Introduction

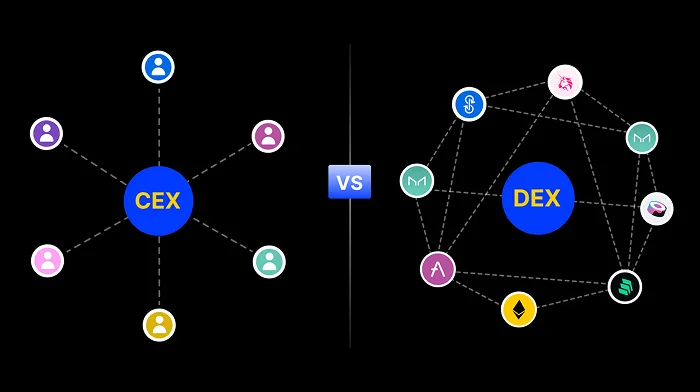

The world of cryptocurrency has exploded in recent years, with over 560 million people using digital coins. This number is growing all the time, and as big organizations start to take an interest in crypto, a key question comes up: is it better to use a centralized or decentralized applications?

It's not a matter of how the technology works. The decision between these two types of exchanges affects a lot of things like:

- •How you handle rules and regulations

- •What kind of experience you offer your users

- •How you keep their assets safe

- •How you provide liquidity

- •How well your system can scale up

Businesses looking to develop crypto platforms need to get a handle on the pros and cons of both models. Whether it's a DeFi platforms, a fintech solutions, or a high-end crypto solution for businesses, this guide takes a look at the DEX vs CEX debate from a business standpoint.

What is a Centralized Exchange (CEX)?

Key Advantages of CEX

For starters, a CEX gives a business total control over:

- •Security

- •User experience

- •Meeting regulatory requirements

Fast transaction processing thanks to centralized systems makes CEXs particularly useful when dealing with traditional currencies. The advantages are numerous:

- •Built-in tools to ensure regulatory compliance

- •Simplified operations for companies that operate globally

- •Easier liquidity management

- •Competitive pricing

- •Simple fiat currency deposits and withdrawals

- •Superior overall user experience

Business Benefits of CEX

Many companies prefer this type of exchange because it allows them to:

- •Get up and running fast

- •Connect with banks easily

- •Offer a range of services involving both traditional and cryptocurrency

Before creating a centralized exchange, solid security and compliance frameworks are essential. A single point of failure can be a security risk since everything is centralized.

CEX Considerations

With a centralized model:

- •Users have to put their trust in your platform to keep their funds secure

- •You've got responsibility for meeting all licensing requirements

- •There's increased regulatory oversight

What is a Decentralized Exchange (DEX)?

A DEX is a type of crypto exchange that lets users trade assets directly, cutting out middlemen like banks or big companies. These exchanges are built on blockchain technology, using smart contract development to make trades automatic, secure, and transparent.

Popular DEX Examples

Some well-known examples include:

- •Uniswap

- •PancakeSwap

- •Curve

Unique DEX Features

What's unique about DEXs:

- •Users can instantly swap tokens using liquidity pools

- •No need to sign up or get approval from anyone

- •No central authority controlling the exchanges

- •Open, fast, and accessible to everyone

Business Benefits of DEX

For companies, creating a DEX platform can be a game changer:

- •Gives users control over their assets

- •Keeps user information private

- •Reduces the need to deal with complex regulations

Key DEX Advantages

User Control: Users are always in control of their assets, which means they don't have to rely on third parties to hold their funds.

Censorship Resistance: Makes it impossible for trades to be blocked or tampered with, creating a platform that's essentially resistant to censorship.

Enhanced Privacy: Increased privacy due to minimal or sometimes even optional KYC requirements.

Global Accessibility: Since all you need to access the platform is a crypto wallet, it's instantly available to anyone anywhere in the world.

Lower Operational Costs: Significantly lower mainly because transaction fees are reduced and intermediaries are cut out.

DEX Considerations

However, there are some drawbacks to consider:

- •User interface can be overwhelming for those without technical background

- •Newer tokens often struggle with liquidity

- •No central support team - users are responsible for managing their wallets

- •Integrating fiat currencies can be challenging

- •Risk of smart contract vulnerabilities if not developed properly

DEX vs CEX: Key Differences Comparison

DEX vs CEX Feature Comparison

| Feature | CEX | DEX |

|---|---|---|

| Fund Control | Custodial (exchange holds funds) | Non-custodial (users control funds) |

| Liquidity | Generally higher | Can be lower for newer tokens |

| KYC/AML Compliance | Full compliance required | Minimal or optional |

| Privacy | Lower (requires personal info) | Higher (anonymous trading) |

| Speed | Faster with low latency | Can be slower due to blockchain |

| Fees | Generally lower | Can be higher due to gas fees |

| Development Complexity | Easier to build and manage | More complex (requires smart contracts) |

| Regulatory Risk | Higher regulatory oversight | Lower regulatory burden |

Market Trends in 2026

Looking at the market in 2026, it's clear that things are still evolving quickly:

- •Over 72% of cryptocurrency trading still happens on centralized exchanges

- •23% growth in DEX trading volume in 2024 compared to the previous year

- •35% of DEX volume came from institutional investors

- •Growing interest in hybrid exchanges that combine benefits of both models

Emerging Trends

Cross-Chain DEXs: Many DeFi companies are creating exchanges that can work across different blockchain systems.

