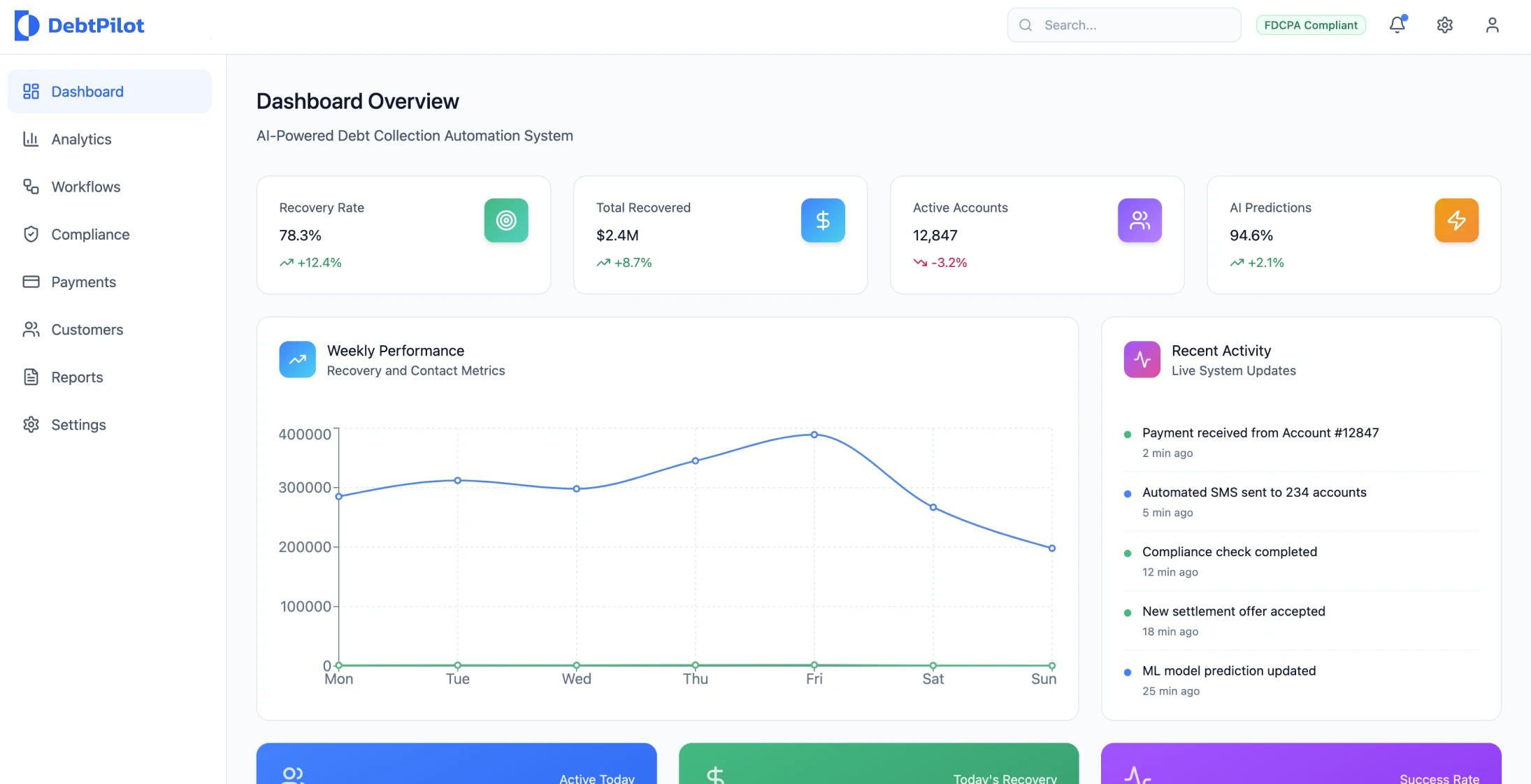

Financial companies struggled with methods for recovering debts, leading to poor customer relations, low success rates, and increased operational expenses. We implemented a comprehensive SaaS automation system that transformed traditional debt collection into a customer-centric, AI-powered solution achieving 67% increase in recovery rates while dramatically improving customer satisfaction.

