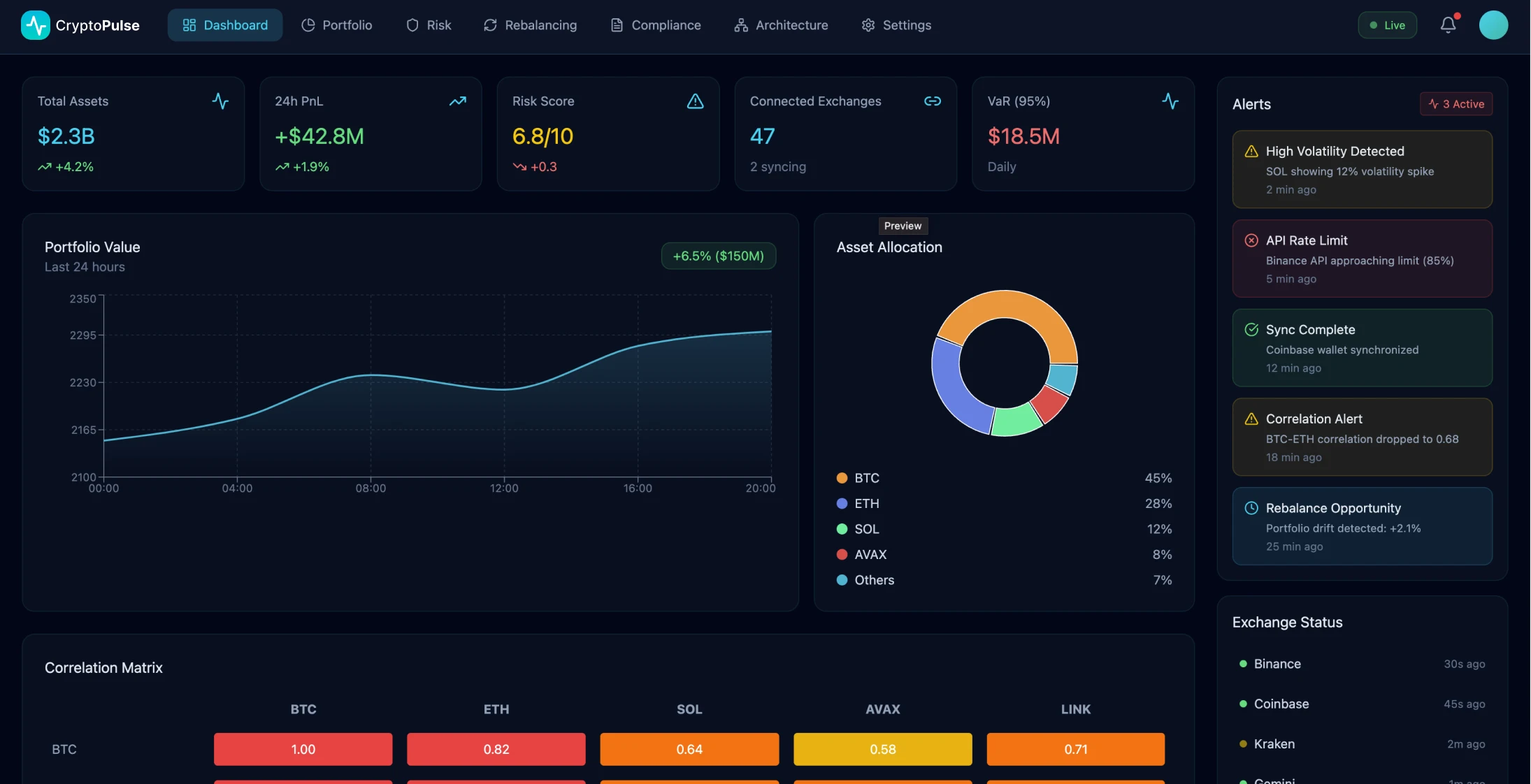

We developed a comprehensive cryptocurrency portfolio management platform that addresses the fragmented nature of crypto asset tracking across multiple exchanges and DeFi protocols. The platform consolidates portfolio data from 47 different exchanges and wallet providers, managing over $2.3 billion in tracked assets while providing real-time risk analytics and automated compliance reporting for institutional portfolio managers.

