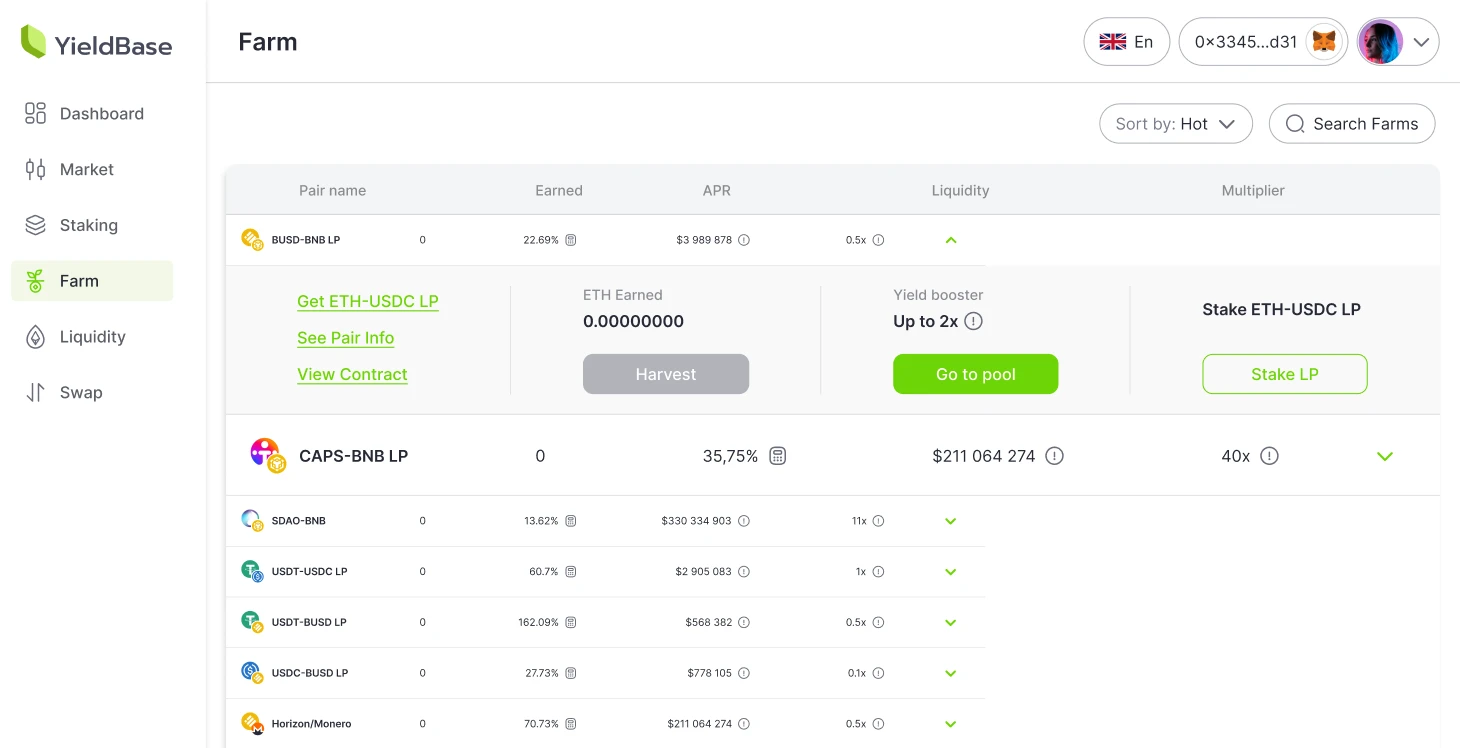

Multi-Platform Management Complexity

Users encountered linked obstacles that hindered their ability to effectively engage in yield farming activities. Given the structure of DeFi protocols it was necessary to manage positions across 8 to 12 platforms in order to attain diversified yield exposure. This involved dealing with interfaces, tokens and withdrawal processes for each platform.

