Bridging the gap between finance and digital assets requires an approach. A unified architecture can bring these two worlds together creating an experience for users and institutions. By combining the stability of finance with the innovation of assets we can forge a new path forward one that blends the best of both worlds.

Project Overview

Executive Summary

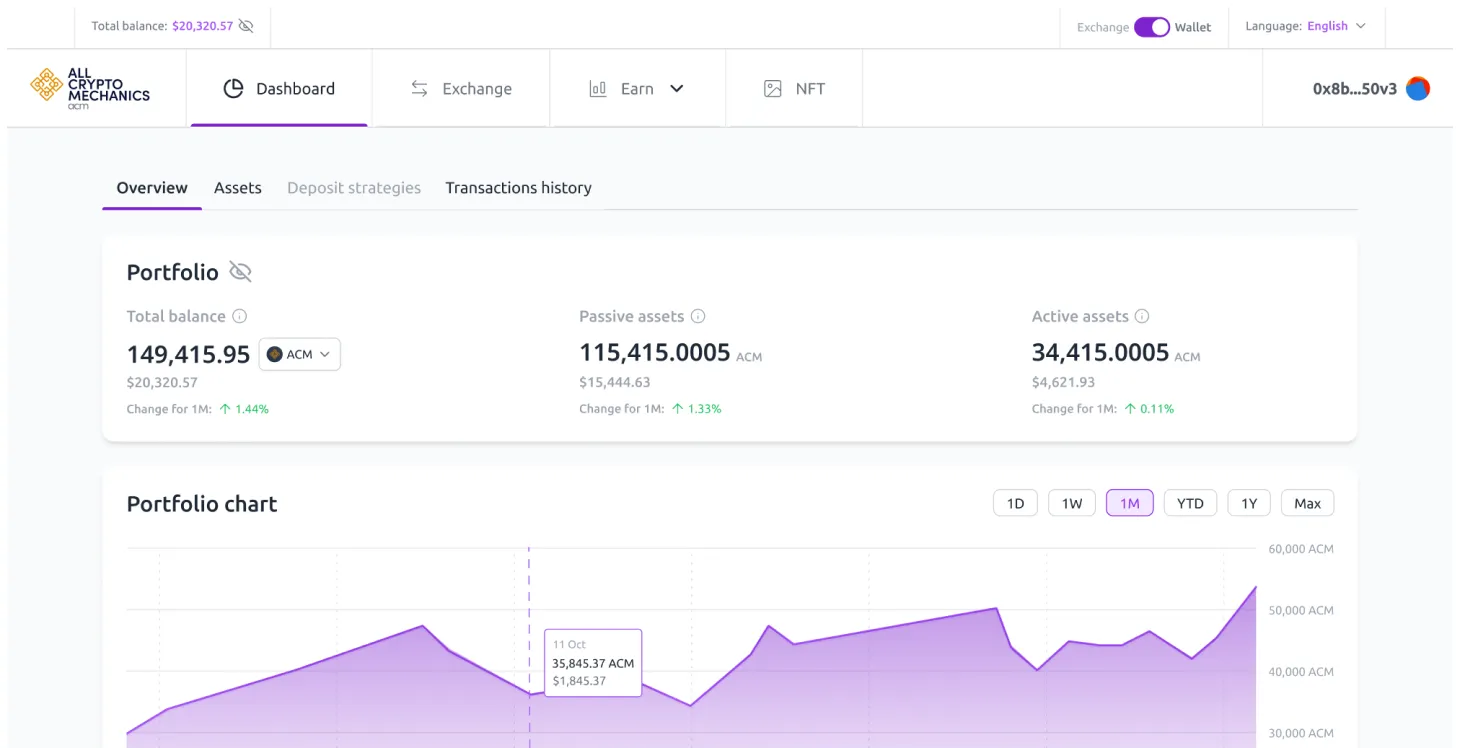

Investors had a time managing their portfolios because they were spread across fashioned and cryptocurrency platforms that didn't work together seamlessly. This caused a lot of hassle and made it harder for them to make investment decisions.