Project Overview

The Challenge

Financial companies struggled with methods for recovering debts, leading to poor customer relations, low success rates, and increased operational expenses.

Handling debt collection is vital but tough in the financial realm due to several critical issues:

- •Customer connection challenges from old-fashioned methods

- •Potential legal risks and compliance complications

- •Unsatisfactory recovery rates using outdated strategies

- •Manual processes and generic messages that don't adapt to each customer's situation or payment ability

Traditional System Limitations

Traditional methods of collecting debts had many flaws that hurt results and customer happiness:

- •Inconsistent Processing: Systems were slow and inconsistent due to manual handling, causing delays and errors

- •Administrative Burden: Agents often spent most of their time on paperwork instead of helping customers directly

- •Poor Communication Strategy: Communication strategies didn't consider personalization or optimal timing, often leading to contact attempts at inappropriate times or through channels customers avoided

- •Limited Analytics: The lack of analytics meant that collection efforts were not tailored based on payment likelihood or customer financial situations

- •Integration Challenges: Collection systems with core banking platforms resulted in data silos that hindered real-time updates on account statuses

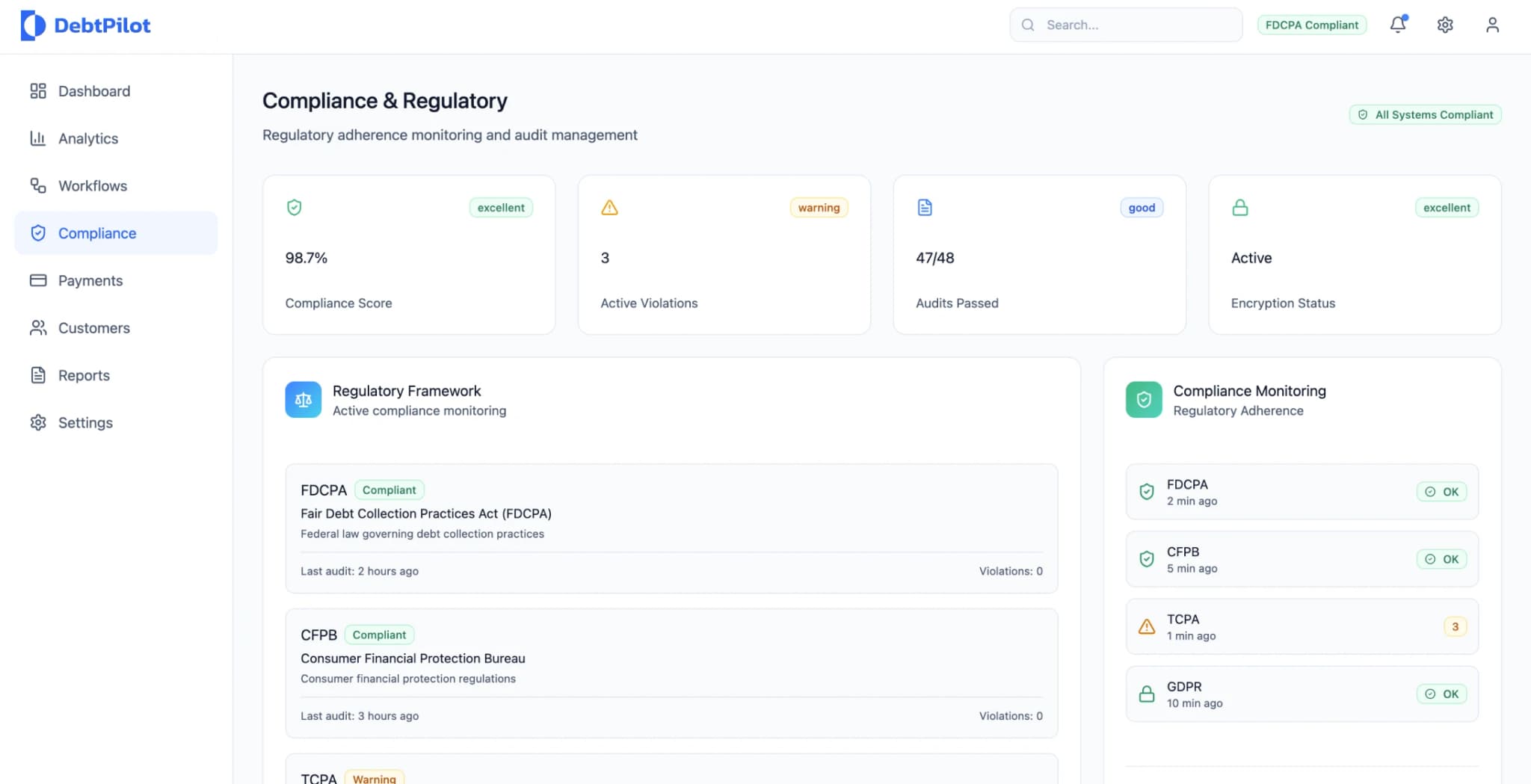

Regulatory Complexity

Laws like the Fair Debt Collection Practices Act (FDCPA), guidelines from the Consumer Financial Protection Bureau (CFPB), and specific state regulations add layers of complexity by necessitating communication approaches and timing adjustments in accordance with rules and customer choices.

Managing compliance posed a major hurdle as it involved monitoring communication efforts and ensuring consent and regulatory compliance, keeping organizations at risk of penalties for non-compliance violations.

