We developed a comprehensive blockchain-based securities tokenization platform that revolutionizes traditional capital markets through automated compliance and instant settlement capabilities. The platform addresses critical inefficiencies in legacy financial systems while maintaining full regulatory compliance across multiple jurisdictions.

Project Overview

Traditional Market Challenges and Blockchain Solution

Traditional financial markets encountered challenges in terms of accessibility and efficiency, in compliance automation and settlement processes. This often resulted in transactions taking weeks to complete despite their potential to be finalized within minutes.

A detailed tokenization system was designed to connect systems, with blockchain based settlement. It includes automated compliance checks and custody solutions for jurisdictions, at an institutional level.

The post measurement data showed an 85 percent decrease in settlement duration time. Compliance processing overhead was reduced by 92 percent.

Additionally beneficially qualifying issuers saw a 67 percent enhancement in capital access. The system maintained a 99.97 percent uptime over 18 months of activity without experiencing any security breaches and staying fully compliant with audits in three significant regions.

Legacy System Limitations

The stock market has been using systems for years with slow settlement times and cumbersome compliance procedures that make it difficult for small companies to participate fully in the market.

The rise of blockchain technology offered a chance to rethink how securities are issued and traded by incorporating compliance features and faster settlements while lowering counterparty risks. Therefore balancing systems with decentralized ledger tech needed a thorough review of regulations institutional custody norms and scalability limits.