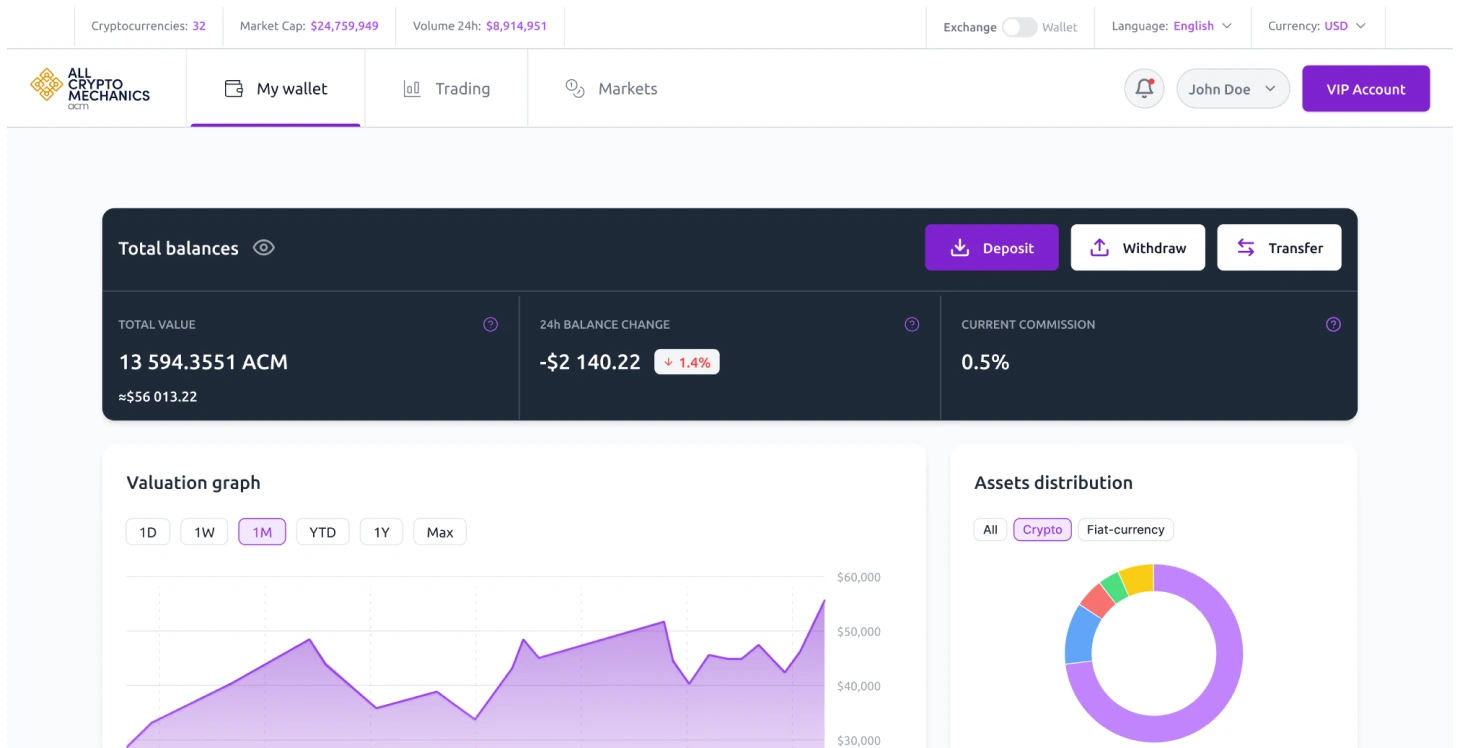

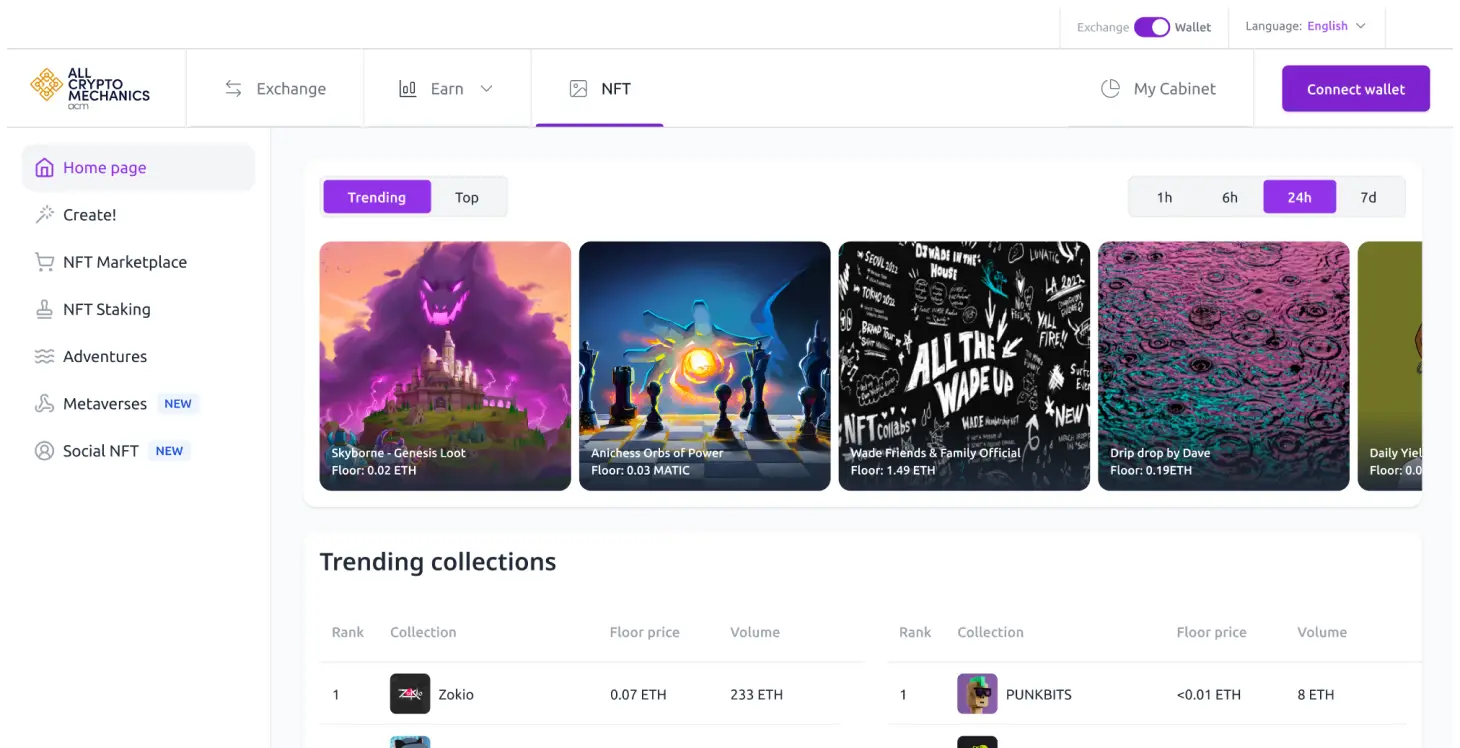

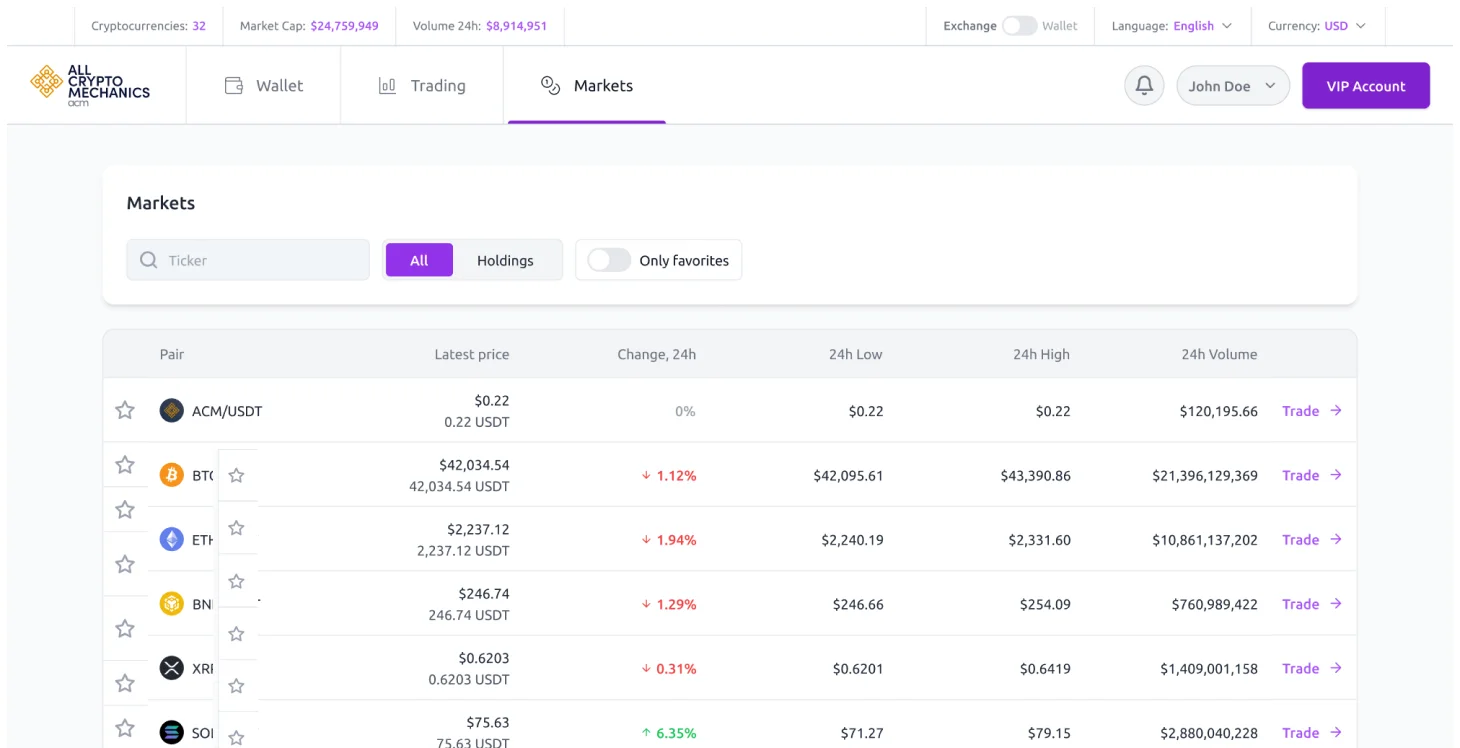

A new financial services platform was created to bring together digital currency operations in one place. This platform supports a range of services from savings accounts to complex derivatives trading all accessible through a single interface. Its designed to be a one stop shop where users can manage all their needs without having to jump between systems.

After putting the system in place the numbers told an impressive story:

- •We saw a 68% drop in the time it took to manage portfolios

- •Cross trading activity jumped up by 40%

- •Platform availability reached 99.95% of the time

- •API response times came under 200 milliseconds

One major hurdle to cryptocurrency adoption has been concerns over security. To tackle this a security first approach was taken focusing on integrating hardware wallets and implementing layers of protection. This not only helped alleviate the concerns of potential users but also ensured that all regulatory requirements were met.

The system was designed to work for everyone from people starting to invest to traders by providing interfaces for each group while keeping strong security and backend services for all users.

Context

The world of finance is going through a shift. Digital assets are becoming more mainstream and are now being considered alongside investments. This change is bringing opportunities but its also creating some big problems for people trying to manage their investments.

Traditional banks and financial institutions are bound by regulations and usually don't have the ability to handle cryptocurrencies. On the other hand cryptocurrency platforms are geared towards assets and offer advanced tools but they can't provide the usual banking services or help with traditional currencies.

This leads to a bit of a mess where people have to juggle accounts through different sets of information and deal with inconsistent interfaces. It's like trying to piece a puzzle with parts that don't quite fit.

