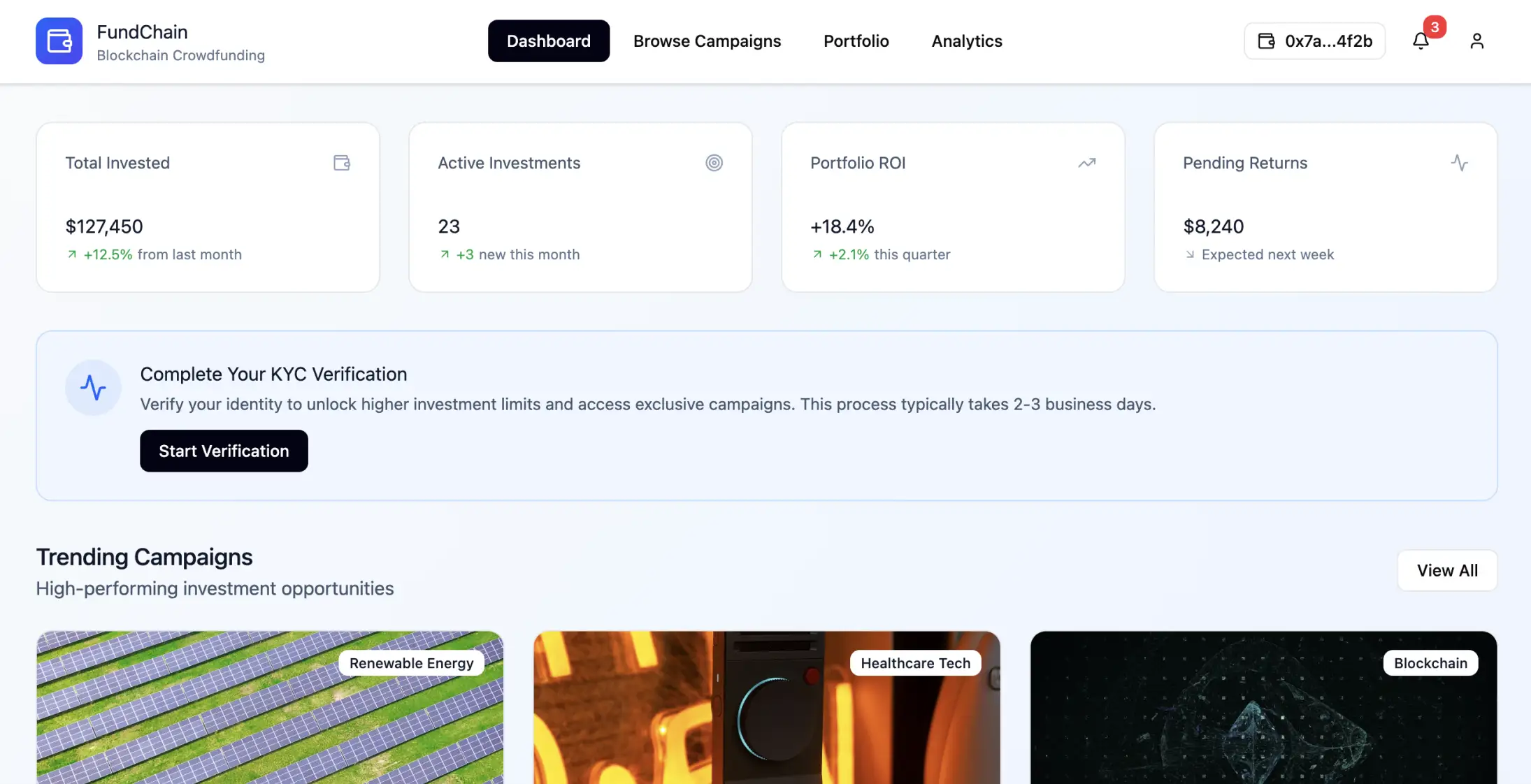

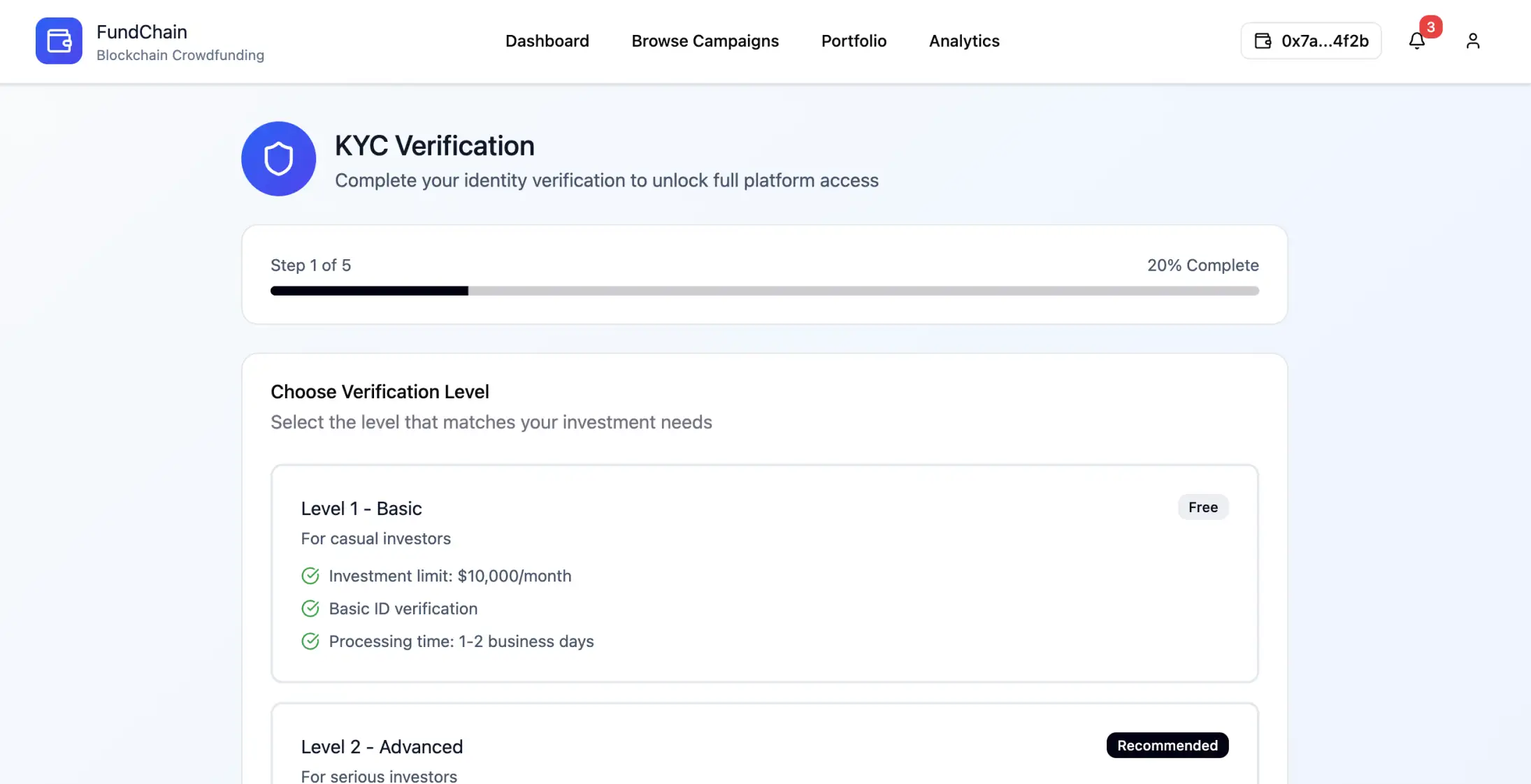

The platform's structure focused on adhering to regulations by utilizing automated processes for Know Your Customer (KYC) and Anti Money Laundering (AML), maintaining transaction records through blockchain technology, and providing real-time analysis for campaigns.

The new strategy led to a 340 percent rise in funding completions and trimmed investor onboarding time from five days to just two hours while keeping regulatory compliance at an impressive 99.9 percent level.

Community Impact and Results

Community involvement tools led to a 65 percent boost in investor loyalty compared to traditional platforms. Moreover, campaign visibility on average surged by 280 percent.

The total cost of the platform decreased by 42% thanks to using cloud-based architecture and automated fintech solutions compliance processes.

