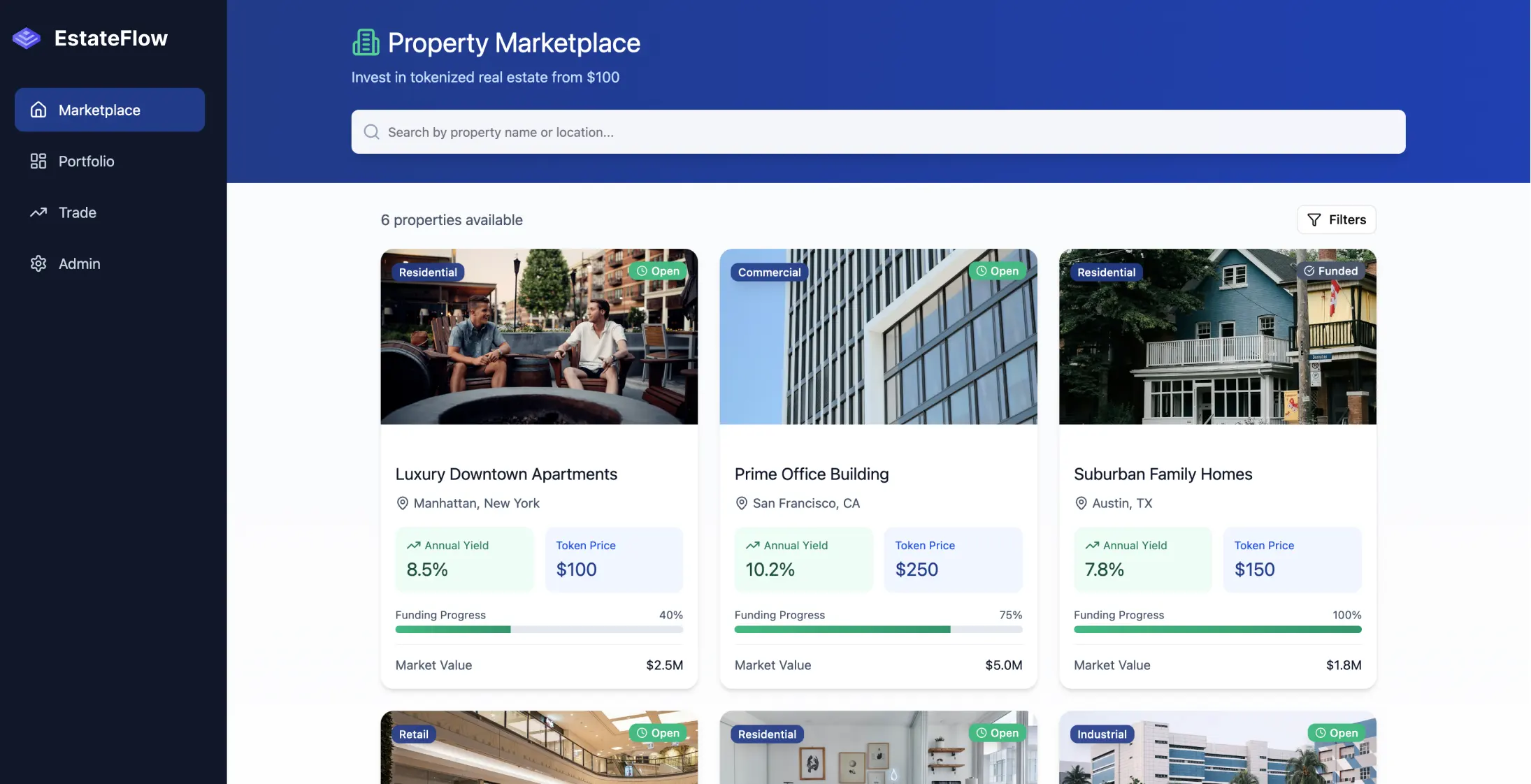

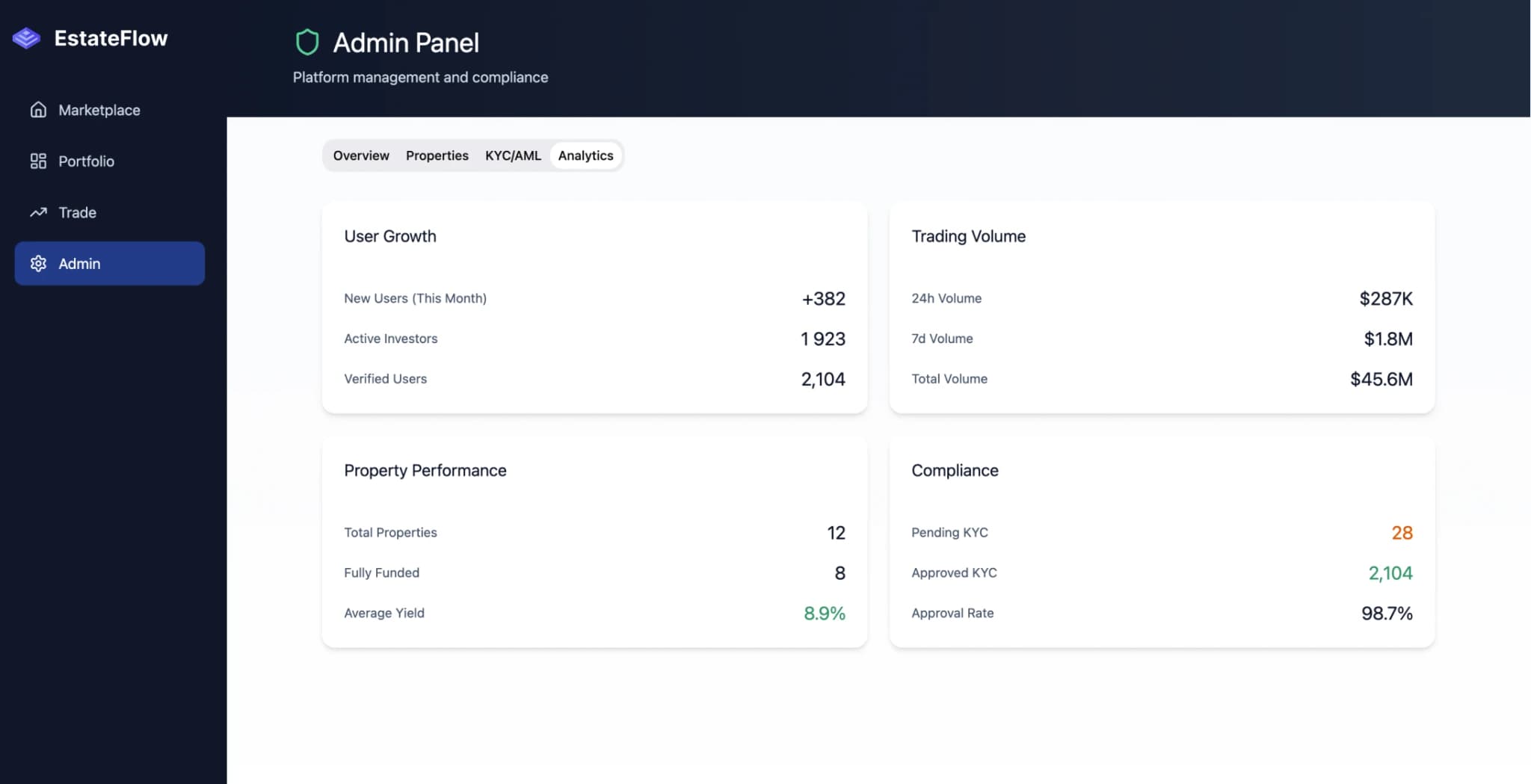

Diving into the realm of democratizing property investment via tokenization offers a groundbreaking shift in the real estate landscape. Leveraging blockchain to enable fractional ownership diminishes entry barriers from $100k and above to a mere $100 investment threshold.

