The current system, for knowing your customer or that really hurt trade finance. For instance companies have to go through the verification process over submitting the same documents to every bank and logistics company they work with.

Key Issues

Each one of these institutions does its background checks and screens, for sanctions, which's just redundant. As a result it takes . Even when dealing with longtime business partners the entire process has to be repeated from scratch every time.

For a time different departments, within institutions couldn't share information easily which slowed down the approval process for trade financing. The problem was that banks couldn't quickly check if a business partner had already gone through a "know your customer" process with another bank, in the group.

The ease with which personal details can be shared has led to a worrying trend. Sensitive information is now scattered across systems leaving us vulnerable, to security breaches.

Data Security Concerns

- •Entire corporate registration documents being transmitted

- •Beneficial ownership information scattered across systems

- •Financial statements stored by various parties

- •Significantly expanded scope of breaches

- •Compliance risks under data protection laws

Compliance Challenges

Audit and compliance challenges popped up because institutions had documentation trails, over the place. Regulators wanted to see records of whos who. Since these records were scattered across multiple systems it was tough to:

- •Show that compliance standards were being enforced consistently

- •Keep everything in line with what the regulators were expecting

- •Maintain proper documentation trails

Manual processing of documents, in areas like verification and sanctions screening was prone to mistakes, which in turn limited the ability to handle increasing workloads.

