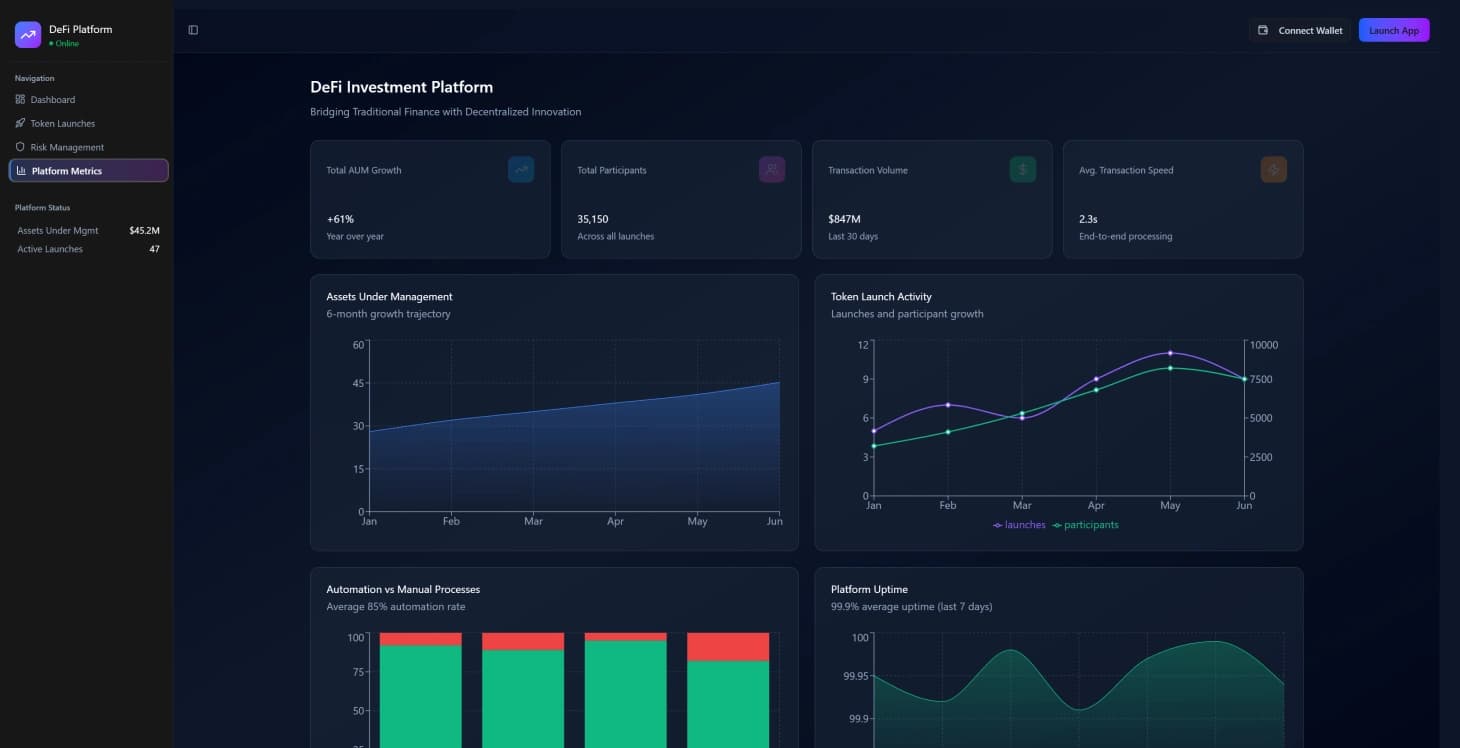

We developed a comprehensive DeFi investment platform that successfully bridges traditional finance with decentralized innovation. The platform addresses critical challenges in cryptocurrency investment by integrating smart contract automation with conventional web infrastructure, achieving exceptional performance metrics including 99.9% uptime during high-traffic events and managing over $45 million in assets under management across 47 token launches.

Project Overview

Traditional Investment Platform Challenges

Traditional cryptocurrency investment platforms faced challenges, with transparency issues and security vulnerabilities while providing poor user experience during token launch periods.

Centralized investment platforms brought about issues like counterparty risk and lack of transparency, while decentralized on-chain solutions lacked the user experience and compliance tools required for institutional acceptance.

Platform Implementation and Architecture

Implemented an investment platform that integrates contract automation with traditional web infrastructure to enhance performance and ensure compliance.