Investment Landscape Transformation

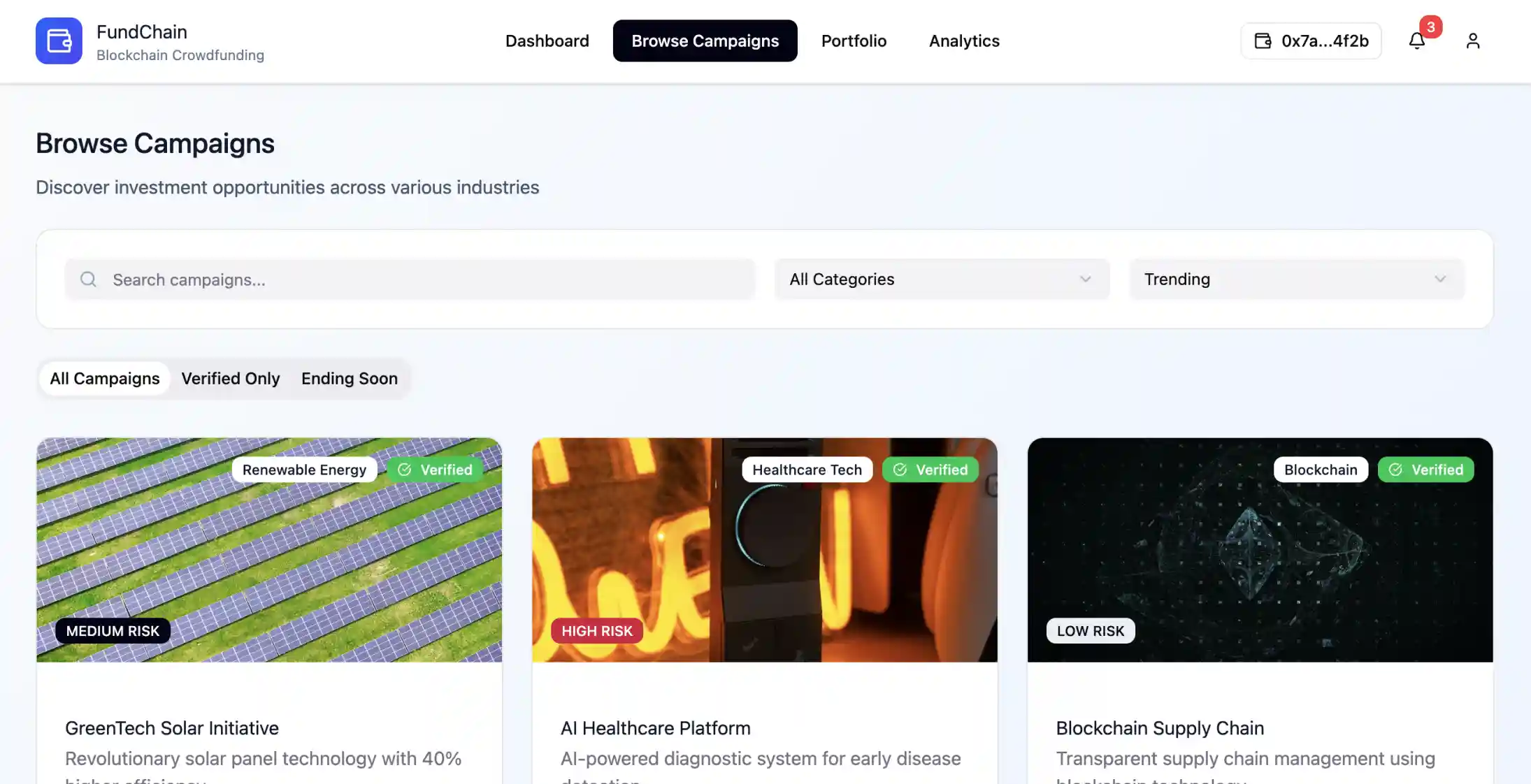

The realm of investments has seen significant change as everyday investors now look for direct entry into early-stage ventures typically only available to accredited investors. Through regulations such as the JOBS Act facilitating crowdfunding platforms have emerged; however, they have also brought about compliance rules concerning investor validation, disclosure norms, and transaction oversight.

Modern Startup Needs

Startups nowadays need more than money. They rely on communities for market validation and customer engagement in the long run rather than just short-term gains from traditional venture capital models that often favor big players and overlook smaller investors with diverse viewpoints on DeFi platforms.

Platform Challenges

Technical Limitations

The current crowdfunding websites faced issues with:

- •User interaction being subpar

- •Lack of transparency in operations

- •Complex compliance procedures

- •Inadequate community development tools

Technical debt resulting from legacy systems caused obstacles to scalability, whereas uncertain regulations required flexible architectures to meet changing needs.

Startup Difficulties

Startups had a difficult time dealing with fundraising methods that involved:

- •Handling various investor connections

- •Managing extensive paperwork

- •Coordinating multiple communication channels

The manual verification processes caused delays lasting for weeks in getting investors on board, which led to decreased momentum in campaigns and conversion rates.

Investor Challenges

Investors encountered challenges with:

- •Limited fund usage information

- •Inadequate investigation resources

- •Portfolio communication issues

- •Security concerns surrounding financial data

- •Transaction reliability concerns

These issues hindered the platform's acceptance by users.

Platform Operations

Platform operators required systems that could manage reporting across regions while expanding to accommodate numerous simultaneous campaigns efficiently. Manual compliance procedures caused operational delays and raised the risk of regulatory issues.

Technical Requirements

The project had specific needs like processing transactions instantly and verifying documents automatically while ensuring secure communication among multiple parties and maintaining detailed audit trails. The system had to accommodate various investment formats such as equity shares or debts and adhere to regulations for different security categories.

Key Improvements

Accessibility Enhancement

Reduced the minimum investment requirement from $25k to $250 for improved access to capital and increased investor base by 1,200%, facilitating startups to connect with broader communities.

Compliance Automation

Automating compliance led to a 68 percent decrease in processing costs by removing KYC processing delays and achieving 99 percent accuracy in regulatory matters through automated verification processes.