The Solution

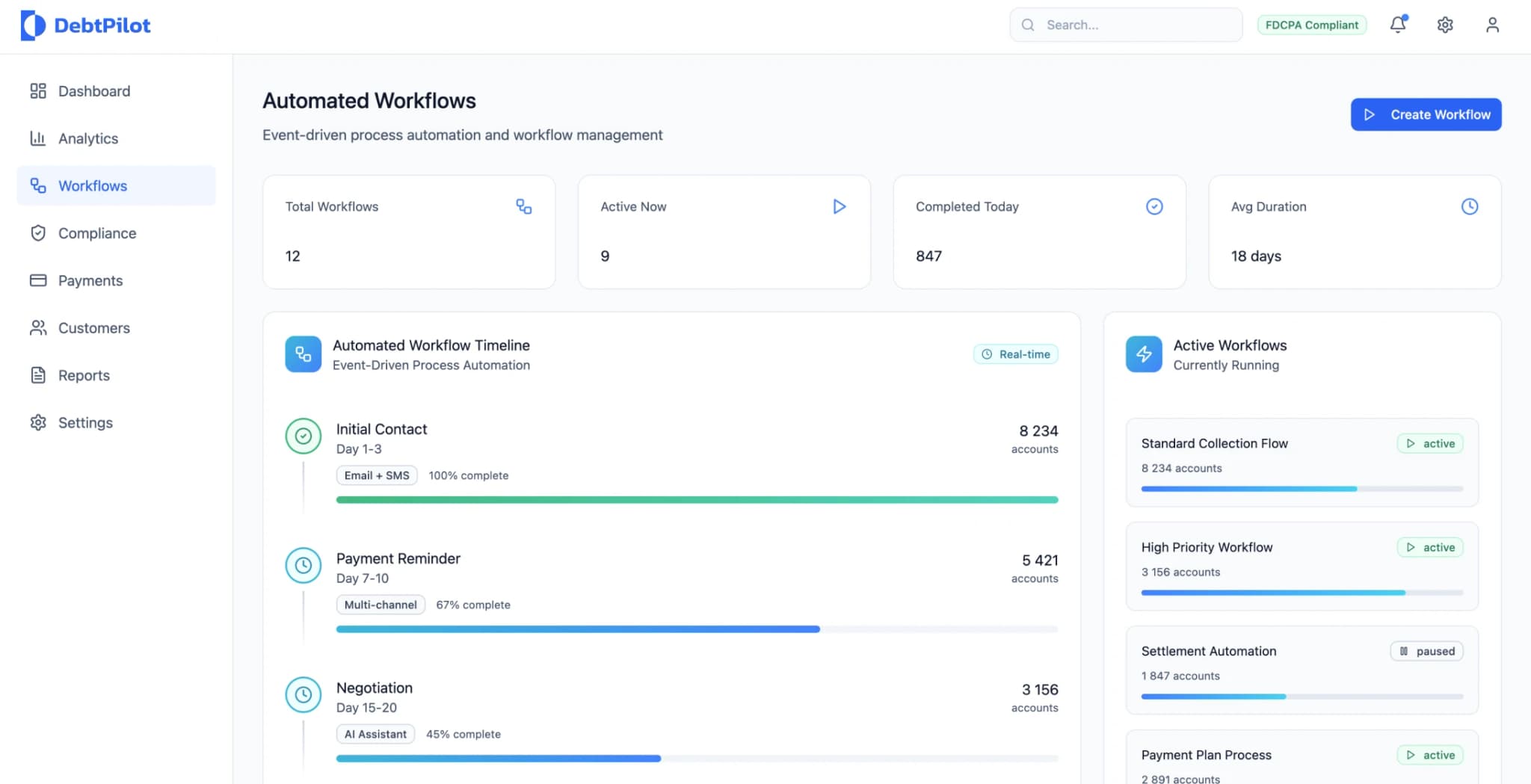

I implemented a versatile SaaS automation system that combines payment scheduling with channel communication setups. It also includes analysis and connections with financial systems.