Regulatory Framework Challenges

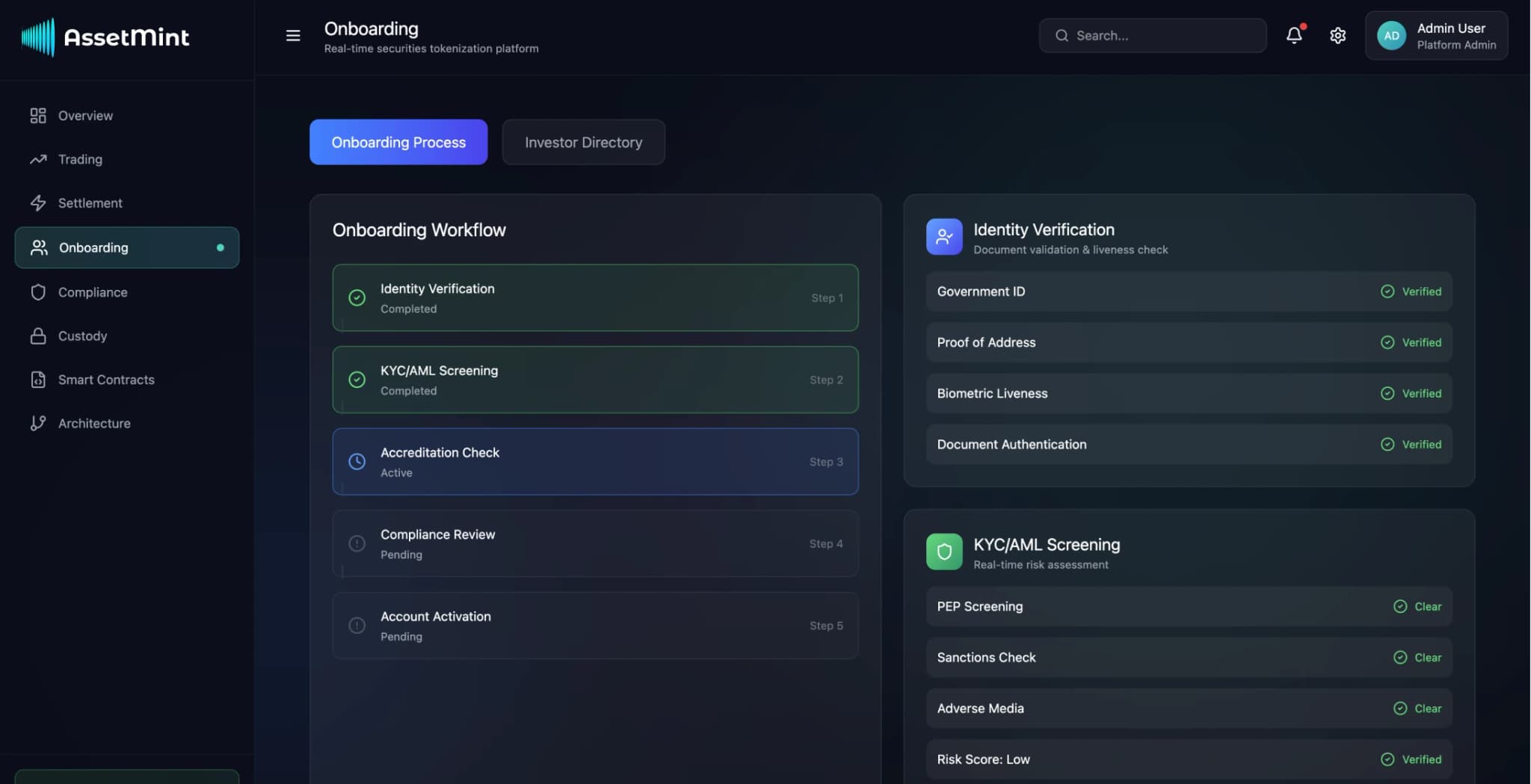

Major legal systems in regions have started to recognize assets as legitimate securities; however, yet putting this into practice involves dealing with intricate sets of rules and regulations that include:

- •verifying identity for anti money laundering purposes (know your customer)