Key Performance Metrics

- •Maintained 99.9 percent uptime during launch events with heavy traffic flow

- •Cut down KYC processing time by a significant 68 percent

- •Providing live access to over $45 million in assets under management

- •Managing over 12,000 investor transactions related to 47 launches on our platform with no financial losses

- •Dashboard response times below 200 milliseconds

Market Context and Challenges

DeFi Sector Growth

The DeFi sector has seen expansion as the total value locked has surpassed $200 billion in protocols. Nonetheless, startup token investment platforms encountered hurdles in aligning decentralization ideals with investor safety and regulatory obligations.

Zero-Day Token Launch Complexity

The rise of zero-day token launches, where tokens are available for investment as soon as the smart contract is deployed, added new layers of complexity regarding:

- •Fair distribution methods

- •Managing investor access

- •Addressing price discovery concerns

Platform Solutions and Improvements

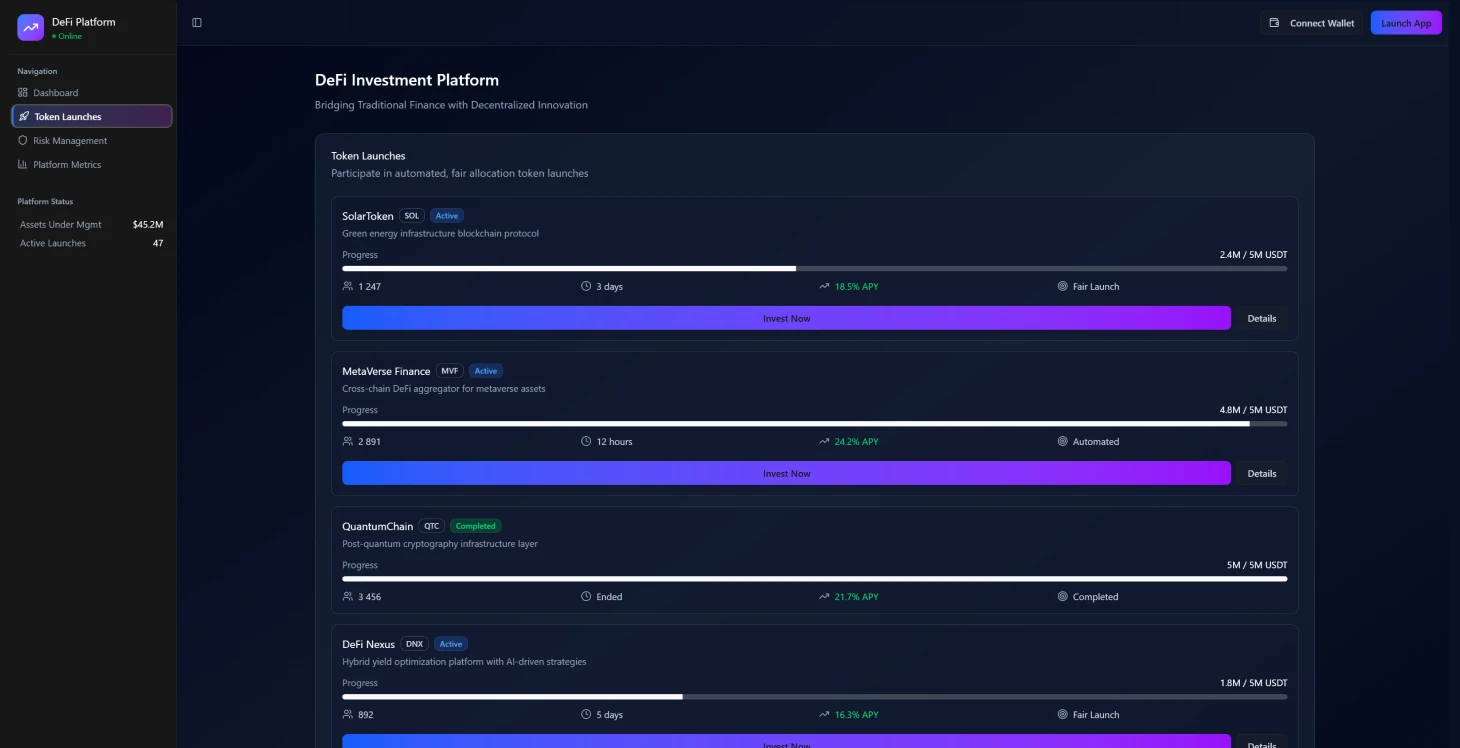

Investment Accessibility and Equity

Addressing Investment Accessibility and Equity Concerns by implementing automated contract-based allocation mechanisms to mitigate preferential access problems in high-demand token releases, thus enhancing fairness.