Trust Through Technology

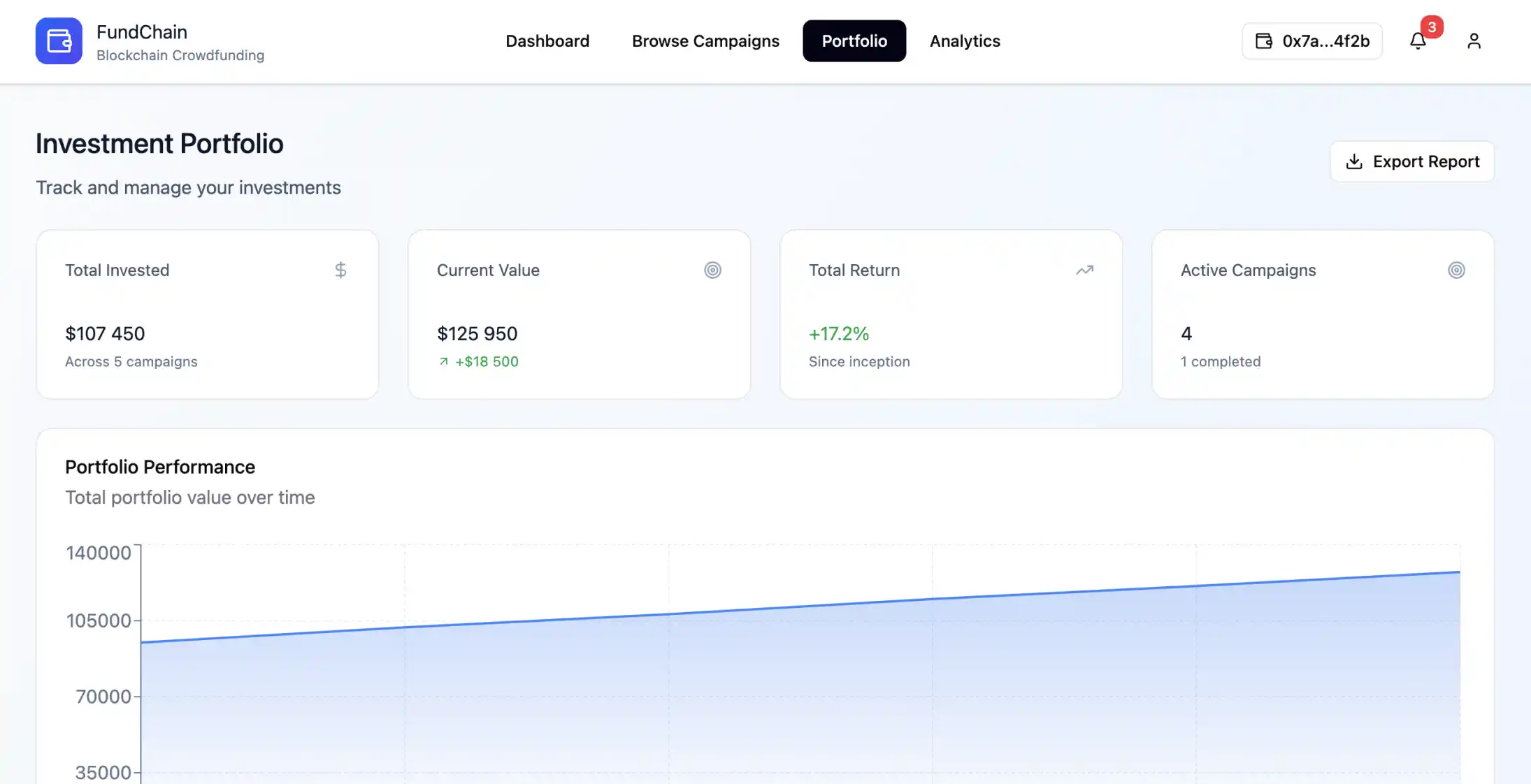

Enhancing investor confidence through blockchain technology led to:

- •85% boost in investor trust scores

- •73% increase in repeat investments

- •Greater transparency in transactions

- •Real-time tracking of fund utilization

Community Engagement

Integrated social elements and progress tracking milestones resulted in:

- •65 percent increase in investor retention

- •280 percent surge in campaign sharing

Cost Optimization

The optimization of costs was achieved through implementing cloud-native architecture and automated procedures, resulting in:

- •42 percent reduction in platform operational expenses

- •Accommodation of 15-fold increase in transaction volume

Market Speed

The optimization of market speed allowed startups to bring campaigns to market in 8 days compared to the previous 6 weeks. This enhancement enables startups to seize market opportunities efficiently.

Transform Your Investment Platform Today

Discover how modern crowdfunding solutions can revolutionize your fundraising approach.