Core Architecture

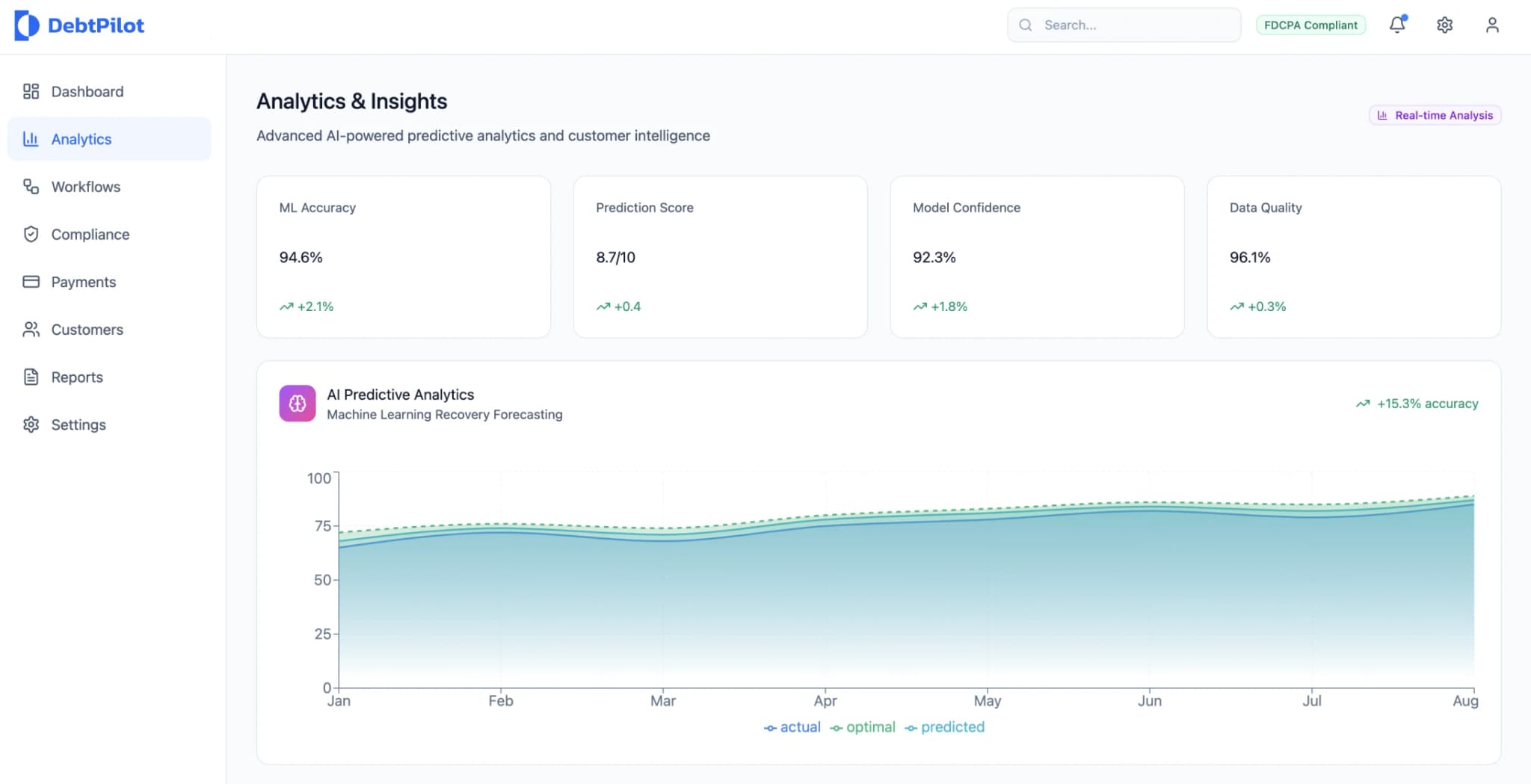

The core structure of the platform focused on event-triggered microservices that support data processing and smooth integration with financial systems while also prioritizing customer-oriented automation over forceful collection methods by leveraging:

- •Behavioral analysis and machine learning

- •Enhanced timing of customer interactions

- •Optimal channel selection

- •Advanced automation features for tailored payment plans

- •Predictive analytics to optimize collection strategies

Key System Components

Security and Compliance

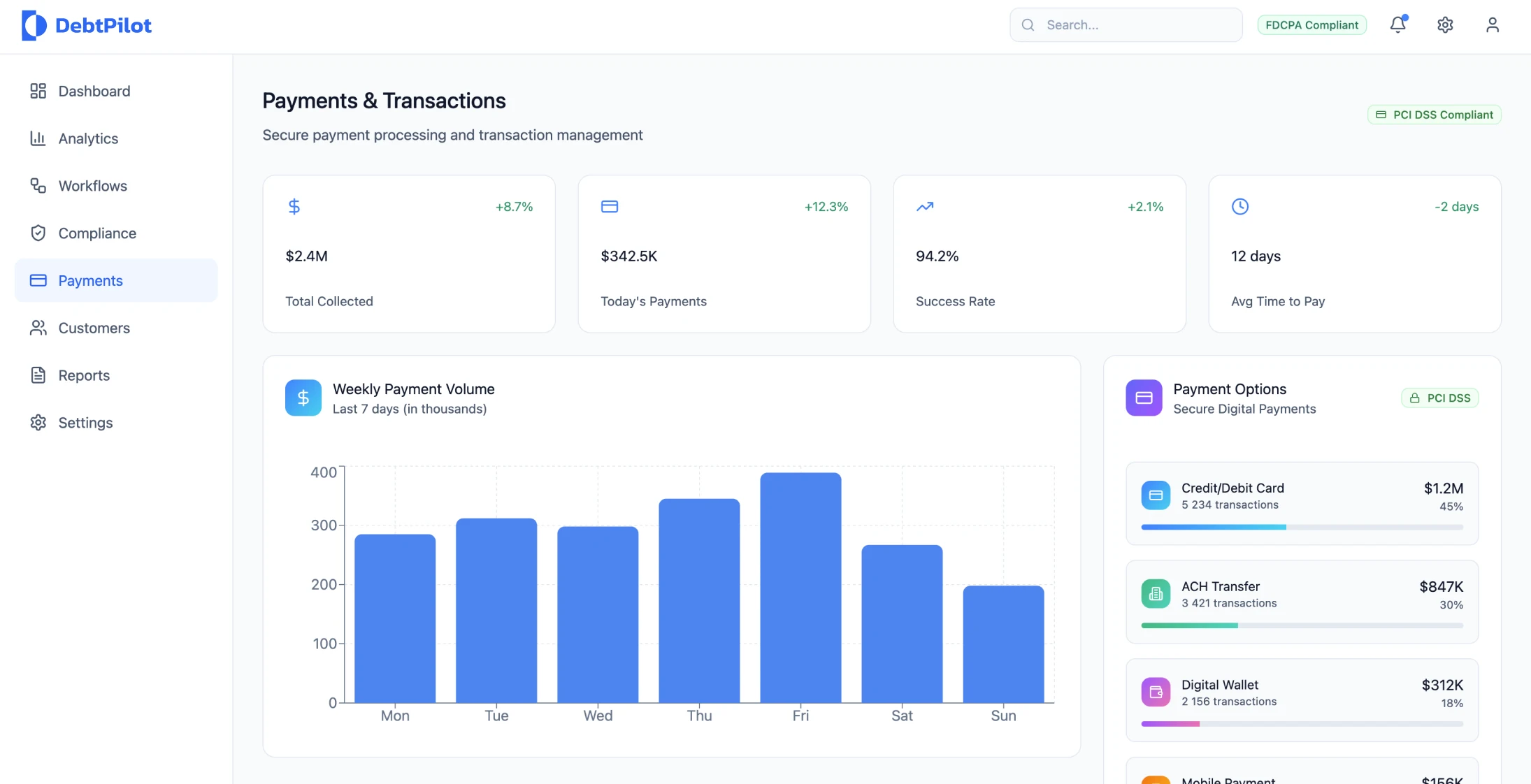

All information transfer is secured with TLS 1.3 encryption along with certificate pinning. Customer data storage is encrypted using AES-256 encryption and follows rotation protocols to enhance security measures.

The system enforces:

- •Role-based access controls

- •Multi-factor authentication

- •Detailed records of all customer engagements

- •System access activities for auditing purposes

System Architecture Components

| Component | Function | Key Features |

|---|---|---|

| API Gateway | Traffic Management | Rate limiting, authentication, request routing and transformation |

| Workflow Orchestration Engine | Process Management | State machine driven collection process management with logic and escalation paths |

| Communication Service | Multi-channel Delivery | Channel message delivery, template management, and personalized delivery optimization |

| Payment Processing Module | Transaction Handling | PCI payment management, integrated with gateways and fraud detection measures |

| Data Analytics Engine | Real-time Processing | Machine learning models execution and score determination |

| Integration Hub | System Connectivity | ETL pipelines for data transformation and connectivity management |

| Compliance Monitor | Regulatory Oversight | Rule enforcement, audit logging, and consent procedures |

Implementation Process

Phase 1: Infrastructure Setup

The project was carried out in phases starting with setting up the infrastructure and establishing security measures.

Phase 2: System Integration

In the subsequent stages, we tested the integration of APIs with financial systems to guarantee data accuracy and real-time synchronization abilities.