- •validating accreditation status of individuals or entities

- •trading constraints based on specific jurisdictions

- •real time reporting required by regulators

Settlement Process Inefficiencies

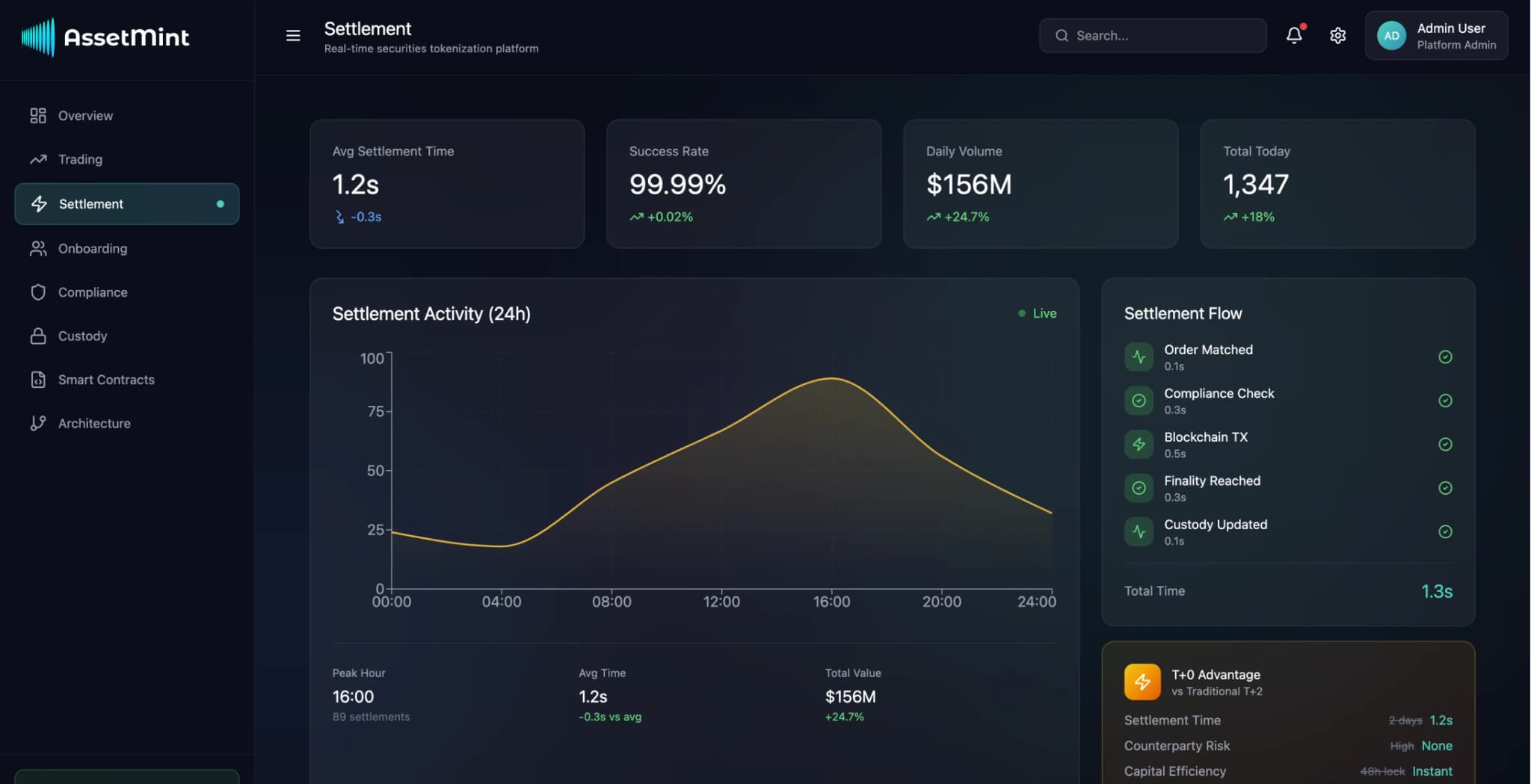

The outdated systems in place for securities caused inefficiencies hindering market involvement and raising risks significantly. Settlement processes spanning over 2 to 5 business days led to risks with counterparties and blocked funds that could have been utilized effectively.

The manual verification procedures caused delays in issuing and trading securities as each transaction had to undergo scrutiny for investor qualifications and compliance with regulations and jurisdictional rules. This process led to inefficiencies and higher costs.

Market Access Barriers

Smaller companies encountered challenges accessing capital due to compliance requirements and limited ways to reach investors. Many growing businesses couldn't tap into investment banking services and found private placement networks lacking transparency and easy cash flow opportunities.