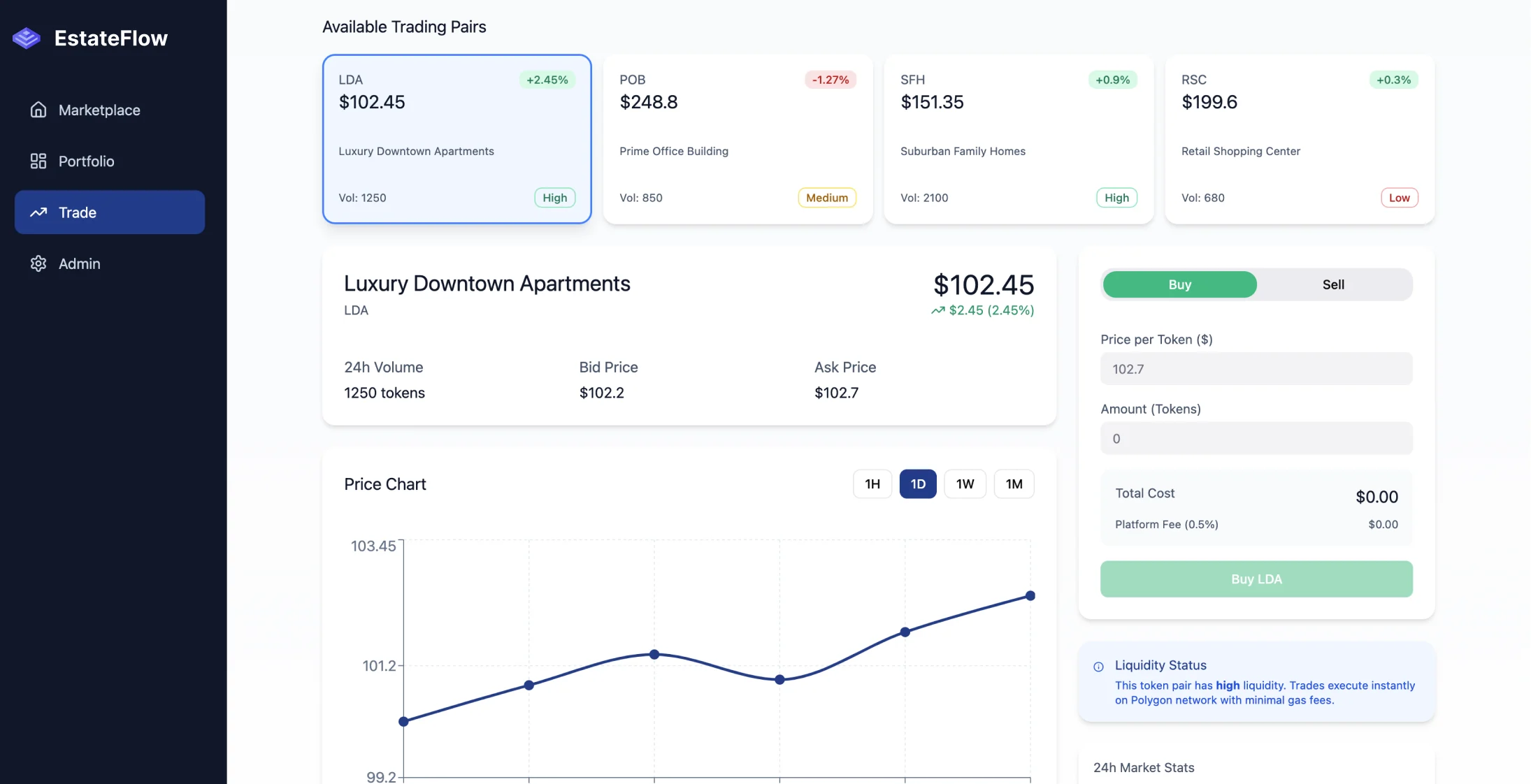

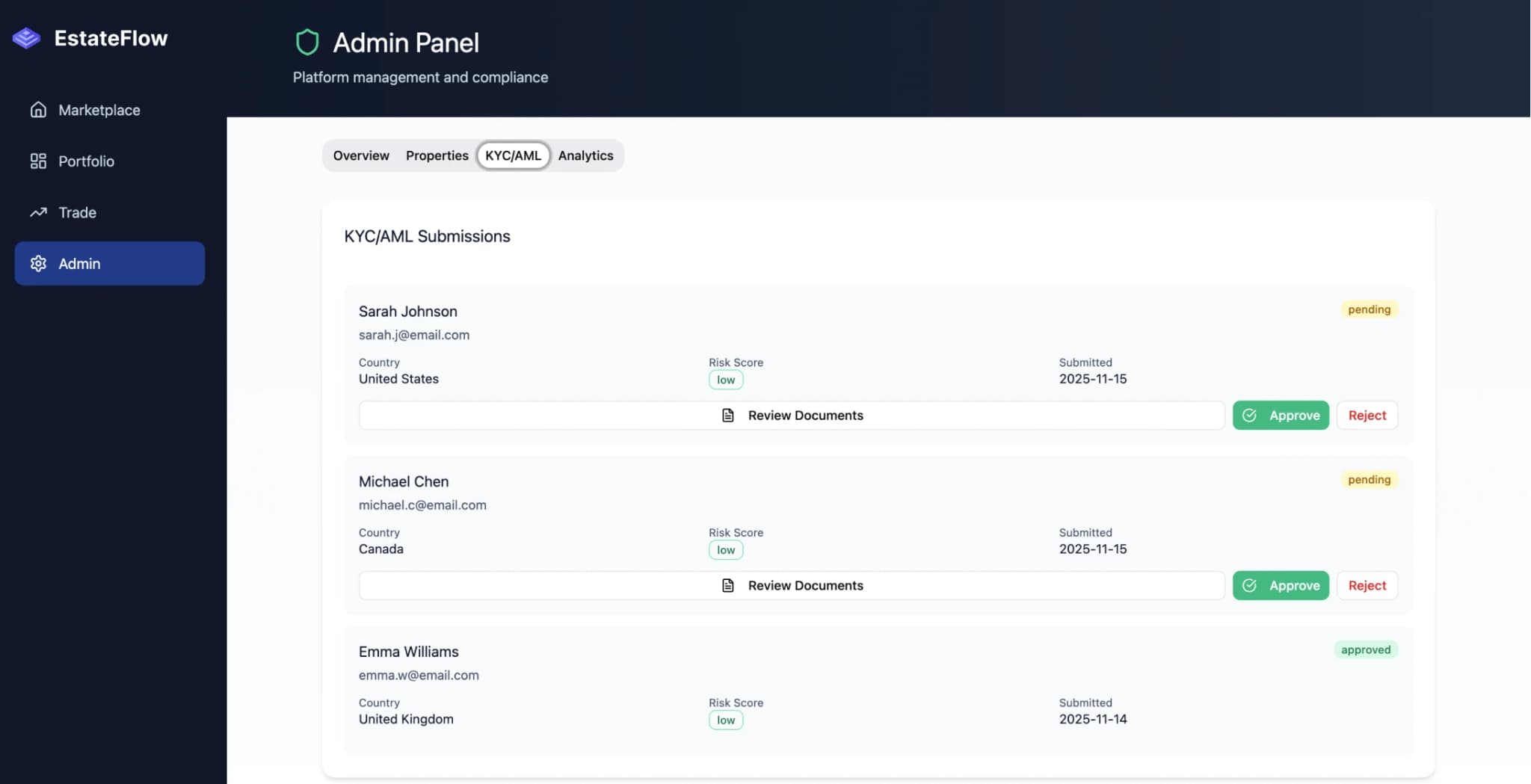

The innovation of smart contracts has revolutionized transaction processing efficiency by 87%, ensuring transparent ownership records and fee structures while paving the way for seamless automation.