Architecture Overview

Microservices Approach

The platform utilized a microservices approach based on domain-driven design principles, involving:

- •Splitting tasks like campaign management and investor relations into independent services

- •Maintaining consistency across investment processes through event-triggered architecture

- •Better coordination between components and streamlined workflows

Compliance by Design

When designing for compliance-by-design principles, automated verification pipelines were incorporated with third-party KYC providers and government databases for smooth investor onboarding processes.

Blockchain Integration

The integration of blockchain ensured that transaction records were secure and unchangeable while smart contracts automated investment terms. Traditional databases managed high-frequency operational data usage effectively in a hybrid architecture model that balanced regulatory privacy constraints with performance optimization needs.

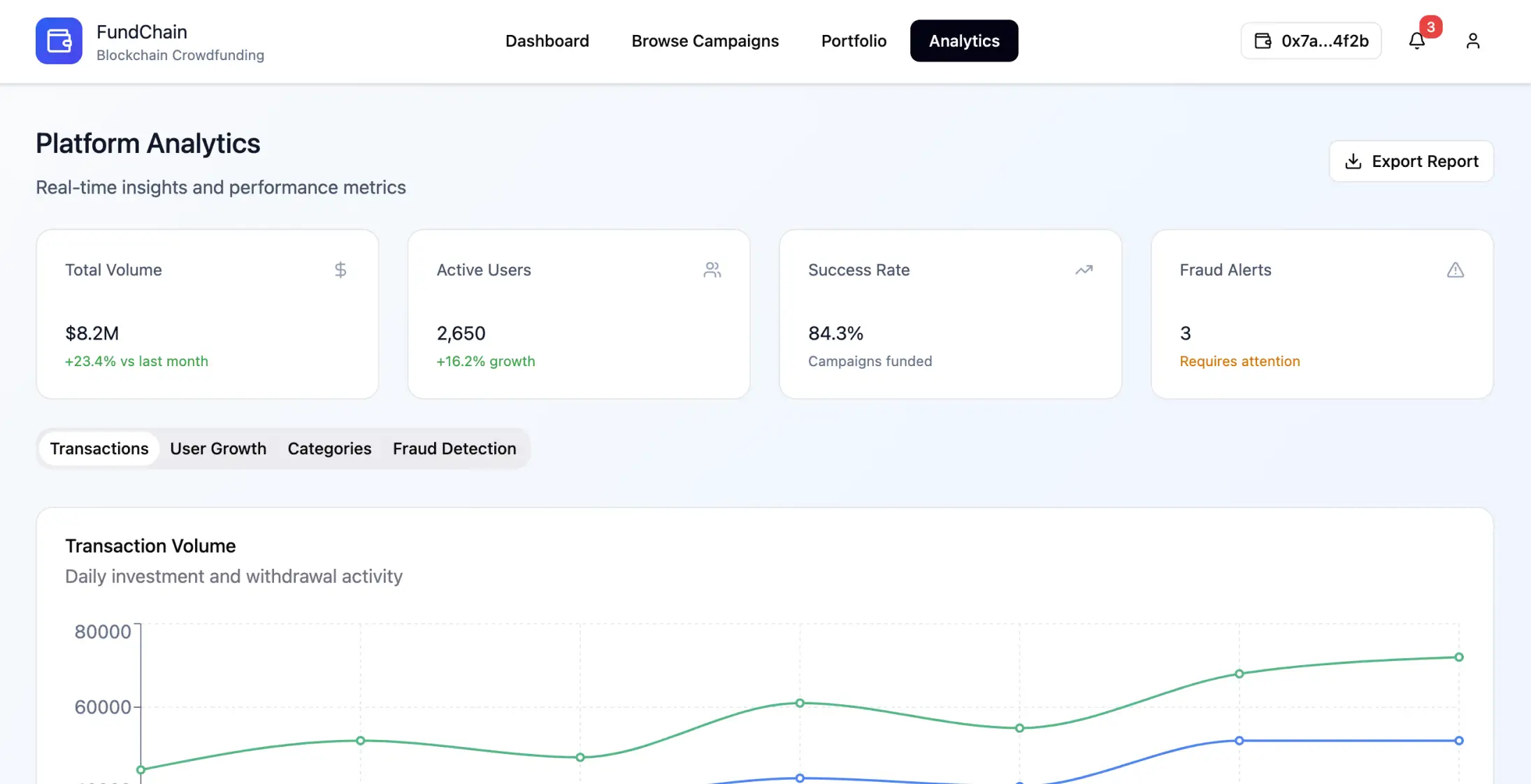

Real-time Analytics

Real-time data analysis and machine learning algorithms were used for:

- •Fraud prevention measures

- •Risk evaluation

- •Providing personalized investment suggestions

- •Interactive community features like progress-based interaction methods

- •Investor forums and collaborative research tools

System Components

API Gateway Service

The API Gateway service includes:

- •Managing request routing and authentication

- •Rate limiting and API versioning

- •OAuth 2.0 and JWT tokens for security purposes

User Management Service

User Management Service includes:

- •Integration with identity providers

- •Role-based access control

- •Multi-factor authentication

- •Support for social login providers

Campaign Management Service

Campaign Management Service organizes projects with media asset control and automates campaign processes through approval procedures.