Hybrid Platforms: Decentralized platforms are changing the game by offering the best of both worlds - the freedom of decentralization and the speed and liquidity of centralized exchanges.

When to Choose CEX vs DEX

Choose CEX When:

- •Users need to convert fiat currencies into cryptocurrencies

- •Operating in heavily regulated markets

- •Need high-speed, high-volume trading capabilities

- •Targeting mainstream users who prefer familiar interfaces

Choose DEX When:

- •Building or launching DeFi protocols

- •Listing experimental tokens

- •Prioritizing user privacy and control

- •Targeting crypto-native users

- •Want to avoid regulatory complexities

Hybrid Exchange Solutions

What is a Hybrid Exchange?

A hybrid crypto exchange brings together advantages of both exchange types:

From CEX:

- •Speed and ease of use

- •Quick transaction processing

- •Simple navigation interface

From DEX:

- •Security and transparency

- •Lower fraud risk

- •Open transaction records

Hybrid Exchange Features

- •Smart contracts handle trade settlement

- •Order books ensure efficient buyer-seller matching

- •Improved liquidity for faster trading

- •Trustless execution where the exchange doesn't control funds

Notable Hybrid Examples

- •Serum

- •Injective

Both follow the hybrid model successfully.

Development Considerations

Pre-Development Planning

Before building any exchange platform, consider:

Licensing and Compliance: Comply with all requirements in target regions

Platform Design: Crucial for determining user interaction and trading experience

Smart Contract Security: Full audits necessary to guard against hacks

User Experience (UX): Create smooth flows for easy trading, especially on mobile devices

Liquidity Planning: Essential strategy for attracting and maintaining trading volume

Teaming up with an experienced cryptocurrency development company can provide a solid foundation. Your platform will be secure, compliant, and scalable from the outset.

Development Costs

Cost Factors

Development costs vary widely depending on:

- •Exchange type (CEX vs DEX)

- •Features and functionality

- •Security requirements

- •Compliance needs

Cost Breakdown

Exchange Development Cost Comparison

| Exchange Type | Cost Range | Key Cost Factors |

|---|---|---|

| Centralized Exchange (CEX) | $120,000 - $350,000 | Complex backend systems, KYC/AML compliance, fiat ramps, margin trading features |

| Decentralized Exchange (DEX) | $80,000 - $250,000 | Smart contract development, UI/UX for on-chain trading, security audits, tokenomics |

Cost Optimization Strategies

White Label Solutions: Consider this approach to cut development costs and get to market quickly while maintaining customization options.

Experienced Development Partners: Can help minimize risks, control costs, and ensure regulatory compliance from the start.

Choosing the Right Development Partner

What to Look For

When selecting a crypto payment gateways development company, prioritize:

- •Track record in building exchange architectures from scratch

- •Smart contract development expertise

- •Security audit capabilities

- •Regulatory readiness and compliance knowledge

- •Dual expertise in both CEX and DEX platforms

- •Enterprise customization capabilities

Key Questions to Ask

- •Can they build both centralized and decentralized exchanges?

- •Do they offer custom features tailored to your business needs?

- •What's their experience with security audits?

- •How do they handle regulatory compliance?

- •Can they provide ongoing support and maintenance?

Success Examples in 2026

Leading DEX Platforms

Notable decentralized exchanges include:

- •Uniswap

- •PancakeSwap

- •dYdX

- •Curve

These platforms are open source, making them excellent examples for companies looking to build similar infrastructure.

Why Exchanges Matter for Business

Crypto exchanges provide the underlying backbone of the crypto economy by:

- •Making tokens liquid

- •Enabling companies to raise funds through token offerings

- •Facilitating new user onboarding

- •Building brand trust

- •Driving transaction volume

Making the Final Decision

For Startups

The choice between CEX and DEX depends on:

- •Target audience: Mainstream users (CEX) vs crypto-native users (DEX)

- •Market focus: Regulated markets (CEX) vs DeFi space (DEX)

- •Business model: Traditional finance integration (CEX) vs decentralized protocols (DEX)

- •Budget constraints: Consider development and operational costs

Strategic Considerations

The decision isn't just about technology - it's a strategic business move affecting:

- •Compliance requirements

- •User trust and experience

- •Scalability potential

- •Revenue models

- •Brand positioning

Many successful businesses don't choose between CEX and DEX - they find ways to combine benefits of both, creating flexible and user-friendly experiences for their customers.

Conclusion

The debate between CEX and DEX in the crypto world doesn't have a clear-cut answer. What works for one project might not work for another, and the best choice depends on your specific goals and priorities.

Key Takeaways

The key to making a good decision lies in understanding:

- •What your business wants to achieve

- •What your customers expect

- •What regulatory requirements you face

- •Where you see yourself in the long run

Building for Success

Whether you choose a Centralized Exchange for control and compliance or a Decentralized Exchange for transparency and user autonomy, success comes from:

- •Understanding your users and their needs

- •Choosing a model that aligns with business goals

- •Building a solid technical foundation

- •Planning for long-term growth

Having an experienced development partner can make all the difference when entering the crypto exchange space, helping you launch with confidence and stay ahead of the competition.

The crypto exchange landscape continues to evolve rapidly, with hybrid solutions offering promising middle ground. The key is not just keeping up with trends, but building a robust foundation that sets you up for sustainable long-term success in this dynamic industry.

Ready to Build Your Crypto Exchange?

Partner with our experienced blockchain development team to create secure, compliant, and scalable exchange solutions tailored to your business needs.