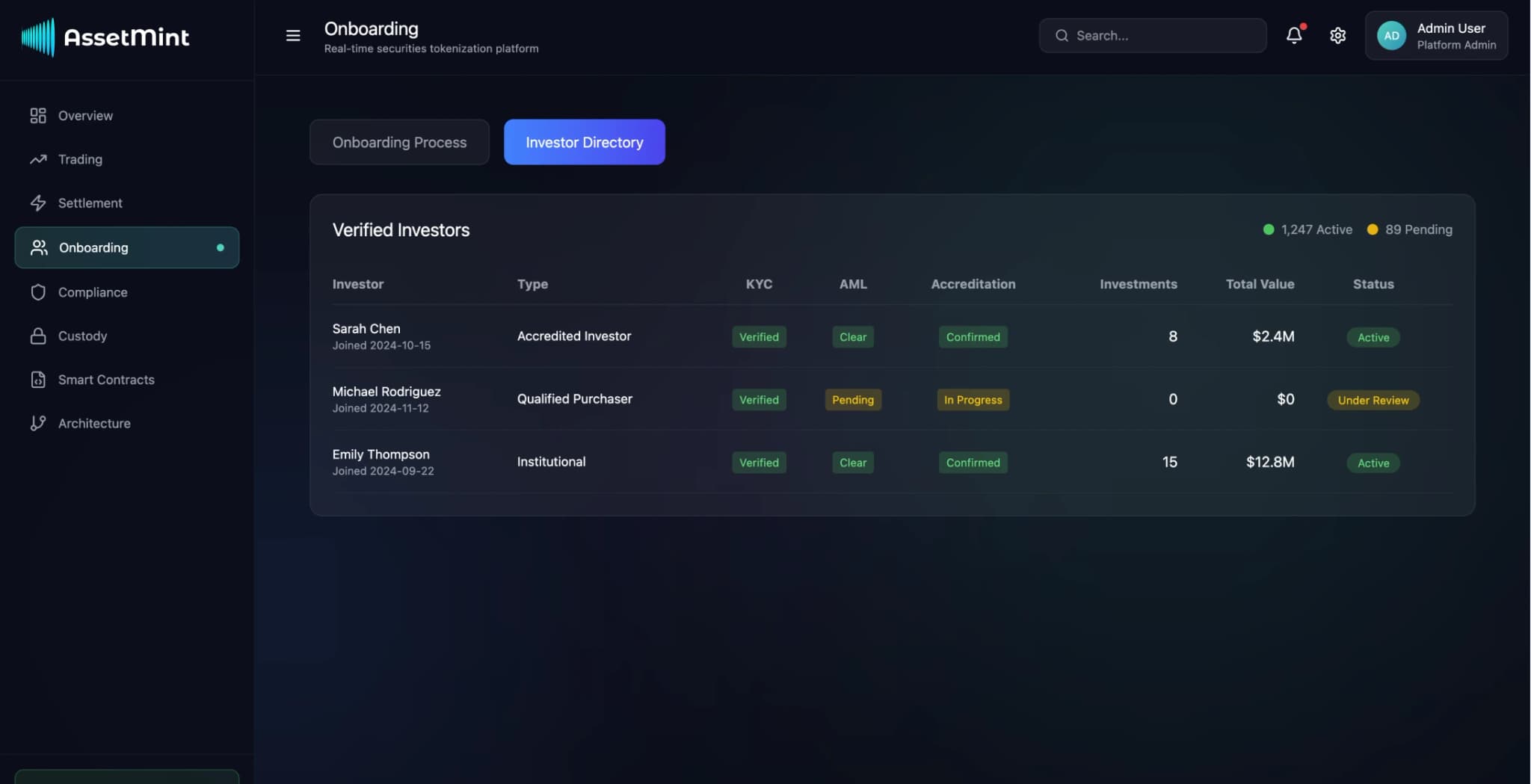

Investors faced challenges due to platforms being scattered and lacking transparency into assets beneath them along with verification processes before trading approval was granted. They had to combine portfolios from sources and lacked real time valuation features for effective management.

Platform Implementation Results

The platform has made it possible for smaller issuers to access institutional quality fundraising infrastructure that was previously only available for large scale offerings by reducing the offering sizes from $50 million to $5 million through automating compliance workflows and removing manual intermediary processes.

Transform Your Capital Markets Experience

Join the future of securities trading with automated compliance and instant settlements.

Key Performance Improvements

Decrease in Regulatory Expenses: The implementation of automated verifications and adaptable compliance measures led to a 78% reduction in compliance costs per activity. The integration of time reporting eliminated the need for manual reconciliation procedures thereby decreasing the workload associated with audit preparation tasks.

Market Liquidity Improvement: The secondary market saw a boost in trading speed by 340% outperforming securities markets significantly thanks to round the clock trading and the ability for fractional ownership attracting a larger pool of investors.

Investors were given insight into asset performance and ownership through transaction records and immediate portfolio value assessment enhancing operational transparency like never before.