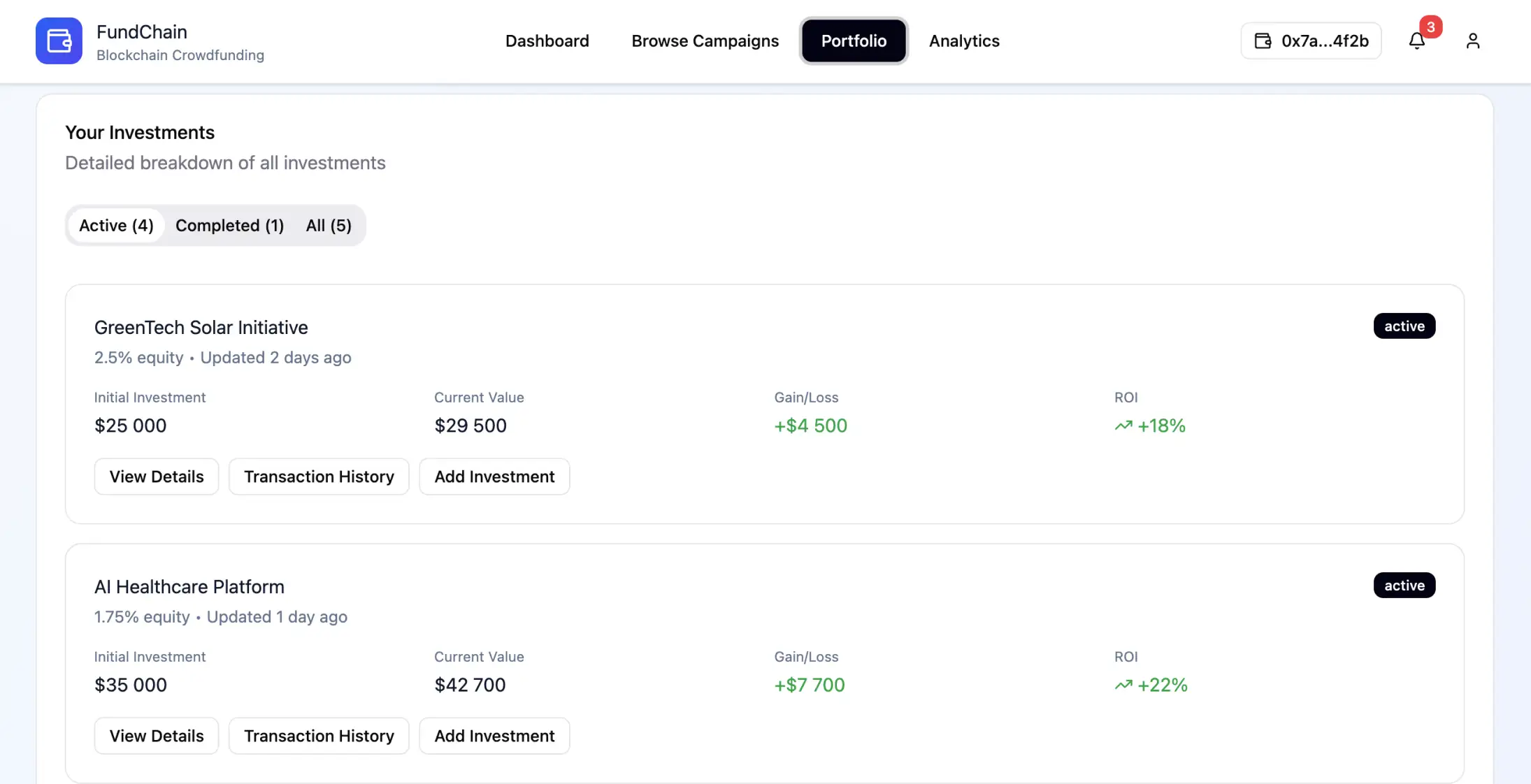

Investor Service

Investor Service includes:

- •KYC and AML processing tasks

- •Accreditation verification

- •Portfolio management

- •Investment history tracking

Payment Processing Service

Payment Processing Service includes:

- •Managing transactions in multiple currencies

- •Handling escrow services

- •ACH/wire transfers

- •Cryptocurrency integrations

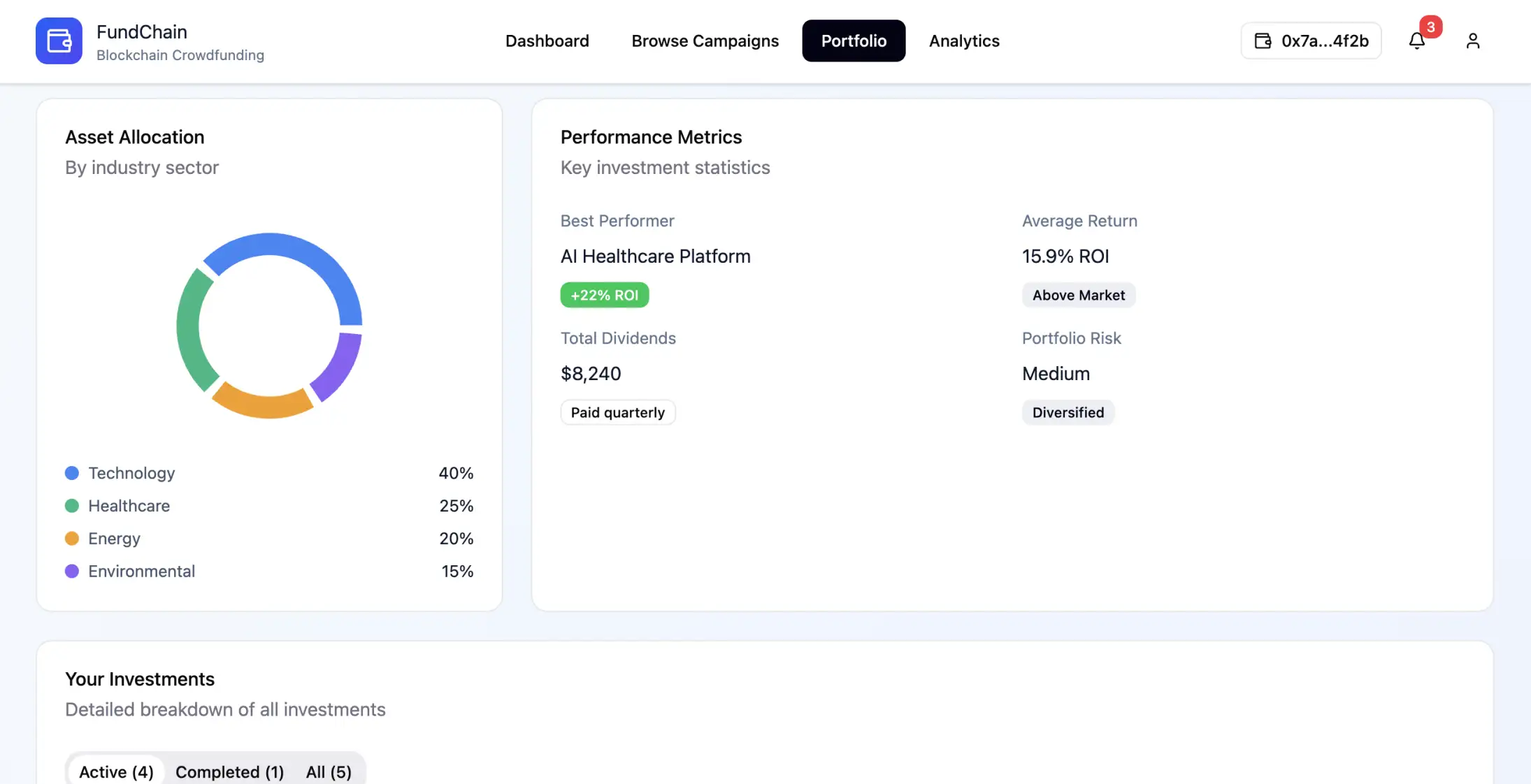

Analytics Service

Analytics Service offers:

- •Real-time data analysis tools

- •Live metrics tracking

- •Fraud detection systems

- •Recommendation engines

- •Comprehensive reporting support

Notification Service

The Notification Service allows for multi-channel communication through:

- •Email and SMS

- •Preference management

- •Required compliance disclosures

Data Architecture

Database Design

The data design incorporated event sourcing to meet audit demands and used separate databases for reading and writing tailored to various usage scenarios. Campaign information was stored in document repositories to allow for schema changes, while financial transactions were managed using ACID-compliant databases.

Security Implementation

The security setup involved:

- •End-to-end encryption to protect sensitive information

- •Field-level encryption for Personally Identifiable Information (PII)

- •Zero-trust network architecture for enhanced security measures

- •API security measures including TLS, request signing, and thorough input validation

Observability Strategy

The observability strategy encompassed:

- •Distributed tracing and structured logging

- •Business metrics gathering

- •Real-time dashboards

- •Automatic alert systems for compliance monitoring throughout all platform engagements

Implementation Process

Phased Rollout

The process began with focusing on building the platform structure and streamlining investor onboarding procedures in stages. Initially, the system was rolled out in a limited area to confirm that compliance processes were automated effectively before extending to support multiple jurisdictions.