The rules surrounding investments are getting more complicated since different countries and regions have their set of guidelines for things like stocks commodities and digital currencies. To stay in line with these rules companies have to balance a lot of demands including:

- •Verifying the identities of their customers

- •Prevention of money laundering

- •Keeping their businesses running smoothly

The Problem

The main problem lies in the gap between fashioned financial systems and new cryptocurrency platforms. This gap shows up in several areas:

Portfolio Management Complexity

For a time managing investments was a process. To handle types of investments people had to use platforms - one for trading stocks another for mutual funds a cryptocurrency exchange and yet another for basic banking services. This made it tough to get a picture of their portfolio making it harder to make decisions about how to allocate their assets.

User Experience Barriers

The world of cryptocurrency can be overwhelming for those used to traditional forms of investing. One major hurdle is the complexity of it all - the learning curve is steep and its tough to get a handle on things. The interfaces used by platforms are over the map which can make it hard for investors to know what they're doing.

Security Concerns

Big security breaches in the crypto world paired with the hassle of managing keys made it tough for people to get on board. What users really needed was top notch security that didn't get in the way of ease of use.

Knowledge Gap

There was a gap in resources which forced people to look elsewhere for information on:

- •How the market works

- •Different trading strategies

- •Ways to manage risk

Transaction Inefficiencies

When money moves between school markets and the newer crypto scene a bunch of middlemen usually get involved. This slows everything down and tacks on fees which eats into profits and makes the whole process more prone to mistakes.

Tackling Business Challenges

Our team made a breakthrough in portfolio management. We cut out the hassle of switching between platforms and compiling data which reduced the time spent on management by a whopping 68%. This change has been a game changer allowing us to make decisions on the fly about how to allocate assets across our portfolio.

Market Democratization

The playing field for trading tools has been leveled with high quality systems to institutions now within reach of individual investors. At the same time an user friendly interface was introduced for those taking their first steps making it easier for newcomers to get started. This shift had an impact growing the market by 45% in just one year.

Revenue Growth

The company managed to open up sales opportunities between its crypto products. By offering a range of services including:

- •Trading with borrowed money

- •Derivatives

- •Products that generate returns

It was able to increase the amount of money it made from each customer over their lifetime by 32%.

Security Improvements

By integrating hardware wallets and multi factor authentication the number of security incidents dropped sharply - 85% less than what's seen in the industry. This is largely due to the fact that a lot of the compliance process was automated which greatly decreased the need for oversight.

User Engagement

The company saw a boost in user engagement - a 58% increase - after launching an integrated educational platform. This move also helped cut down on the number of users jumping ship with a 28% reduction in churn.

Transaction Speed

One major benefit is that we can now handle transactions quickly. Instead of taking days to settle things get done in minutes. This is because we can easily switch between money and cryptocurrency and we've got built in banking services.

Transform Your Trading Experience

Join thousands of traders who've already made the switch to unified portfolio management.