Technical Architecture

Platform Design

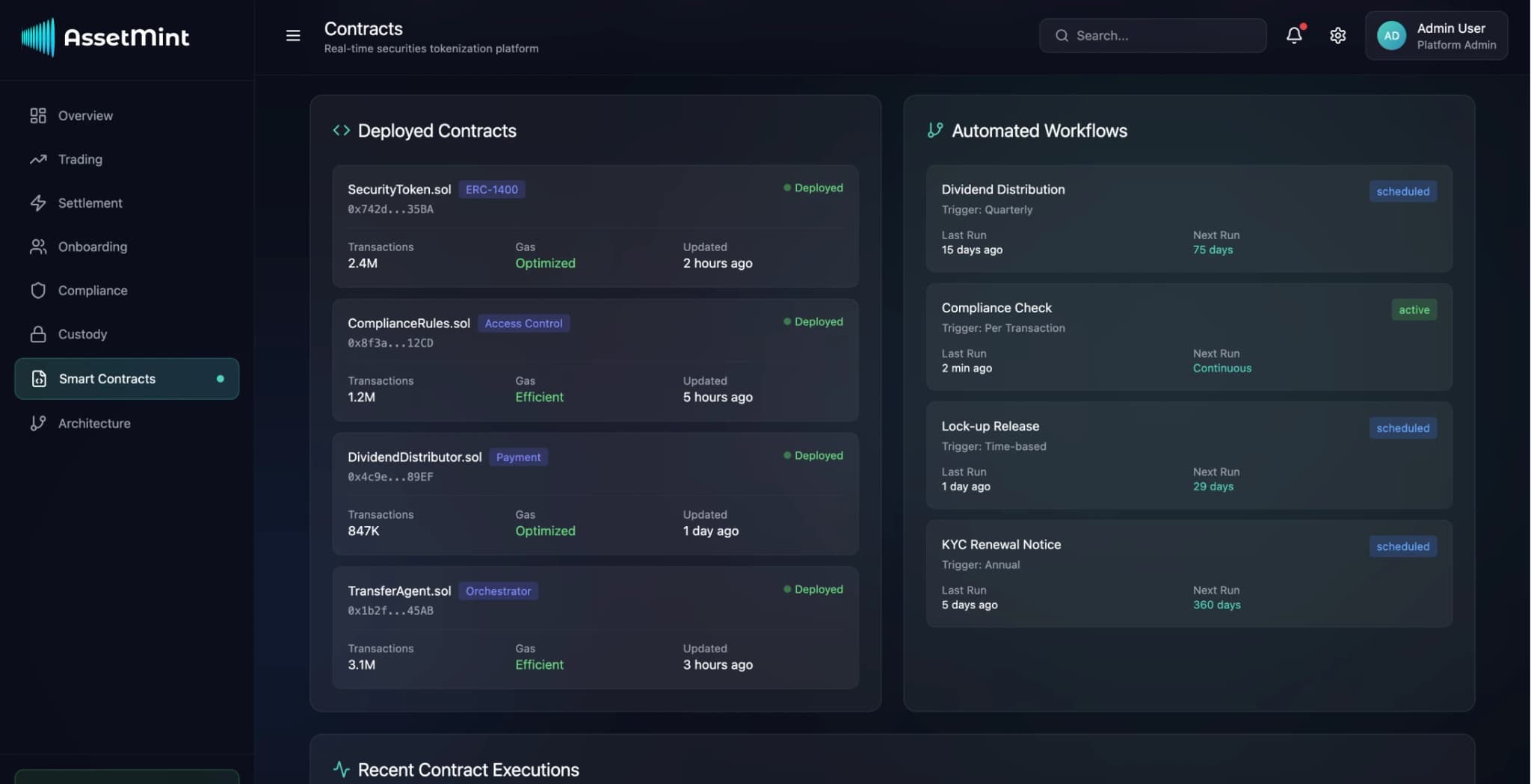

The design of the platform focused on using a mix of public blockchain security and private network efficiency for performance. Smart contracts were used to embed rules into operations to automate the enforcement of:

- •trade limits and rules

- •distributing dividends

- •managing governance rights

Security and Compliance Framework

An encompassing security and regulatory system linked with KYC and AML verification services as well as accreditation checks from multiple regions regulatory databases was in place here to swiftly confirm investor qualifications and oversee compliance automatically.