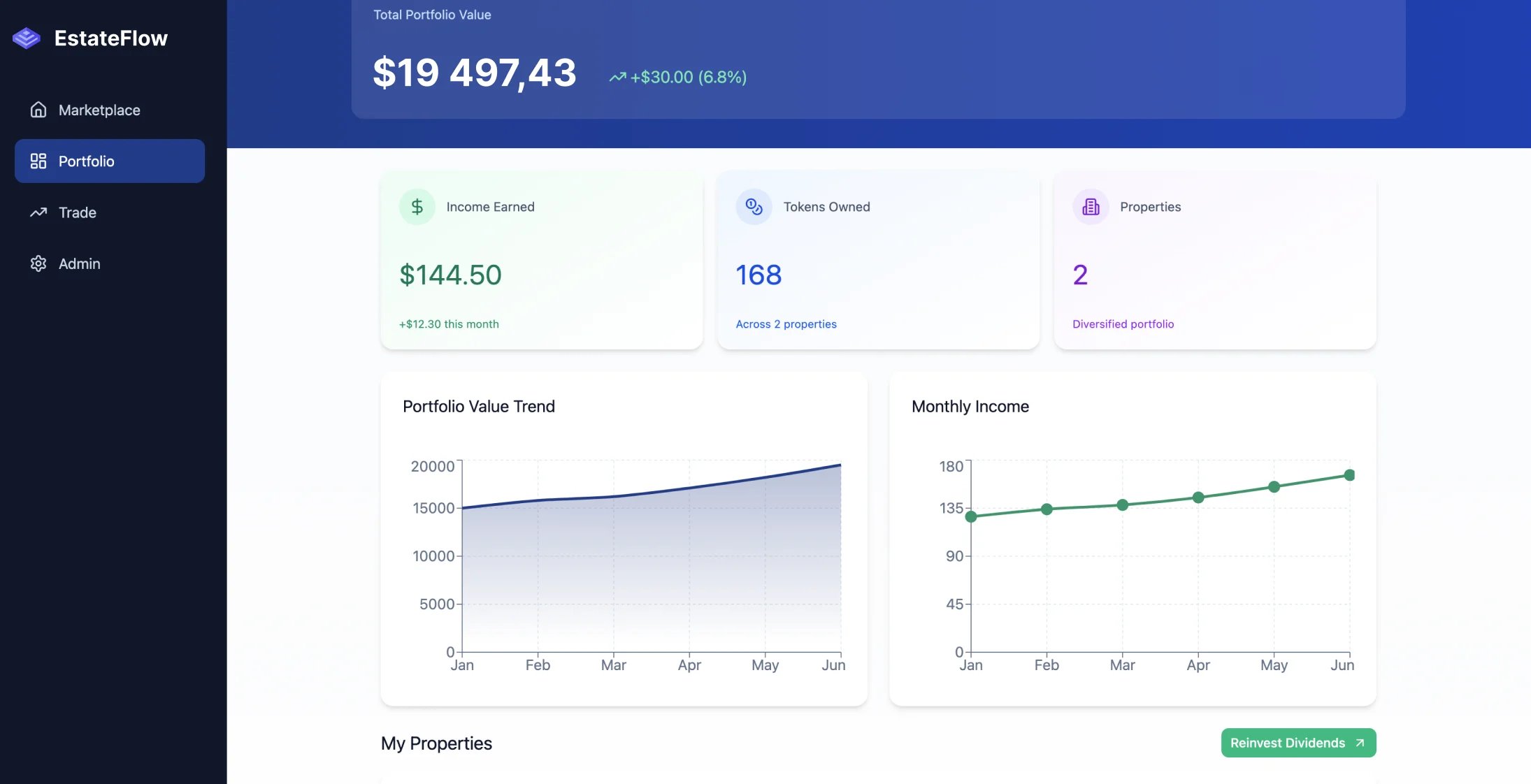

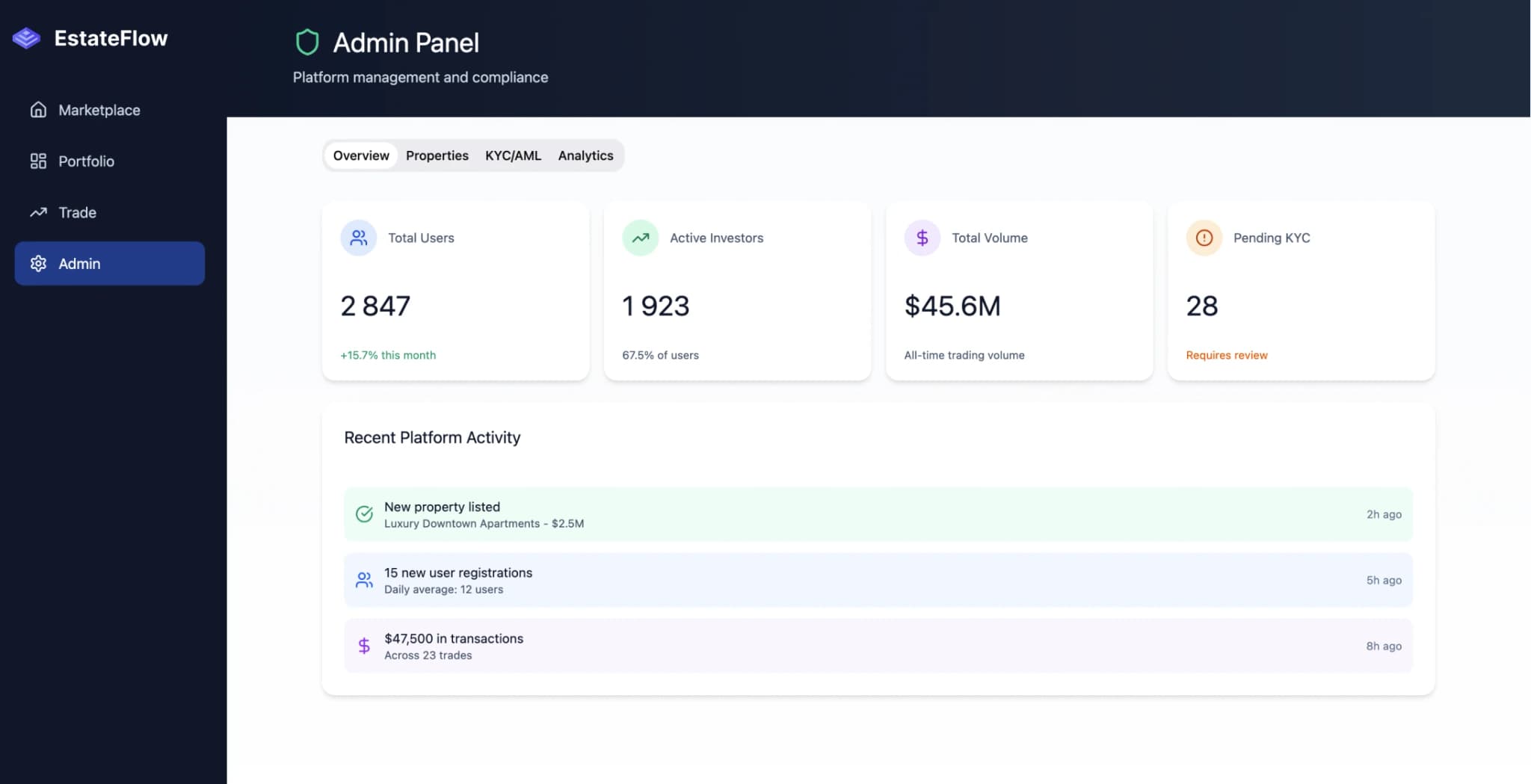

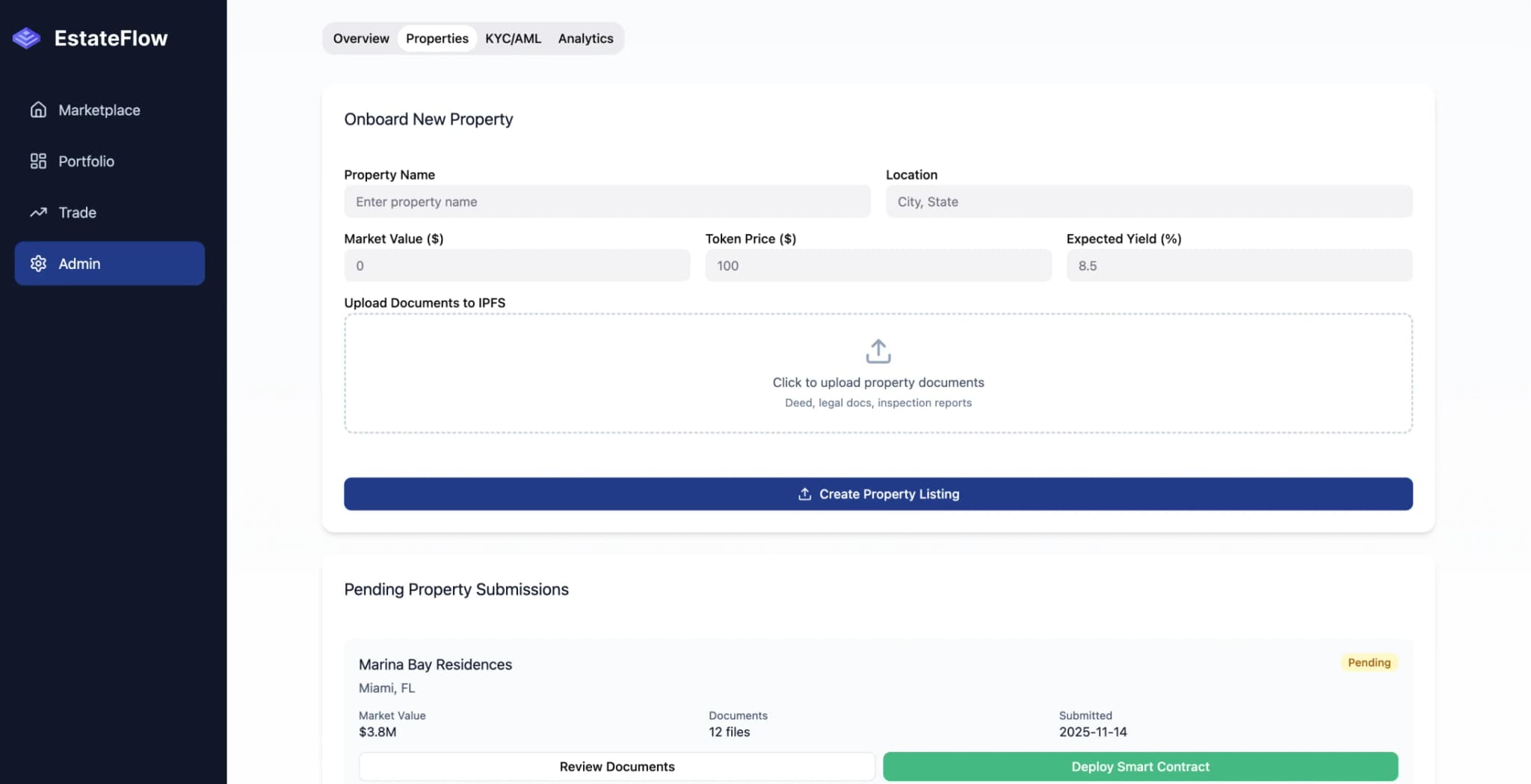

The platform's robust infrastructure can accommodate over 15,000 users with an uptime of 99.97%, facilitating transactions totaling $47 million across 280 properties through tokenized investments.