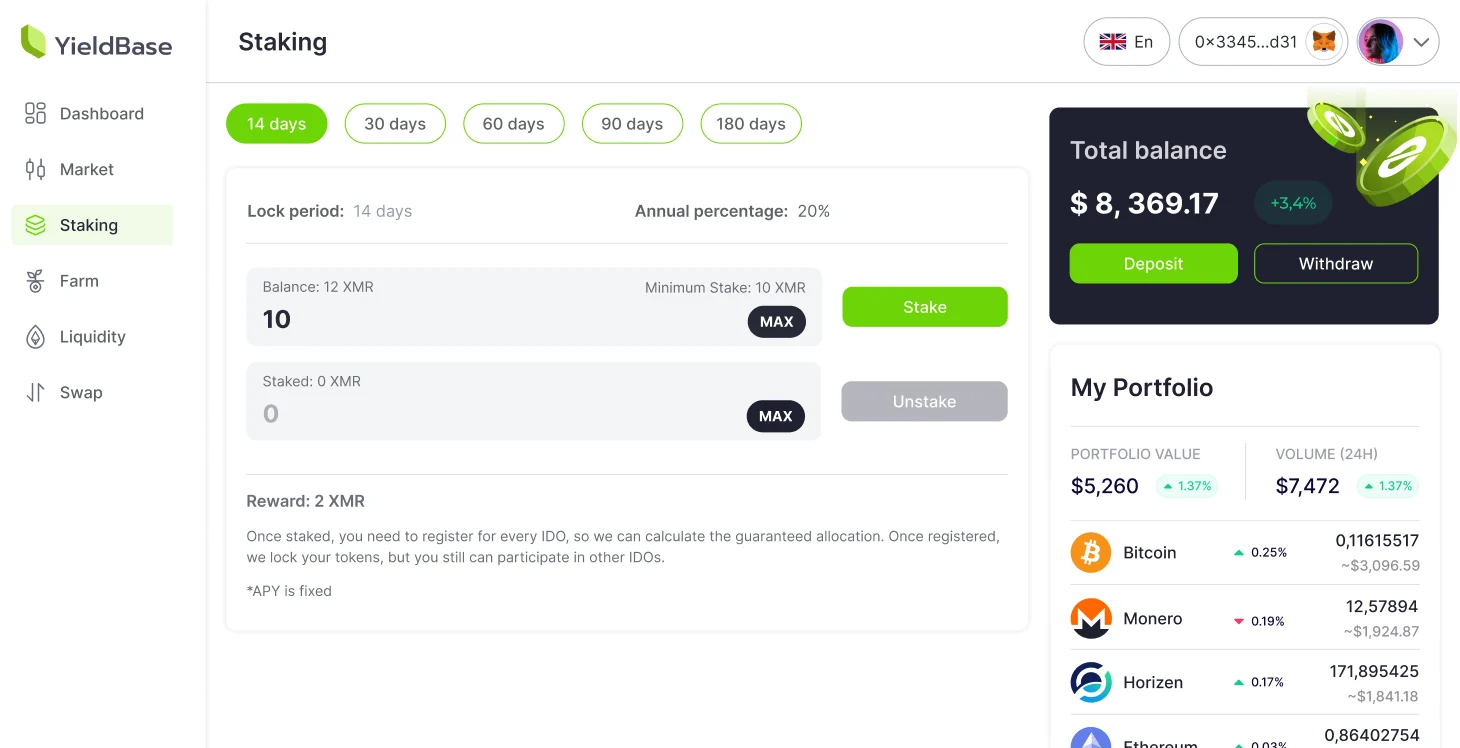

Time-Intensive Manual Optimization

Engaging in manual yield optimization was found to be a time consuming and error prone endeavor for users who habitually checked their positions 3 to 4 times a day. However they often missed out on opportunities for rebalancing their investments due to the process's intricacies and the potential for human error that it entailed.

High Transaction Costs

Transaction costs were observed to consume a significant portion of yields—ranging between —for positions valued under $10k. Additionally navigating the calculations involved in impermanent losses, annual percentage rates and compound interest acted as barriers for new entrants into this realm of investment strategies.