Solution Overview

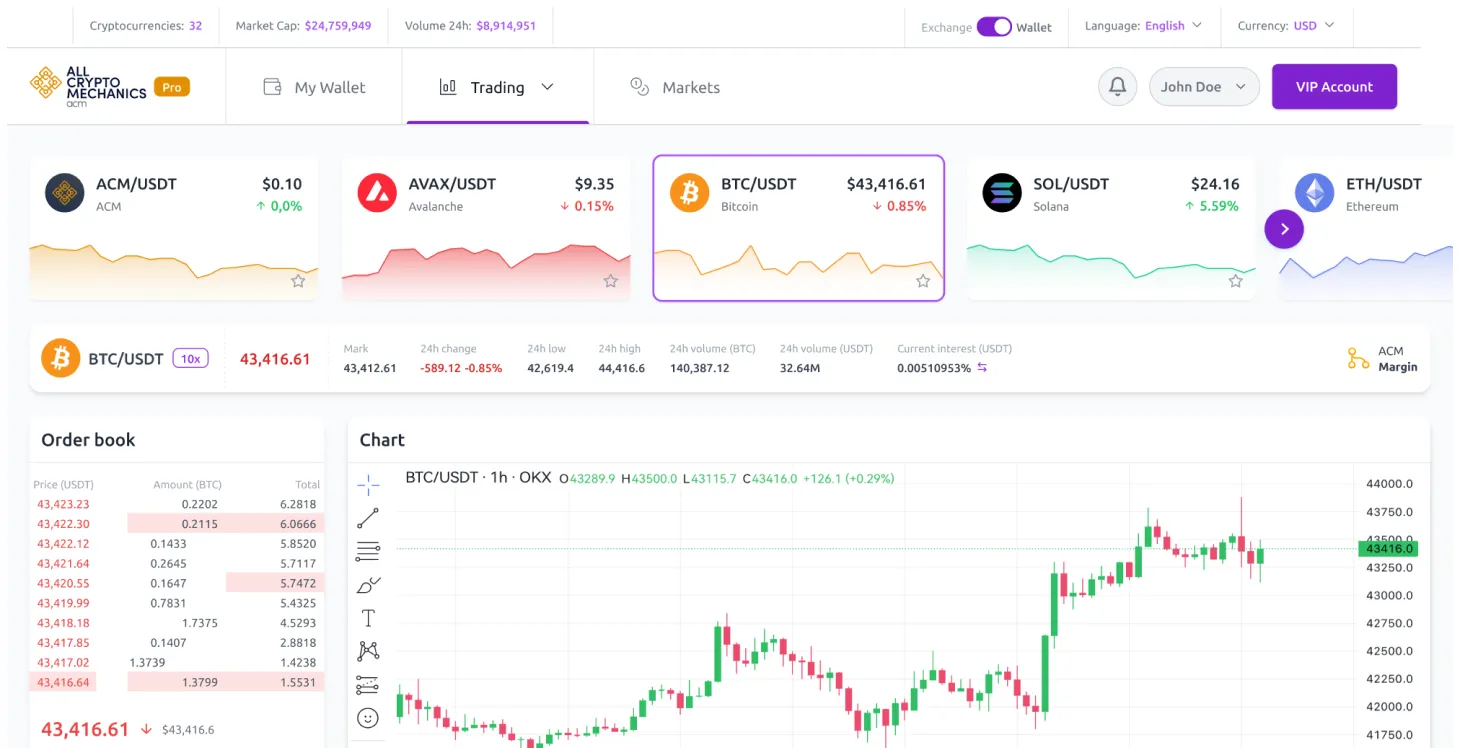

The platforms design focused on building a layer that could bring together traditional financial services and cryptocurrency transactions in a way that still met all the necessary regulations and security requirements. To make this work the system was built using a collection of services. This approach allowed each part of the system to be scaled up or updated on its own without affecting the others.

Unified User Experience

To make financial products more user friendly the goal was to create an experience across the board. This meant designing interfaces that could cater to both beginners and seasoned pros all while using the systems. The system had to get to know its users and figure out what features to show them and when based on:

- •How skilled they were

- •What they liked

- •Their experience level

Security Architecture

The security setup was built around a hardware wallet which was a part of the system rather than something bolted on. This meant that users had control over their keys while still being able to make transactions. The platform used several strategies:

- •Multiple layers of approval needed for transactions

- •Wallets set up in a way that made it easy to keep track of everything

- •Multi-signature transaction approval workflows

Educational Integration

The way we handled the educational part was to make it a natural part of the system rather than something tacked on. This meant people could learn as they went getting information and updates there in the trading and investment sections.

System Architecture

Frontend Layer

The web application is built using Angular making it responsive and able to adapt to devices. It also has the capabilities of a Progressive Web App (PWA) for short. Key features include:

- •Component based architecture supporting role-based UI rendering

- •Real-time market updates using WebSocket connections

- •Offline transaction queuing with sync capabilities

- •Multi-language support with regional compliance considerations

API Gateway and Backend Services

A microservices architecture based on Nest.js where each component is designed to operate independently allowing for flexible deployment options. This setup enables the development team to work on and release services as needed without affecting the system.