Project Overview

The Challenge

The visibility of investment portfolios was inconsistent across exchanges and wallet providers, leading to challenges in monitoring risks and performance for both retail investors in the cryptocurrency market.

Market Fragmentation

The world of cryptocurrency works within a system of exchanges and storage options that are not interconnected like financial systems are with their standardized data flows and clearances. Instead, crypto assets are stored in separate entities with different API norms and authentication processes, which results in a fragmented landscape of information structures and formats.

Volatility Impact

The complexity is heightened by the market's volatility impact on assets like Bitcoin and altcoins, which can see fluctuations within periods of time exceeding 80%. To manage this effectively and make decisions quickly in moving markets requires portfolio managers to have constant access to position data and risk metrics and maintain awareness of correlations between assets.

Compliance Complexity

Navigating through obligations complicates matters. Keeping tabs on tax details across regions necessitates monitoring of costs in numerous small transactions. Financial entities are obligated to uphold records to adhere to anti-money laundering (AML) and know your customer (KYC) rules and regulations.

Key Problems Identified

Portfolio managers encountered hurdles that were beyond the scope of conventional investment instruments to tackle:

- •Managing investments spread out among platforms like Binance and Coinbase Pro along with using hardware wallets like Ledger and DeFi protocols resulted in portfolio insights due to data fragmentation issues

- •Tracking these investments manually through spreadsheets led to error rates of 15-20% caused by overlooking transactions and outdated pricing data

- •The decision making process in a paced environment like cryptocurrency trading is crucial due to the market's operation and rapid price fluctuations often surpass 10% within minutes

Inaccurate or delayed portfolio information could result in less than optimal trading choices and higher slippage expenses.

Operational Burden

Operational Burden

- •During times of market stress events when correlations among assets increased levels caused by the lack of real-time correlation analysis and value at risk (VaR), portfolios ended up holding risky concentrations in correlated assets

- •The operational burden of reconciling tasks amounted to 8-12 hours per week for each portfolio manager necessitating accounting assistance for cost basis computations essential for taxation purposes

- •Balancing security with accessibility dilemma: The strict security measures of storage clashed with the desire for instant portfolio updates and speedy trade transactions

Solution Results

Portfolio Consolidation

Managers gained insight into $2.3 billion in tracked assets by consolidating data from 47 exchanges and wallet providers to remove portfolio blind spots.

Cost Reduction

- •Managed to cut down costs by 75% thanks to automated reconciliation and instant synchronization

- •This shift allowed portfolio managers to dedicate time to planning rather than getting caught up in data collection

- •Cost savings achieved by implementing API rate limiting and caching resulted in a 62% reduction in third-party data expenses along with an enhancement in response times from 2.5 seconds to 340 milliseconds

Performance Improvements

- •Enhanced risk-adjusted returns by 23% using correlation analysis and early warning systems to manage portfolio concentration risks

- •Streamlining compliance reporting has slashed the time needed from 40 hours to 3 hours per quarter by utilizing automated cost basis tracking and generating reports efficiently

- •Reduced trading expenses by 31% utilizing execution routing and identifying real-time arbitrage opportunities across trading platforms

Advanced Security & Performance

99.98% uptime with enterprise-grade security features and regulatory compliance standards.

Technical Architecture

System Design

The system used a microservices design along with event-based data syncing to address the issue of portfolio consolidation efficiently, focusing on creating a data foundation of handling various API structures and offering consistent portfolio perspectives irrespective of custody setups underneath.