Phase 3: Testing and Validation

- •Automated testing suites covering unit tests, integration tests, API contract validations

- •End-to-end workflow verifications

- •Performance tests mimicking high-volume scenarios with concurrent user loads

Phase 4: Deployment

During the transition to the new system, we gradually moved traffic while monitoring confidence metrics, ensuring a smooth migration process for historical data using ETL procedures with validation checkpoints.

Seamless Migration Success

Gradual traffic migration with confidence metrics ensured smooth transition while maintaining service quality.

Results and Impact

Recovery Performance

- •67% increase in recovery rates

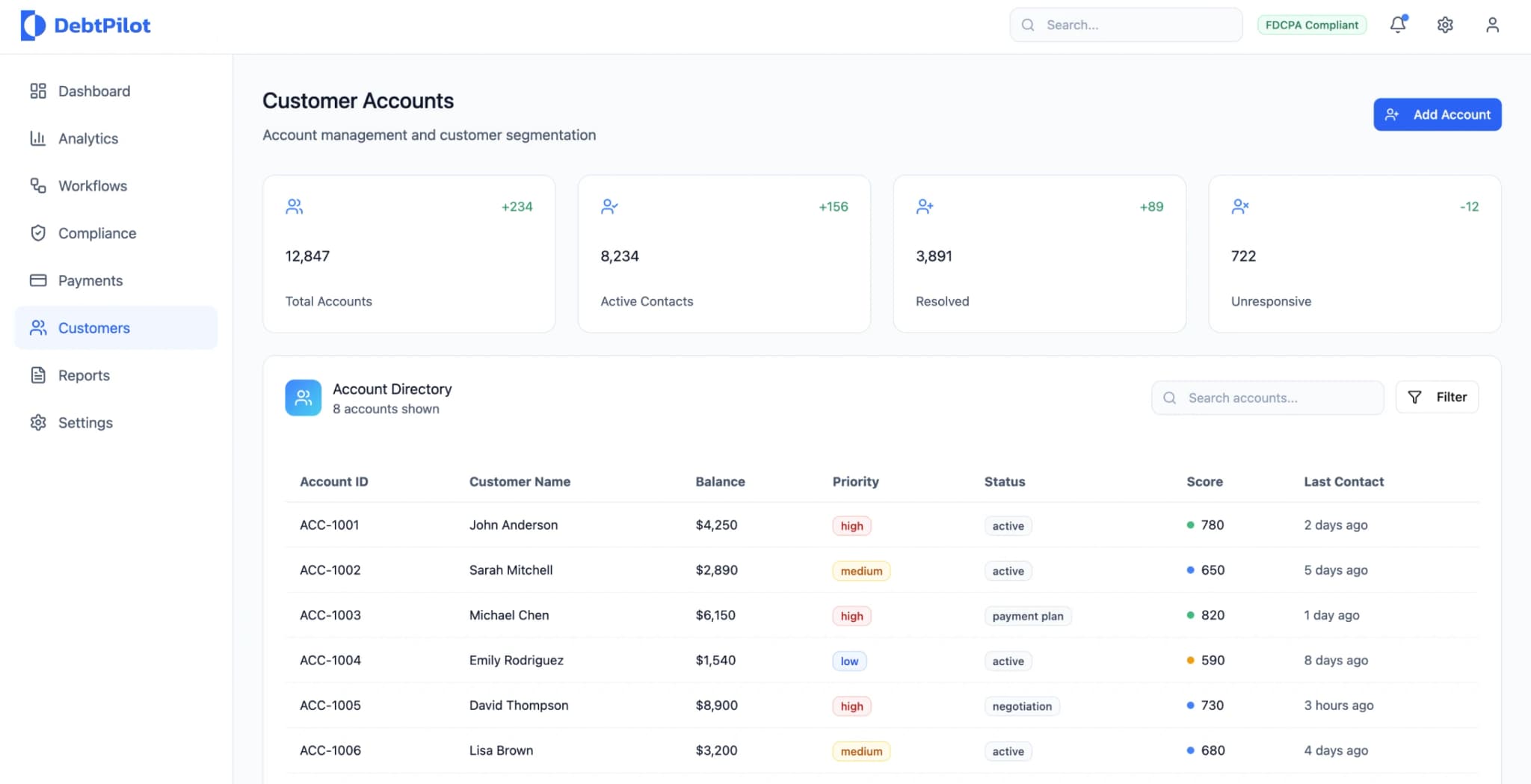

- •Successfully enhanced debt recovery from 34% to 57% through customer segmentation and customized engagement methods