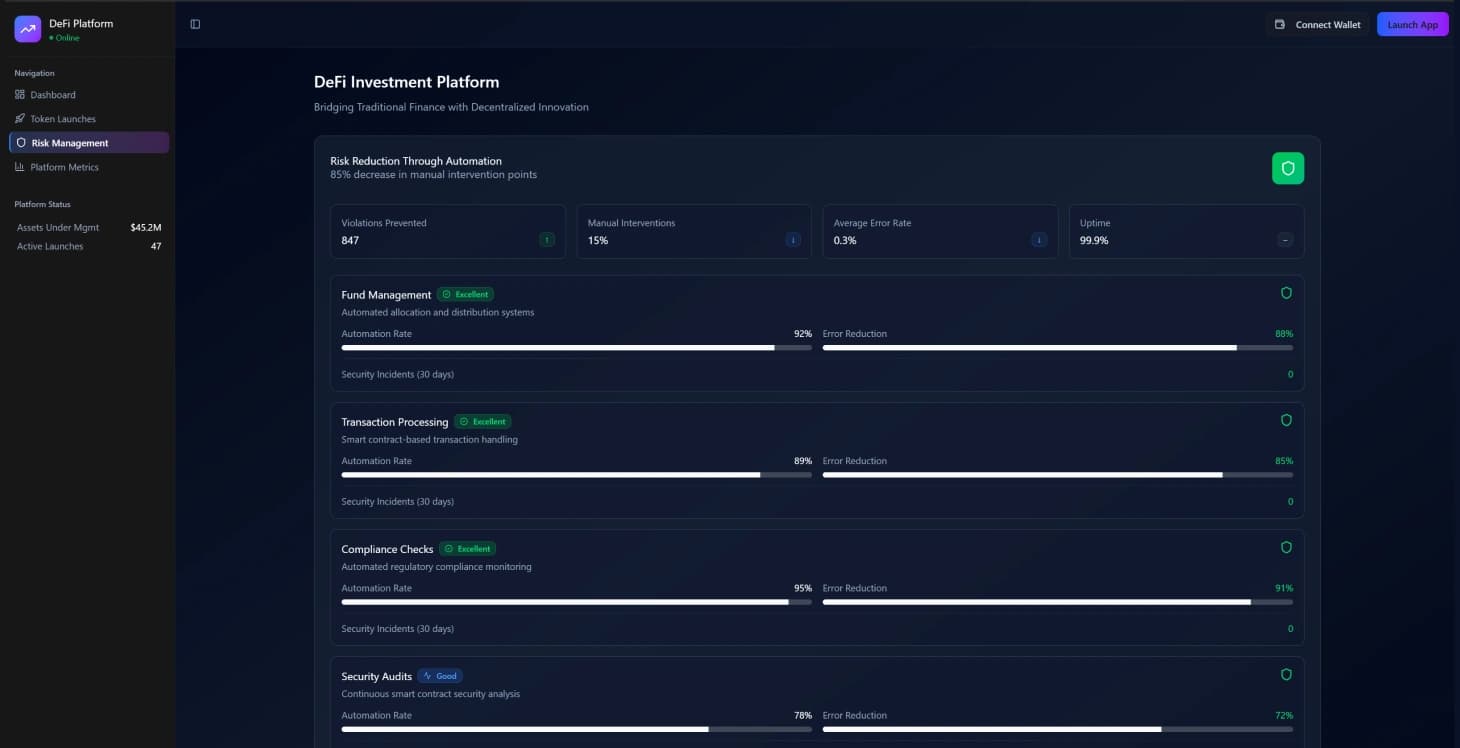

Risk Reduction Through Automation

The reduction of risk was achieved through contract automation resulting in an 85% decrease in manual intervention points and effectively eliminating human errors in:

- •Fund management

- •Transaction processing tasks

- •Automated compliance checks that successfully averted violations proactively

Capital Efficiency Improvements

The efficient use of capital was improved through investment pools that allowed for rebalancing and compound returns resulting in a 23% increase in average investor yields compared to static allocation strategies.

Transform Your DeFi Investment Experience

Join our platform for transparent, secure, and efficient cryptocurrency investments.

Enhanced KYC Processing

Enhanced KYC Processing

Integrated Know Your Customer (KYC) onboarding has been seamlessly incorporated through professional blockchain consulting, significantly cutting down compliance processing duration from 3-4 business days to 4-7 hours while maintaining comprehensive audit records.