Key Technical Features

- •Architectural choices favored eventual consistency over ACID principles to manage exchange API constraints and network partitions effectively

- •The system utilized a method called "tiered data enhancement" to ensure that fundamental position data was synchronized in real time while allowing for the asynchronous calculation of complex analytics

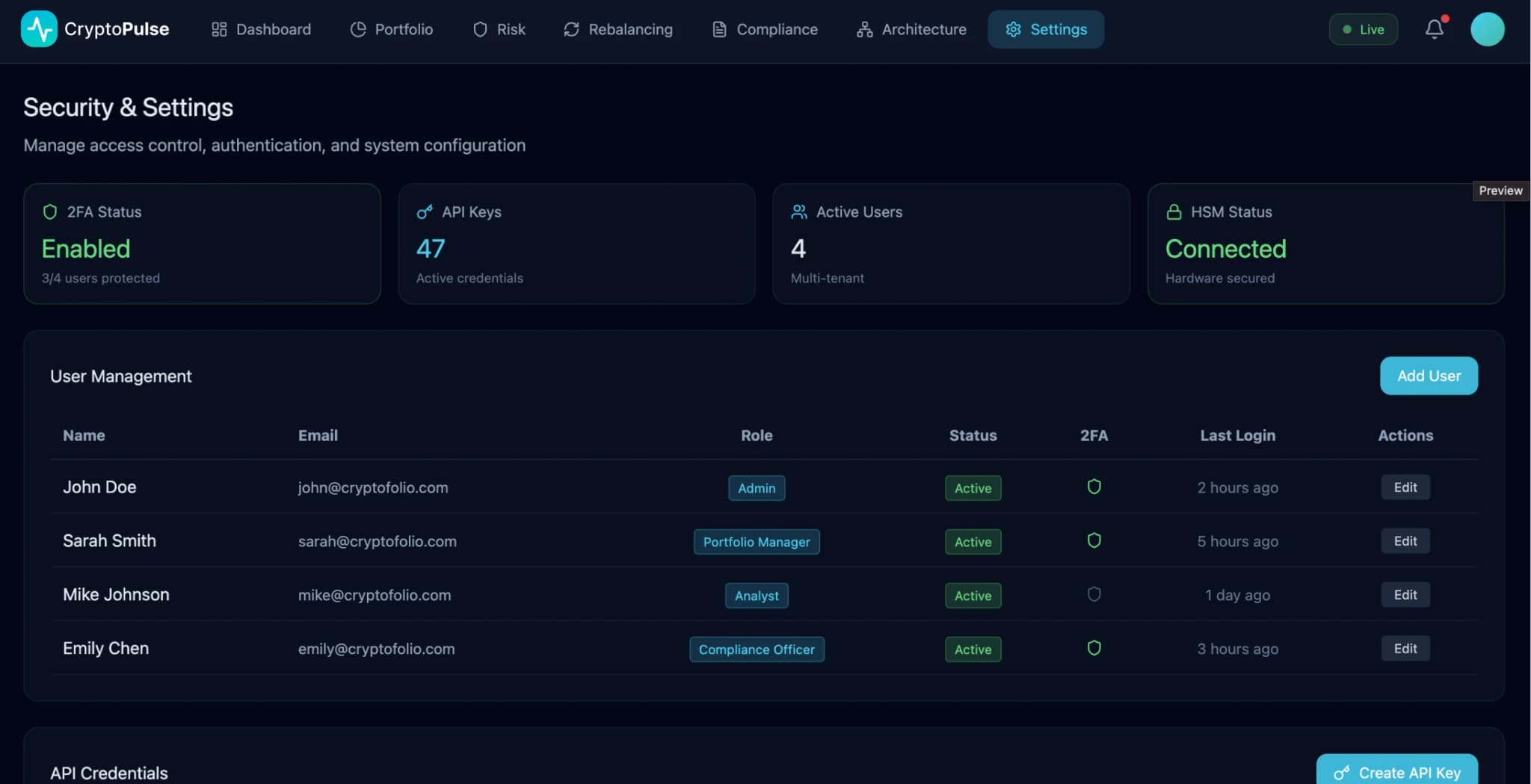

- •Security boundaries that cater to multiple tenants serve to safeguard customer data and promote resource efficiency effectively

Data Processing

The advanced analytics engine processes 2,300,000 price feeds every day allowing for risk analysis and automated adjustment strategies to be implemented seamlessly.

