Compliance Integration

During implementation phase there were no instances of compliance or regulatory citations reported. Automated auditing features decreased compliance team workload by while enhancing documentation quality and comprehensiveness.

User Trust and Transparency

Users value understanding the reasons behind AI recommendations as it boosts confidence in the advice given. By incorporating explainable AI elements:

- •User acceptance rates increased by

- •Notable decline in support queries regarding recommendation logic

- •Enhanced overall platform credibility

Data Quality Importance

The value of a system is deeply influenced by the quality of real time data it receives. Investment in premium data sources and validation processes proved crucial for maintaining system credibility and recommendation effectiveness.

Early Compliance Planning

Ensuring compliance from the start during project planning avoided expensive rework and feature limitations later in the process. Consulting regulatory experts early in development potentially cut development time by .

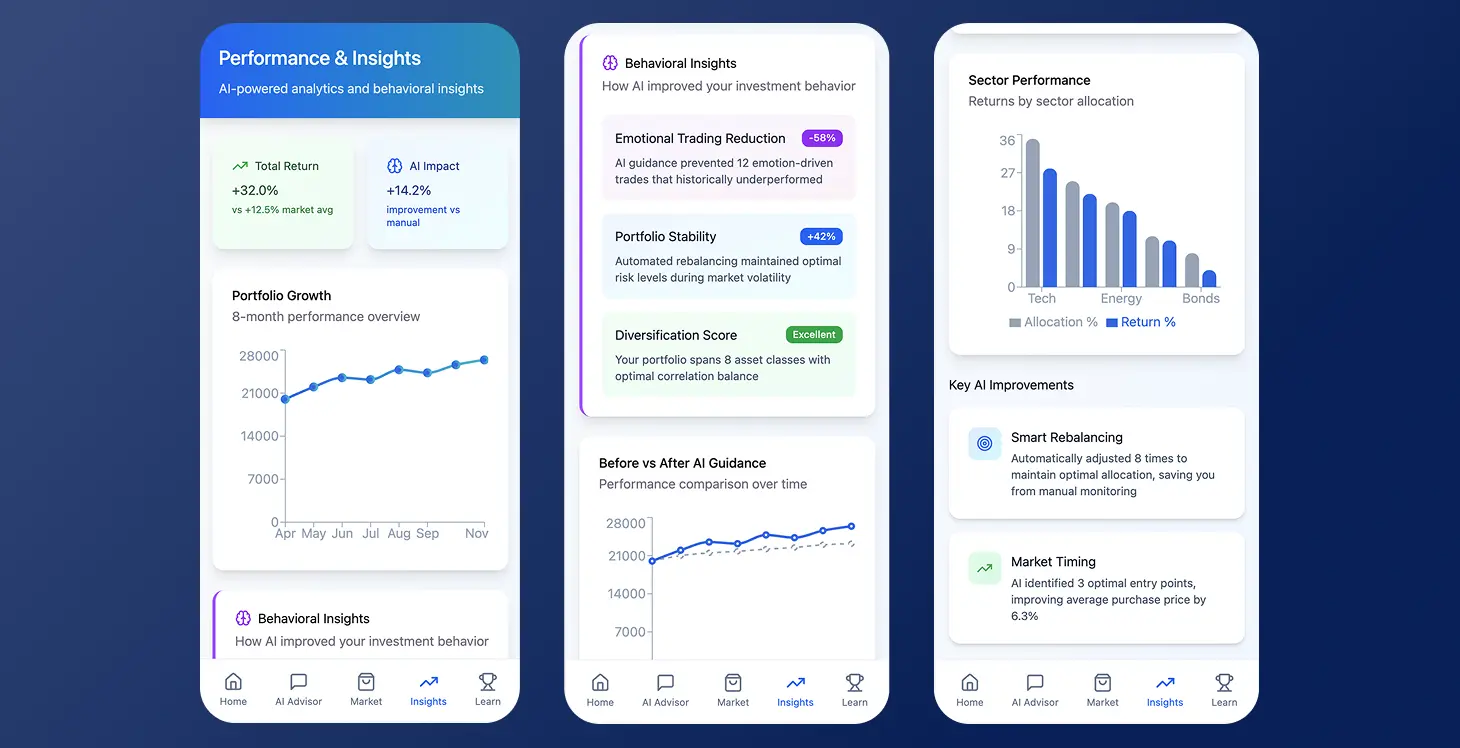

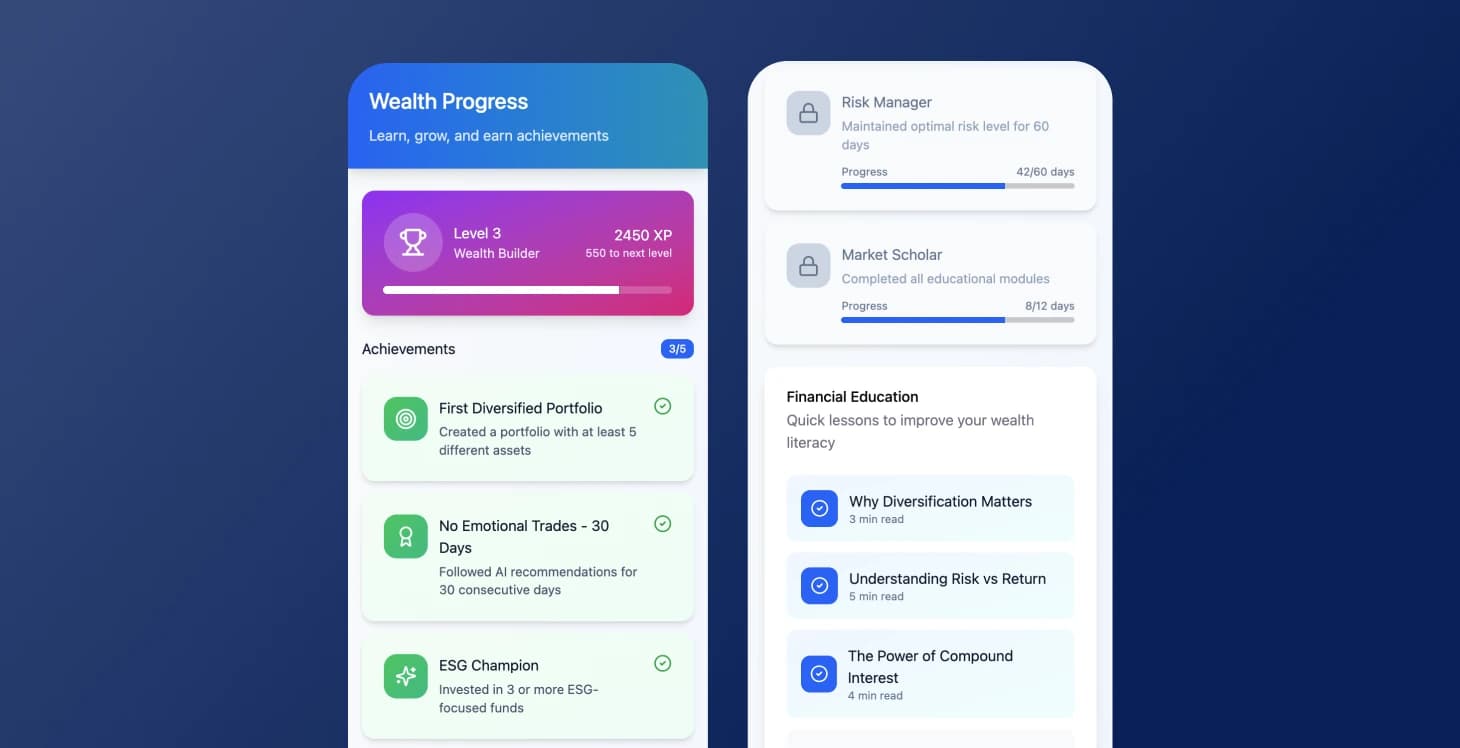

Behavioral Finance Integration

Integrating behavioral economics proved crucial for retail investor success. Purely quantitative models fell short in achieving optimal outcomes and preventing platform abandonment rates by users.

Continuous Model Monitoring

Continuous oversight is essential for monitoring shifts and biases in machine learning models as financial markets undergo transformations. Models relying on historical data may falter during regime changes or unusual market circumstances.

User Education Impact

User education plays a vital role in platform engagement. By incorporating educational materials and tailoring learning paths to individual preferences we observed:

- • in user engagement

- •Substantial enhancements in investment decision quality

Infrastructure Scalability

During times of market volatility it's crucial to have infrastructure capacity to handle traffic increases from heightened financial market activities. This ensures users can access the platform without service disruptions during high stress market events requiring immediate attention.

Data Privacy Considerations

In financial services the utmost importance lies in safeguarding data privacy. User apprehensions regarding data security significantly influence adoption rates. Essential steps include:

- •Establishing robust privacy protocols

- •Frequent security evaluations

- •Granting users authority to manage data sharing preferences