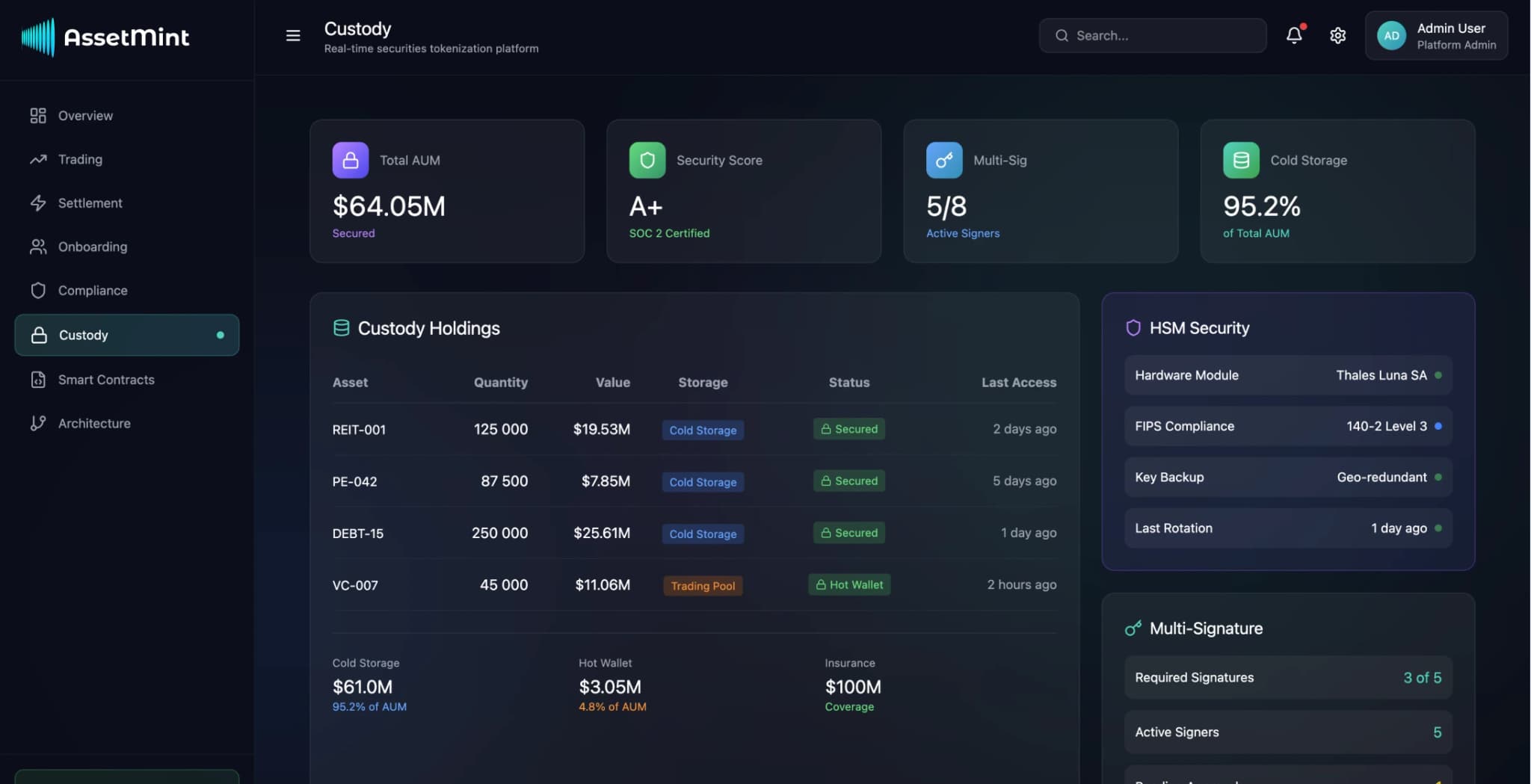

The custody system utilized signature wallets with high level security measures such as hardware security module integration and comprehensive audit logging while also enabling fiat currency settlements along with digital asset transfers through traditional banking channels.