Development Infrastructure

The development setup utilized:

- •Infrastructure as code with Kubernetes orchestration

- •Secure deployments across development and production environments

- •CI/CD pipelines with security checks and automated testing

- •Compliance requirement validation at all stages

Testing Approach

The testing approach focused on:

- •Ensuring compliance in various situations

- •Load testing for high-volume campaign launches

- •Security penetration testing

- •Automated regression testing for investor protection workflows

- •Chaos engineering to assess system resilience during failures

Migration and Risk Management

Data Migration

The plan for migrating existing users involved a gradual shift of data while both systems ran concurrently during switchover phases to ensure a smooth transition with minimal disruption to user access and compliance with investment portfolio regulations.

Risk Mitigation

Risk management involved:

- •Backup plans and disaster recovery strategies

- •Ensuring business continuity during disruptions

- •Automated compliance monitoring and regular audits

- •Legal reviews for platform updates

Third-party Integration

Careful assessment of third-party integrations was necessary to meet security and reliability standards as well as compliance requirements. Thorough scrutiny and integration testing were conducted on payment processors, KYC providers, and communication services.

Results and Impact

Performance Improvements

The platform's overhaul led to significant enhancements in efficiency and user satisfaction as well as key business performance indicators. Campaign success rates saw substantial boosts due to improved user experience and community engagement functionalities.

Compliance Excellence

The automation of compliance processes removed bottlenecks while maintaining regulatory accuracy standards, leading to increased investor confidence through enhanced transparency features and improved security measures.

Enhanced Engagement

Improvement in investor involvement and startup-investor connections saw significant boosts based on community engagement metrics, with higher retention rates and increased investment amounts per user driven by interactive features and transparency tools.

Scalability Success

The platform's ability to handle increased transaction volume by 15 times while meeting performance standards was enhanced through scalability improvements, maintaining favorable economics for growth by optimizing costs with cloud-native architecture.

Key Learnings

Compliance by Design

Implement compliance-by-design principles to ensure growth in new markets by integrating regulatory requirements into the core architecture from the outset rather than as external constraints to avoid technical debt buildup and reduce compliance expenses in the long run.

User Experience Focus

User testing and iterative design play crucial roles in enhancing user experience within complex financial processes, where progressive disclosure methods are utilized to simplify information management while ensuring compliance with regulatory disclosure standards.

Community Benefits

The community aspects brought significant benefits through network effects and user-generated content, enhancing the quality of investor interactions and collaborative research efforts, thereby reducing risks associated with the platform.

Challenges and Solutions

Automation Limitations

Automation efforts in compliance were initially unsuccessful because they did not adequately address edge cases that may arise. Regulations frequently include exceptions requiring human supervision, even within automated frameworks.

Blockchain Integration Challenges

Integrating blockchain required careful evaluation of scalability and privacy concerns along with meeting regulatory standards through careful trade-offs. Pure blockchain approaches fell short in meeting demanding high-frequency needs, prompting the need for hybrid setups.

Fraud Detection Balance

Real-time fraud detection managed to prevent significant losses but also created false positives that affected user experience negatively. Continuous optimization of machine learning models was needed, taking into account evolving patterns in fraudulent activities and user behaviors.

Dependency Management

Having multiple third-party services created potential vulnerabilities. Backup options were necessary, especially for essential services such as payment processing and identity verification, to ensure continuity in case of failures with primary providers.

Performance Optimization

During high-usage periods, bottlenecks were discovered in complex queries and real-time data analysis, which were resolved through improved caching methods and database optimization for notable enhancements in efficiency and speed.

Platform Performance Metrics

| Metric | Before | After | Improvement |

|---|---|---|---|

| Funding Completion Rate | Standard Rate | +340% | 340% increase |

| Investor Onboarding | 5 days | 2 hours | 98% reduction |

| Regulatory Compliance | Variable | 99.9% | Consistent excellence |

| Investor Loyalty | Baseline | +65% | 65% improvement |

| Campaign Visibility | Standard | +280% | 280% increase |

| Platform Costs | Baseline | -42% | 42% reduction |

This comprehensive transformation of the crowdfunding platform demonstrates how modern technology, thoughtful architecture, and user-centered design can revolutionize traditional fundraising methods while maintaining strict compliance and security standards.

Project Results

- 340% increase in funding completions

- 99.9% regulatory compliance achieved

- 98% reduction in investor onboarding time

- 65% boost in investor loyalty

- 42% reduction in platform costs

Key Performance Metrics

Funding Growth

Increase in funding completions

Compliance Rate

Regulatory compliance accuracy

Onboarding Speed

Reduction in processing time

Cost Optimization

Platform cost reduction