Business Impact Solutions

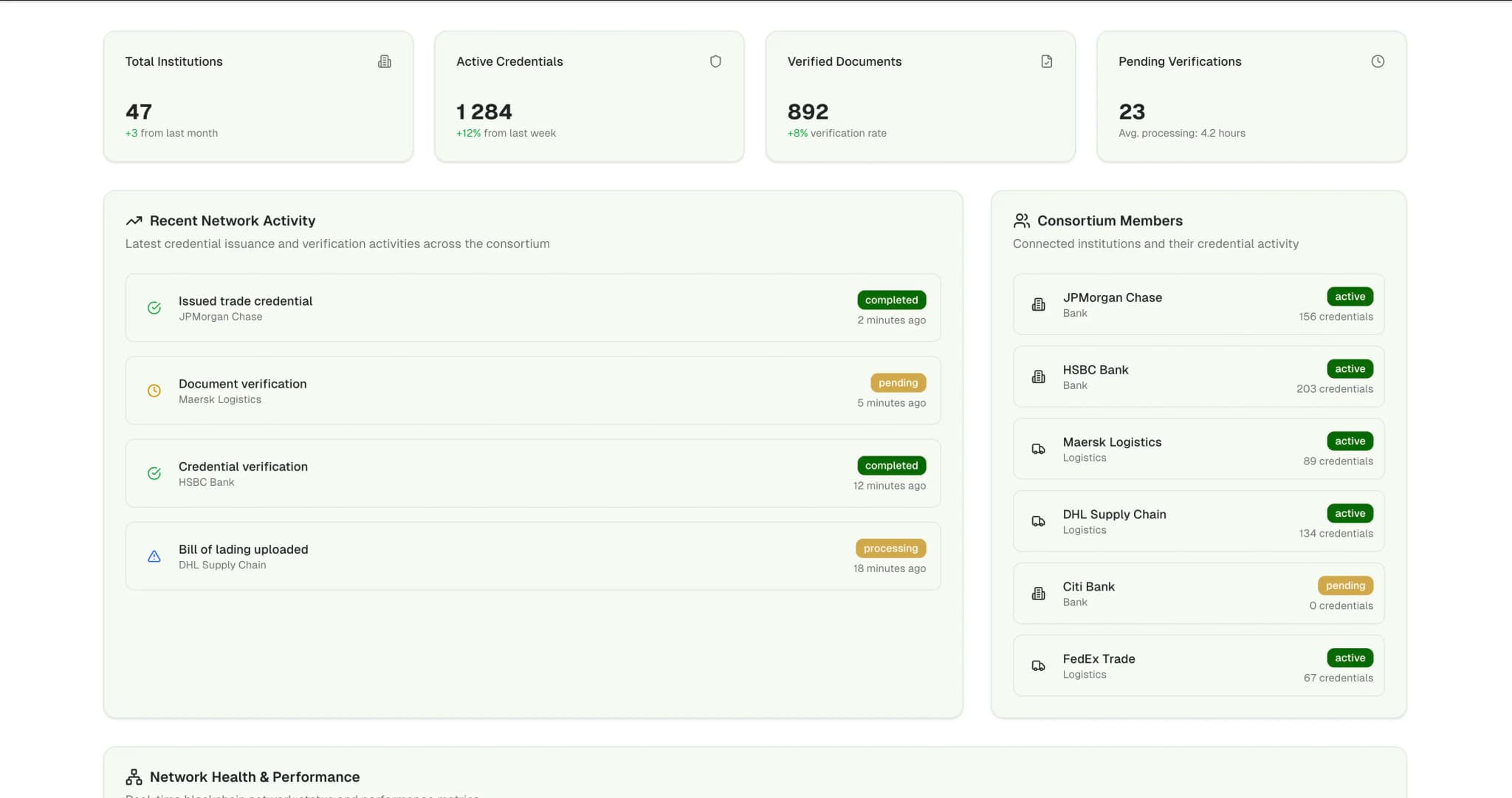

The introduction of a decentralized identity system has led to an overhaul, in efficiency. In one instance it managed to cut down on the reducing the overhead by a staggering .

This was made possible because different members of the consortium could now:

- •Reuse existing credentials

- •Rely on verified counterparties

- •Eliminate redundant documentation processes

- •Make quicker trade financing decisions

Automated Compliance

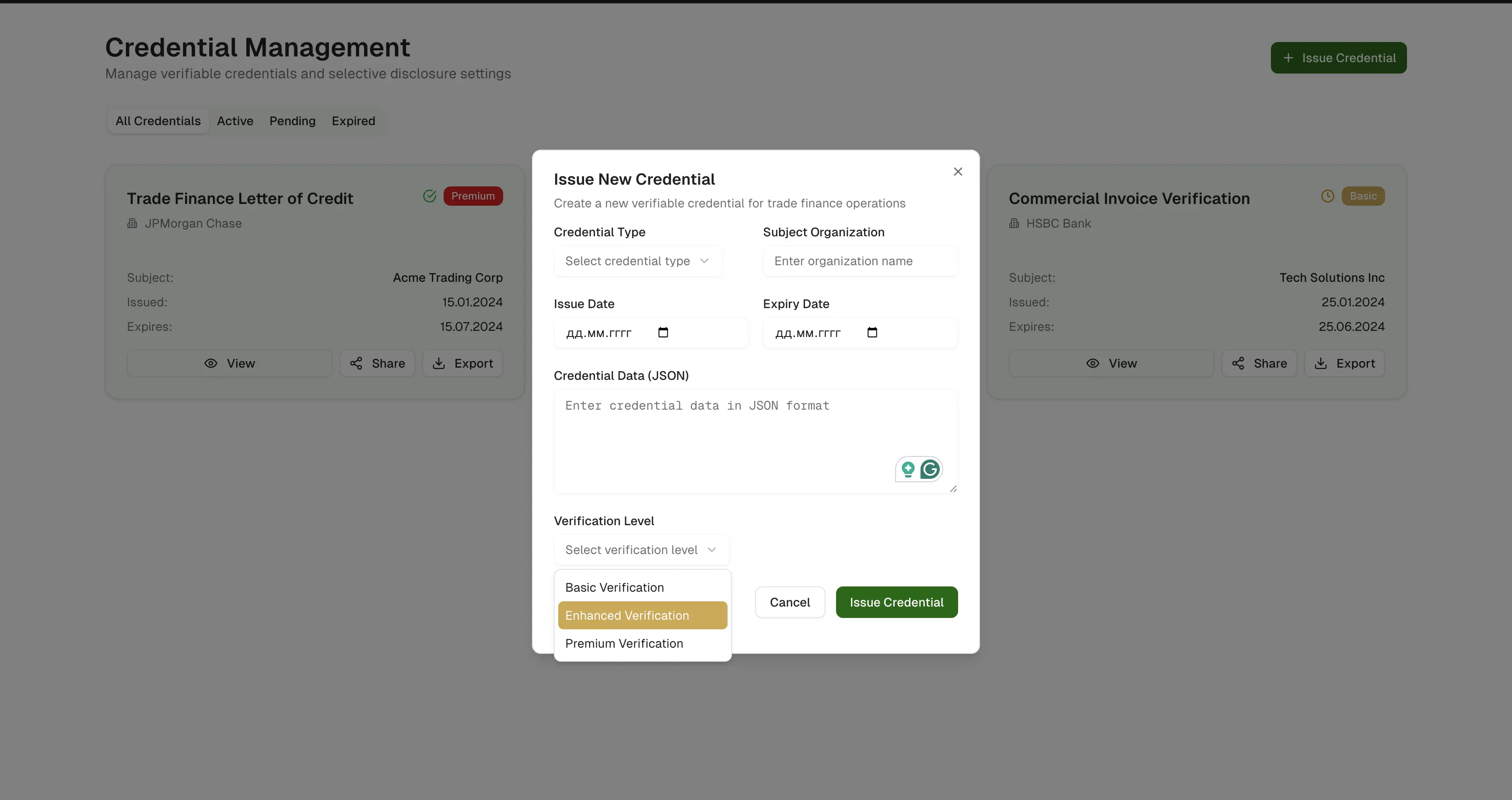

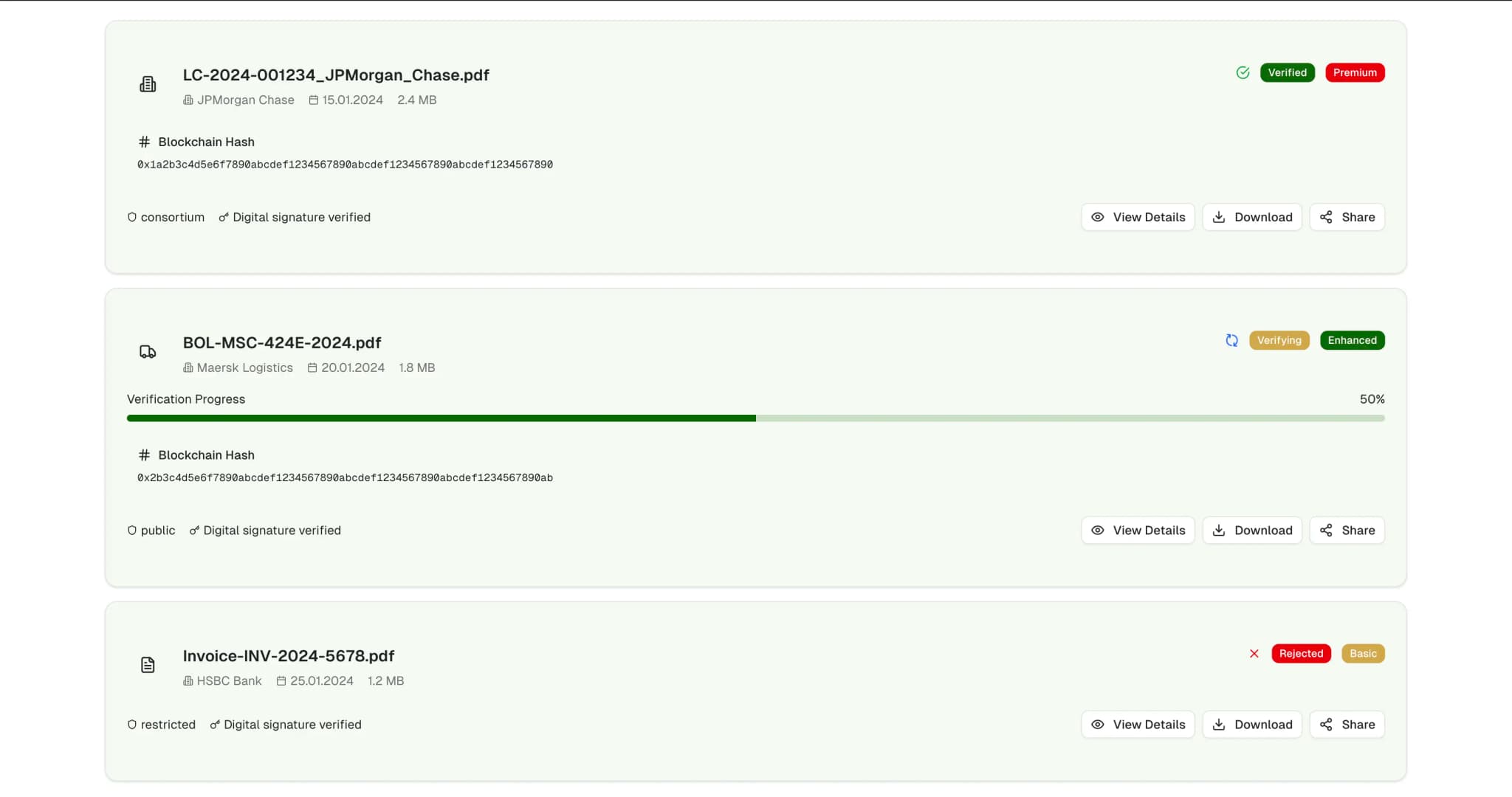

To cut down on compliance risks the system used through contracts. This meant that only credentials that met rules were accepted when:

- •Issuing letters of credit

- •Factoring invoices

- •Processing trade documents

As a result the need, for checks to ensure compliance was eliminated, which in turn reduced the risk of violating regulations.