Key components include:

- •RESTful APIs combined with GraphQL federation

- •Event driven approach using AWS EventBridge

- •Redis for session management and real-time data caching

- •Rate limiting and API versioning

Core Financial Services

At the heart of our operation is a set of services that play a crucial role:

- •Trading Engine: Handles all sorts of investments including equities bonds cryptocurrencies and derivatives

- •Portfolio Management: Tracks positions in real time and calculates profit and loss

- •Risk Management: Includes position limits and margin requirements

- •Settlement Services: Handle multiple currencies simultaneously

- •Compliance Automation: Tax reporting and compliance documentation

Security and Wallet Management

- •Hardware Security Module (HSM) integration for key management

- •Multi-signature transaction approval workflows

- •Multi-factor authentication with biometric support

- •Transaction monitoring and suspicious activity detection

- •Immutable audit trail for regulatory compliance

Data and Analytics Platform

- •Real-time market data from multiple sources

- •Historical data warehouse for backtesting

- •Machine learning applications for fraud detection and market analysis

- •Customer analytics for personalization

- •Automated reporting with audit capabilities

Infrastructure and DevOps

- •AWS multi-region setup with active-active failover

- •Container orchestration with Amazon EKS

- •Infrastructure as Code using AWS CDK and Terraform

- •CI/CD pipelines with automated testing and security scanning

- •Monitoring and observability with CloudWatch and custom metrics

Implementation

We started by building the foundation focusing on the core infrastructure and security components. Once that was in place we added the user facing services and advanced features layer by layer.

Foundation Phase (Months 1-3)

The project started with setting up the infrastructure and getting the security framework in place. Key activities included:

- •AWS landing zone configuration for governance

- •Core authentication and authorization services

- •Hardware wallet integration with extensive device testing

- •Security framework implementation

Core Services Phase (Months 4-7)

Focus on developing the trading engine with proper order matching algorithms and market data integration. The portfolio management service needed an approach to tracking positions across types of assets. A data streaming infrastructure was set up using AWS Kinesis for:

- •Market data distribution

- •Real-time transaction processing

- •Cross-asset position tracking

User Experience Phase (Months 8-11)

Frontend development emphasized responsive design for all devices. Key developments included:

- •Progressive web application features

- •Educational platform integration with content management

- •Learning path monitoring systems

- •Personalization engines based on user behavior

Advanced Features Phase (Months 12-15)

Introduction of sophisticated features including:

- •Margin trading and derivatives with advanced risk management

- •Debit card integration with banking partnerships

- •PCI DSS compliance implementation

- •Rewards center with loyalty programs

Testing Strategy

The testing process was comprehensive covering everything from units of code to integrated systems and complete workflows with focus on:

- •Getting calculations exactly right

- •Making sure security protocols were foolproof

- •System performance under high trading volumes

- •Market volatility stress testing

- •Security penetration testing

- •Compliance standards verification

Migration and Rollout

Beta Launch

The beta launch was initially aimed at experienced traders and those familiar with cryptocurrency as a way to test advanced features. The gradual feature introduction allowed the team to:

- •Monitor performance closely

- •Make adjustments based on user feedback

- •Validate system scalability

Legacy System Migration

For existing customers the migration process involved comprehensive data review to ensure accuracy including:

- •Data validation procedures

- •Reconciliation processes

- •Gradual feature migration

Results and Metrics

The new platform made a significant difference in operations efficiency user satisfaction and business growth. The system handled over 10 million transactions monthly with API response times under 200ms and 99.95% uptime.

User Adoption

Cross-platform activity increased by 40% with the ability to switch between traditional money and cryptocurrencies being a major draw. On the educational side 78% of people finished beginner courses compared to the industry average of 45-55%.

Security Performance

Despite handling over $2.8 billion in transactions there wasn't a single security breach in the first year. Hardware wallet adoption reached 67% of users indicating successful balance between security and usability.