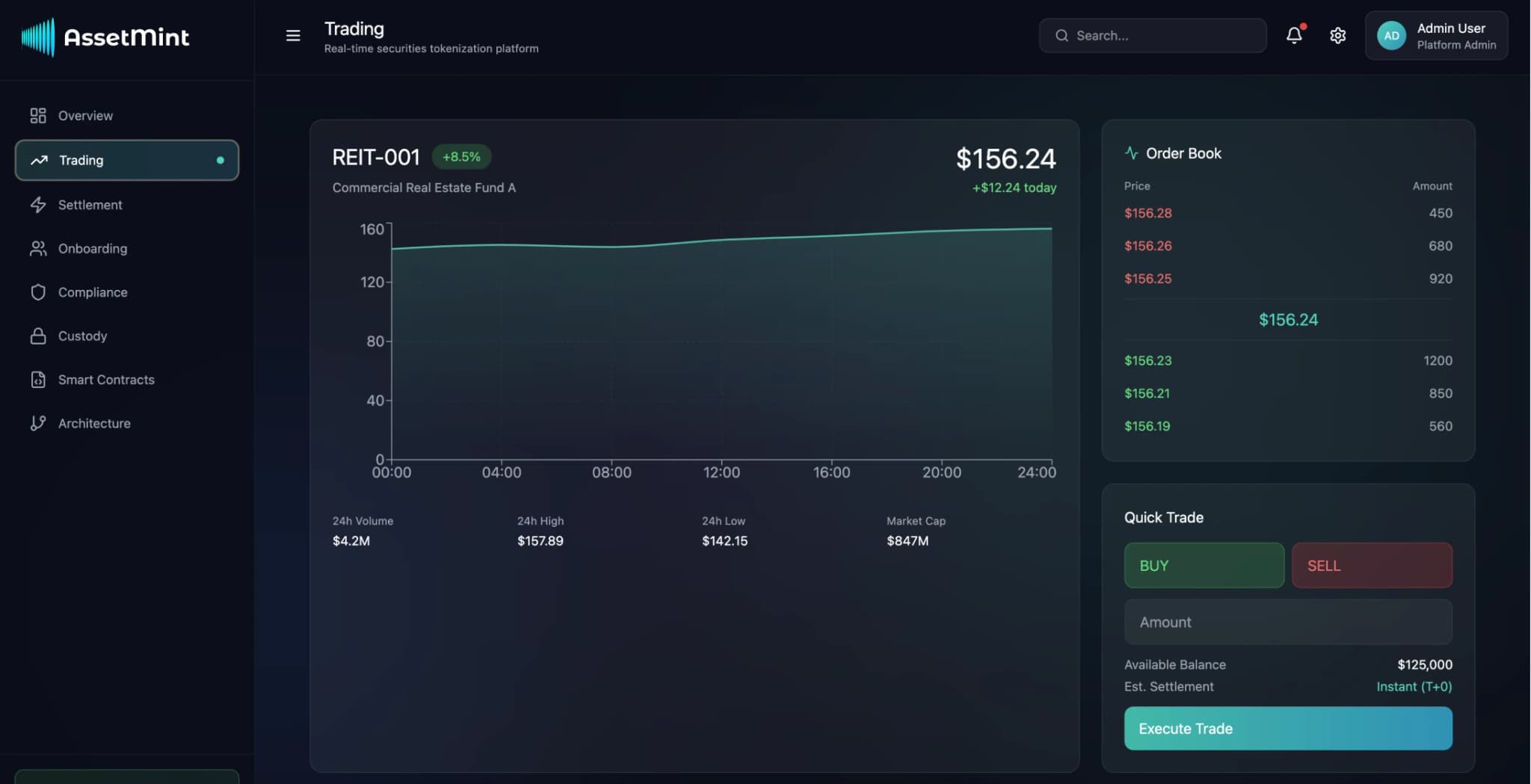

User Experience Design

Institutional familiarity was emphasized in the user experience with web based dashboards simplifying blockchain intricacies while ensuring cryptographic security remained intact for retail investors using apps for portfolio management and transaction authorization security.

System Components

Blockchain Infrastructure

The Ethereum main network has been set up with integration to the Polygon Layer 2 to facilitate high frequency trading activities on the blockchain layer incorporating contracts based on ERC 1400 security token standards supplemented with custom compliance extensions tailored to meet jurisdictional regulations.

Identity and Compliance Service

The Identity and Compliance Service is a system that handles investor accreditation processes along with KYC and AML verifications as well as regulatory compliance requirements across various regions such as the US EU and APAC by integrating seamlessly Jumio and Onfido in addition to regulatory databases accessible in these jurisdictions.

Custody Infrastructure

The custody infrastructure includes a signature wallet setup that integrates with Fireblocks for institutional custody purposes utilizing hardware security modules (HSMs). These HSMs are used for protecting keys while multi party computation protocols are employed for transaction authorization.