Key Improvements

The time it takes to complete the has been significantly reduced:

- •From to

- •Major improvement impact on trade financing approval

- •Allows importers and exporters to get funds quicker

- •Improves cash flow for businesses

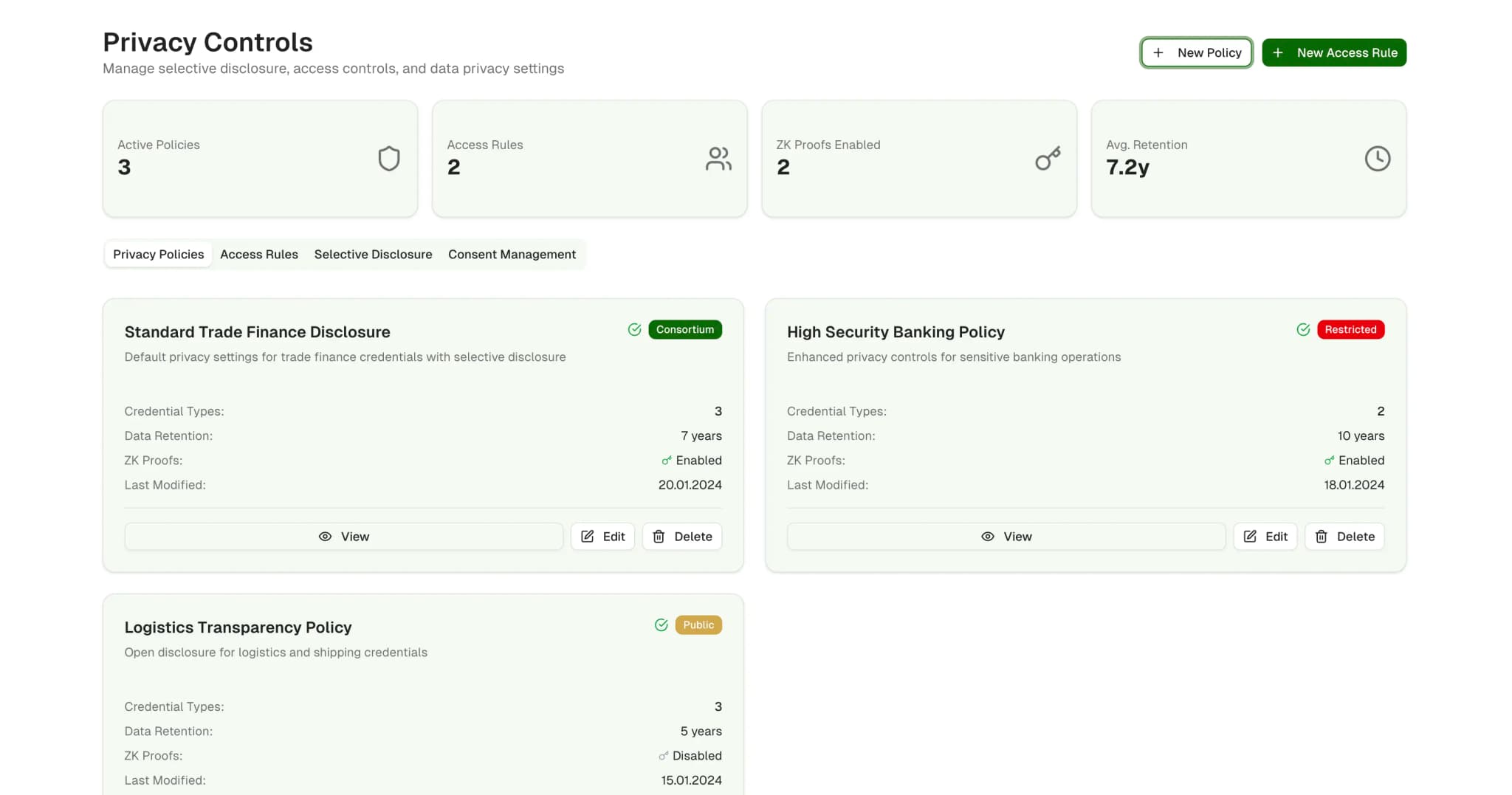

Another key benefit is the ability for businesses to be about what information they share with their counterparts releasing the details while keeping sensitive business information private.

Enhanced Security

Improving a companys security posture can be achieved by taking steps:

- •Using pairwise identifiers or

- •Scaling back the amount of identifiable information stored on blockchain

- •Significantly cutting down on exposure to data breaches

- •Quick action mechanisms for credential revocation

The audit trail, for credentials was made efficient by using a log on a shared ledger. This approach provided a record of all actions, which helped meet requirements. As a result the amount of paperwork needed for compliance was significantly reduced.