Key Performance Metrics Comparison

| Metric | Before | After | Delta |

|---|---|---|---|

| Portfolio management time (daily) | 47 minutes | 15 minutes | -68% |

| API response time (P95) | 850ms | 185ms | -78% |

| Cross-asset trading frequency (monthly) | 2.3 times | 3.2 times | +40% |

| Platform uptime | 99.2% | 99.95% | +0.75% |

| User onboarding time | 6.5 hours | 2.1 hours | -68% |

| Security incidents (monthly) | 0.12 | 0.01 | -92% |

| Customer lifetime value | $3,200 | $4,225 | +32% |

| Monthly transaction volume | $890M | $2,800M | +215% |

Service Level Objectives Achievement

| Service Level Objective | Target | Achieved |

|---|---|---|

| Trading API latency (99th percentile) | <300ms | 248ms |

| Market data lag | <50ms | 32ms |

| Transaction settlement time | <5 minutes | 3.2 minutes |

| User authentication success rate | >99.9% | 99.97% |

| Portfolio sync accuracy | 100% | 100% |

| Mobile app crash rate | <0.1% | 0.08% |

| Hardware wallet integration completion | >95% | 97.3% |

| Educational content engagement | >70% | 78% |

Lessons Learned

Security First Approach

Making security a top priority from the start is vital. Integrating hardware wallets into system architecture from the beginning rather than adding later greatly impacts user adoption and reduces implementation complexity.

Microservices Balance

The initial microservices setup was too fragmented which led to complications. Grouping related functions into bigger more cohesive units improved performance while maintaining service benefits.

User Experience Personalization

Using machine learning to recommend features helped strike a balance between simplicity and functionality. Personalized learning paths significantly improved user engagement compared to generic educational content.

Market Data Architecture

Designing real-time market data architecture requires careful WebSocket connection management and failover planning especially during volatile market conditions.

Financial Calculations Testing

Traditional software testing approaches weren't sufficient for financial precision. Specialist testing frameworks became essential for validating financial logic across multiple currencies and asset types.

Trading Engine Performance

High-frequency order processing during market events required moving from sequential processing to priority queue systems for better performance under heavy workloads. Smart contract development principles were applied to ensure transaction integrity and automated execution.

Educational Content Impact

Personalized learning paths based on trading history and interests significantly outperformed generic educational content in user retention and completion rates.

Building compliance checks into business logic rather than treating them separately provides natural user feedback and improves overall experience.

Hardware wallet device compatibility varies significantly between manufacturers. Comprehensive device compatibility mapping and fallback procedures are crucial for large deployments.

Technology Stack

Frontend Technologies

- •Angular Framework: TypeScript-based framework

- •Angular Material Design: UI components

- •NgRx: State management

- •RxJS: Reactive programming

- •Service Workers: PWA capabilities

Backend Technologies

- •Nest.js: Node.js server-side framework

- •TypeScript: Type safety

- •Express.js: Web server

- •Socket.io: Real-time communication

- •Bull: Background job queue system

Database and Storage

- •PostgreSQL: Primary database

- •Redis: Caching and session management

- •Amazon S3: Document storage

- •Amazon DynamoDB: High-frequency data

- •Amazon ElastiCache: Distributed caching

Cloud Infrastructure

- •Amazon Web Services (AWS): Cloud platform

- •Amazon EKS: Container orchestration

- •AWS Lambda: Serverless functions

- •Amazon API Gateway: API management

- •AWS CloudFront: Content delivery

Security and Compliance

- •AWS Key Management Service (KMS): Key management

- •Hardware Security Modules (HSMs): Secure key storage

- •OAuth 2.0 and JWT: Authentication protocols

- •Multi-factor authentication: Identity verification

- •SSL/TLS encryption: Data protection

Monitoring and Analytics

- •Amazon CloudWatch: Infrastructure monitoring

- •AWS X-Ray: Distributed tracing

- •Custom metrics and dashboards: Performance tracking

- •ELK Stack: Log aggregation

- •Prometheus: Application metrics

Project Results

- 68% reduction in portfolio management time

- 40% increase in cross-platform trading activity

- 99.95% system uptime achieved

- 200ms API response time maintained

- 67% hardware wallet adoption rate

Key Performance Metrics

Time Reduction

Portfolio management efficiency

Trading Activity

Cross-platform usage increase

System Uptime

Platform availability

Response Time

API performance