Cost Reduction

- •45% reduction in collection operation expenses by automating workflows

- •Eliminated manual duties and boosted agent efficiency in important tasks

Customer Satisfaction

- •89% decrease in customer complaints through convenient payment options and communication preferences

- •Significant improvement in Net Promoter Scores

Operational Efficiency

- •Reduced collection cycle time from 180 days to 78 days

- •52% decrease in write-off rates

- •Collection teams can now manage 280% more accounts per agent

System Performance Metrics

Key Performance Indicators

| Metric | Before | After | Improvement |

|---|---|---|---|

| Recovery Rate | 34% | 57% | 67% increase |

| Collection Cycle | 180 days | 78 days | 57% reduction |

| Customer Complaints | Baseline | Reduced | 89% decrease |

| Payment Plan Completion | 41% | 73% | 78% increase |

| System Availability | 99.0% | 99.9% | 0.9% improvement |

Project Results

- 67% increase in recovery rates

- 89% decrease in customer complaints

- 45% reduction in collection operation expenses

- 57% reduction in collection cycle time

- 52% decrease in write-off rates

Key Performance Metrics

Recovery Rate Increase

Improvement in debt recovery

Customer Complaints Reduction

Decrease in customer complaints

Cost Reduction

Collection operation expenses

Cycle Time Improvement

Reduction in collection cycle

Key Learnings and Best Practices

Integration Complexity

The initial timeline projections did not fully account for the challenges of integrating with banking systems. For projects of this nature, it's wise to allow additional time for:

- •API development

- •Data mapping

- •Integration testing phases

Data Quality Importance

For analytics to be successful and accurate in their predictions, it is crucial to have high-quality data. Organizations are advised to prioritize investing in data quality initiatives before implementing advanced collection strategies.

Compliance Automation

Automating compliance became crucial as manual management became unsustainable at scale. This shift to automated enforcement and audit trail creation has become vital for organizations operating in various jurisdictions through blockchain consulting approaches.

Change Management

Change management is crucial for adoption. The training of collection agents and workflow adjustments demanded more focus than originally foreseen.

The key to success lay in comprehensive training initiatives and a phased introduction of features rather than rushing into full-scale platform implementation.

Technical Architecture Details

Cloud Infrastructure

The system employed a cloud-based microservices structure implemented across multiple availability regions equipped with:

- •Automated failover features

- •Horizontal scalability to accommodate processing requirements

- •Automated scaling using Kubernetes for container orchestration

Data Processing

- •Real-time and batch processing methods to meet integration demands

- •Time Series Database for storing analytics and performance metrics

- •Machine learning models for payment propensity scoring and contact timing prediction

Payment Processing

- •PCI-compliant payment management

- •Integration with multiple payment gateway providers

- •Fraud detection and real-time validation systems

Conclusion

The platform overhaul led to significant enhancements in efficiency and financial results while boosting customer satisfaction measures. The focus on customer needs brings positive business outcomes, as shown through the success of respectful communication methods over forceful debt collection strategies, leading to improved payment compliance and stronger customer connections.

This comprehensive transformation demonstrates that modern debt collection can be both highly effective and customer-centric when powered by the right technology and approach.

The financial industry today necessitates advanced automation features to manage payment situations while ensuring adherence to regulations across regions and maintaining personalized customer interactions with respect and care.