Security and Risk Assessment Challenges

Users were primarily focused on security issues when making decisions because vulnerabilities in contracts had led to more than within the ecosystem's sphere of influence. Users faced challenges in assessing protocol security while also seeking out the most profitable opportunities available.

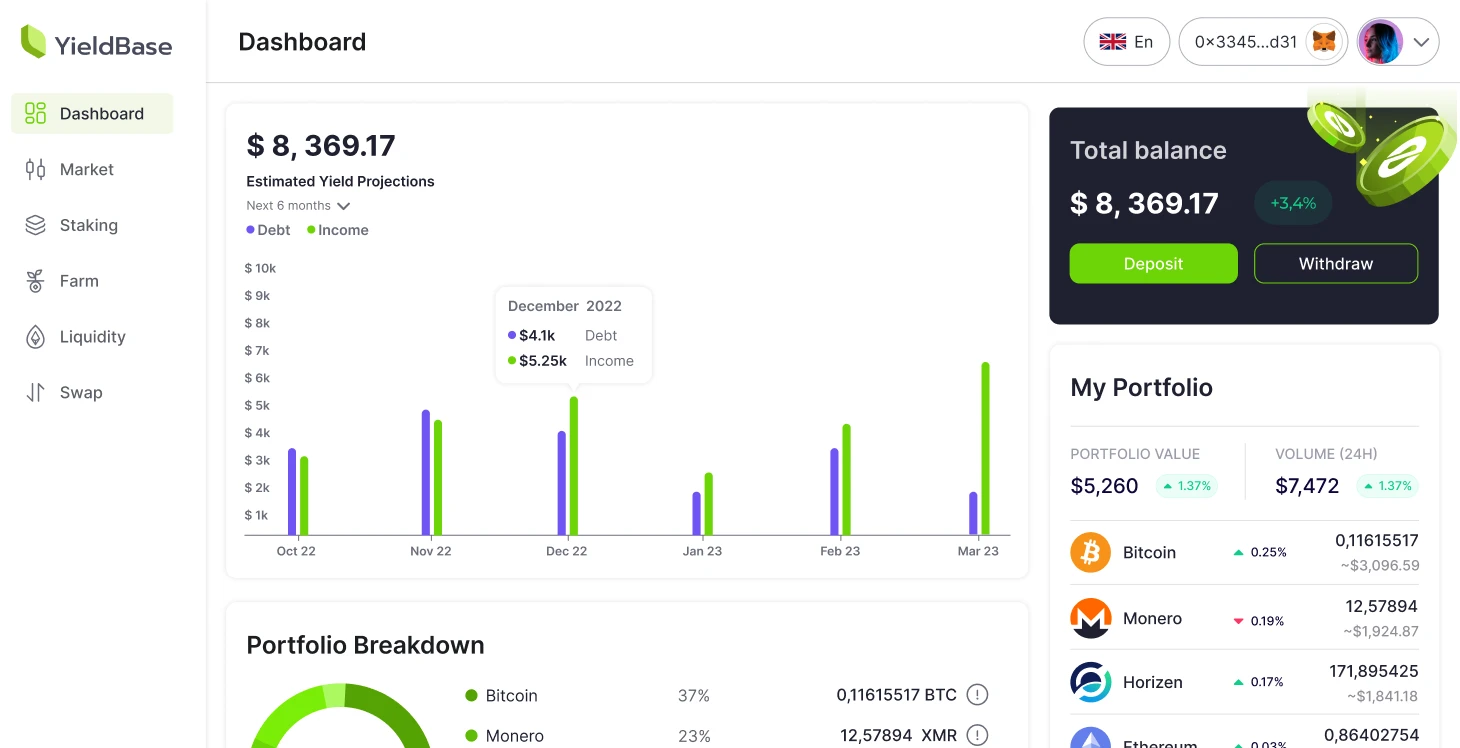

Limited Analytics and Risk Management

The absence of analytics made it extremely difficult to track portfolio performance effectively. Users had to resort to using spreadsheets or subscribing to dashboards for information tracking purposes. Risk management was quite basic then; many users struggled to adopt tactics such as automated stop loss orders and adjusting positions gradually or rebalancing dynamically in response to market volatility conditions.