Implementation Journey

Initial Setup

The project started by setting up the data pipeline and security structure. We deployed Kubernetes clusters in three availability zones with automated failover functions. Our first task was to integrate with the 5 top exchanges based on trading volume:

- •Binance

- •Coinbase

- •Kraken

- •Bitfinex

- •Huobi

Database Architecture

The team made strategic choices such as opting for PostgreSQL over NoSQL options for managing portfolio data considering the need for ACID compliance in financial information storage methods. They also divided the database by customer ID to enable growth while ensuring transactions within each portfolio segment.

Data Quality Management

The data analysis system utilized Apache Kafka's exactly-once delivery approach to avoid duplicating transactions. Stream processing tasks computed totals, profit or loss amounts, and portfolio percentages instantaneously.

Key Features Delivered

Risk Management

- •Real-time correlation analysis and Value at Risk (VaR) calculations

- •Automated rebalancing features linked with exchange APIs

- •Safety measures to curb trading in times of heightened market volatility

Tax Optimization

Tax optimization functions necessitated cost basis computations that support:

- •FIFO (First In, First Out)

- •LIFO (Last In, First Out)

- •Specific identification techniques

The system stored a complete transaction history with hashes to maintain the integrity of the audit trail.

Security & Compliance

- •Integration with hardware security modules and custody solutions

- •Multi-tenant security boundaries with isolated message queues and database schemas

- •Automated compliance reporting with audit trail maintenance

Production Deployment

Testing & Rollout

- •The test coverage for all microservices has surpassed 85%

- •The beta rollout catered to 50 clients over a span of 6 weeks and managed assets totaling $500 million in value

- •The official release utilized blue-green deployment strategy alongside automated fallback mechanisms

Impact & Results

Operational Excellence

The platform transformation has led to significant enhancements in efficiency and risk management while also improving user experience aspects. Portfolio managers have shared that they are now saving considerable time in their daily operations and accessing advanced analytical features that were previously exclusive to quantitative hedge funds.

During market turmoil in October 2022, when conventional manual tracking methods failed to detect correlation disruptions, platform users were able to make proactive adjustments based on real-time alerts.

Cost Efficiency

Cost Efficiency

Cost efficiency surpassed expectations by implementing API usage limits and strategic data storage methods. The system managed to bring down third-party data expenses from $180k to $68k while enhancing data accuracy and speed of response during the analyzed period.

Technical Stack

Core Infrastructure

Technology Stack Components

| Component | Technology | Purpose |

|---|---|---|

| API Layer | Node.js with Express, GraphQL | Data queries and API management |

| Caching | Redis Cluster | Session management and frequently accessed data |

| Time Series Storage | InfluxDB | Historical price and performance metrics |

| Container Orchestration | Kubernetes with Helm | Application deployment |

| Frontend | React with TypeScript, Material UI | User interface |

| Real-time Communication | WebSocket connections | Live price feeds and portfolio updates |

| Security Infrastructure | AWS KMS, HashiCorp Vault | Encryption keys and secrets management |

| Monitoring | Prometheus, Grafana, ELK Stack | Metrics collection, visualization, and logging |

Lessons Learned

API Management Strategy

Implementing a strategy to handle API rate limiting involves utilizing request batching and strategically caching frequently accessed data instead of relying solely on parallelization techniques that may not bypass the strict limits imposed by exchange APIs.

Data Quality Priority

In the beginning stages of development, we focused on delivering results quickly rather than ensuring the accuracy of the data used, which resulted in users questioning the reliability of our platform. Upon reassessment, we shifted towards prioritizing data validation and quality checks even if it meant longer processing times.

Security vs Performance Balance

Creating a blend between security and performance was crucial in integrating hardware wallets into the user experience design process, ensuring that users could access real-time portfolio updates without sacrificing the security of their private keys.

It's always best not to depend on one exchange API for portfolio information, as outages and rate limits can lead to risky blind spots, especially when the market is volatile.

Key Performance Metrics

Cost Reduction

Operational cost savings

Assets Tracked

Total portfolio value managed

Exchange Integration

Connected exchanges and wallets

Response Time

Average API response time