Trade Engine

A system for matching orders that includes real time compliance checks and automated market making functions integrated with messaging protocols like FIX and SWIFT for institutional connections.

System Components Overview

| Component | Technology | Purpose |

|---|---|---|

| Database | PostgreSQL with Redis caching | Primary data storage and performance optimization |

| Search & Analytics | Elasticsearch with Apache Kafka | Transaction indexing and real-time monitoring |

| API Layer | GraphQL with WebSocket | Query handling and real-time updates |

| Authentication | Auth0 integration | Rate limiting and user authentication |

| Monitoring | Splunk with New Relic | Logging and application performance tracking |

Implementation Process

Development Phase

The process began by rolling out the core blockchain infrastructure and developing contracts in phases step by step. The security token contracts went through third party auditing conducted by Trail of Bits and Quantstamp with an emphasis on compliance logic and potential economic vulnerabilities.

In the process of developing environments for testing blockchain configurations in production settings were replicated using both Ganache and Hardhat frameworks for accuracy and reliability checks. Testing procedures involved a range of assessments including:

- •unit tests to validate contract logic functionality

- •integration tests to ensure compliance with workflows

- •end to end testing scenarios covering issuance and trading processes holistically

Compliance Integration

During the phase of integrating compliance measures into our system we worked closely with experts in jurisdictions. We translated frameworks into contract terms by collaborating with specialists in securities law to ensure that the automated enforcement process followed all regulatory standards and requirements.

User Acceptance Testing

During user acceptance testing institutional investors and qualified issuers carried out transactions on testnet infrastructure refining user experience flows based on feedback while ensuring security and compliance standards were met.

Migration Strategy

During the transition from systems to ones in the migration strategy used a dual write approach to maintain data consistency between both platforms with thorough reconciliation processes in place. Rollback features were also retained throughout the migration phase to ensure operations.

Initial estimates of the time needed for developing contract logic did not fully consider the nature of incorporating compliance requirements from various jurisdictions leading to delays in the process.

Operational Results

The shift in platform operations resulted in enhancements in efficiency and compliance automation as well as improved access to capital measures. Settlement periods were reduced from the industry norm of T+1 to almost instant blockchain verification while ensuring adherence to all standards in the various regions served.

The burden of compliance processing significantly decreased with the implementation of automated verification processes that removed review bottlenecks and enhanced accuracy through enforceable rules programming. The system handled more than $8 billion in security transactions within its initial 18 months of operation.

Lessons Learned

Development Considerations

For future projects suggesting a 40% increased allocation for regulatory integration tasks is advisable for better planning and execution efficiency.

Achieving a balance between top notch security measures and user friendly interfaces involved rounds of design revisions when addressing the complex user experience issue of managing private keys efficiently which can be improved through gradual disclosure and optional custody solutions.

Technical Challenges

Implementing contracts using proxy patterns has been crucial for adjusting to regulations but has led to higher complexity and increased gas costs in the process of regulatory compliance adaptation. To enhance upgrade flexibility further and mitigate these challenges effectively consider adopting a modular contract architecture approach.

The complexity of integrating third party services for KYC/AML verification and custody along with banking systems brought about operational challenges than expected. Robust API standards and thorough testing environments play a role in ensuring integrations into existing systems.

Performance vs Decentralization

The debate between performance and decentralization revolves around the significance of Layer 2 solutions in enhancing transaction speed and cost effectiveness while also raising concerns about complicating security measures and user education needs.

It's advisable to start contract audits in the development process as waiting until later stages can lead to major architectural modifications affecting project timelines and security assumptions.

Project Results

- 85% reduction in settlement time

- 92% decrease in compliance processing overhead

- 67% improvement in capital access for qualifying issuers

- 99.97% system uptime over 18 months

- $8 billion in transactions processed

Key Performance Metrics

Settlement Time Reduction

Faster settlement process

Compliance Overhead

Processing overhead reduction

Capital Access

Improvement for issuers

System Uptime

Over 18 months