Investor Experience Enhancement

The enhancement of investor experience was significant as a result of implementing real-time dashboards and transparent reporting leading to:

- •34% increase in investor retention

- •41% decrease in support ticket volume

Technical Architecture

Hybrid Infrastructure Design

The platform integrated a structure that merges contract-driven investment strategies with conventional web infrastructure to enhance performance and user satisfaction, striking a balance between:

- •Advantages of decentralization

- •Practical needs of operations

Smart Contract Management

The smart contracts managed tasks like:

- •Fund custody

- •Distribution methods

- •Ensuring transparency

- •Reducing counterparty risks

Scalability and Performance

The design focused on expanding to manage surges in traffic when new tokens were introduced by using techniques such as:

- •Connection pooling

- •Caching

- •Parallel processing to sustain efficiency during heavy traffic times

Database Architecture

| Component | Purpose | Performance Impact |

|---|---|---|

| High-frequency transaction data | Immediate operations | Optimized for speed |

| Analytical tasks | Complex portfolio searches | Separated for efficiency |

| Real-time dashboards | User interface | Enhanced user experience |

Security Implementation

Security Implementation

The security measures were designed based on defense-in-depth strategies with:

- •Validation layers

- •Rate limiting for protection

- •Thorough monitoring procedures

- •Open source smart contracts for transparency

- •Robust encryption methods and access controls through comprehensive security audits

Development and Testing Approach

Agile Development Process

The project used an approach with two-week periods concentrating on feature areas for development progress tracking. The creation of contracts came before the frontend design to lay a solid financial groundwork.

Comprehensive Testing Strategy

Comprehensive testing covered:

- •Unit tests for each contract operation

- •Integration tests for interactions between contracts

- •Load testing for peak traffic situations

Security Auditing

The smart contracts went through three security examinations before being launched on the mainnet platform with attention to:

- •Verifying essential financial processes

- •Optimizing gas to avoid potential denial of service threats

- •Implementing thorough access controls

- •Multi-sig requirements safeguarding tasks by utilizing distributed management across various hardware security modules

Infrastructure and Deployment

Global Distribution

The system is set up in multiple regions with the ability to switch over automatically in case of failure incidents ensuring:

- •Data availability during regional downtime periods

- •Global caching of static assets through Content Delivery Networks (CDNs)

- •API endpoints using load balancing to achieve optimal response times

Gradual Rollout Strategy

The first release was set up with a limited number of tokens to test how the system performs in real trading scenarios. As we increased capacity gradually, we were able to fine-tune the infrastructure according to how users actually used it.

During beta testing with a select set of investors, we pinpointed user experience problems before making the platform available to the public.

Performance Results and Metrics

Transaction Management

The system effectively handled more than 12,000 investment transactions from 47 diverse token releases and oversaw assets totaling over $45 million in value overall.

Security Performance

- •Zero fund loss events happened during the operational period

- •All investor assets were securely held through contract custody without any issues

- •The platform effectively thwarted 23 security incidents such as DDoS attacks and attempts to exploit contracts

Regulatory Compliance

Regulatory adherence levels surpassed the set standards in all regions:

- •KYC completion rates achieved 94% within the initial 48 hours of investor sign-up phase

- •Automated screening flagged all sanctioned bodies and high-risk regions effectively at 100%

Future Considerations and Improvements

Smart Contract Upgrade Strategy

When smart contracts were first deployed, they needed updates to enhance performance and meet new feature requests. It is important for upcoming versions to focus on:

- •Incorporating detailed proxy patterns

- •Modular architecture that allows smooth upgrades

- •No impact on investor funds or migration processes required

Scalability Challenges

During times of high market activity, increased network congestion led to transaction costs that exceeded what smaller investors could bear comfortably, prompting the need for:

- •Better solutions like flexible gas pricing tactics

- •Integrating Layer 2 scaling solutions to enhance access during peak demand periods

Database Optimization

The increasing number of users with over 5,000 accounts started to affect the speed of the transaction database due to complex analytics queries. To maintain performance:

- •Set up separate databases solely for analytics purposes

- •Ensure efficient data extraction, transformation and loading processes

Technical Stack

Frontend Technology

- •React.js paired with TypeScript to ensure both type safety and enhance the development experience

Backend Infrastructure

- •Adonis.js framework offering MVC architecture with built-in security features

- •PostgreSQL for managing data

- •Redis for caching purposes and session management

Recovery and Backup

- •Backup recovery time is expected to be completed within 2-3 hours

- •Time-restricted withdrawal systems implemented to safeguard investors' interests

- •Detection of network congestion to optimize gas prices

Project Results

- 99.9% uptime during high-traffic launch events

- 68% reduction in KYC processing time

- $45M+ in assets under management

- 12,000+ investor transactions processed

- Zero fund loss events during operation

Key Performance Metrics

Platform Uptime

During launch events

KYC Time Reduction

Processing time improvement

Assets Under Management

Total managed assets

Investor Retention

Increase in retention