The traditional banking systems have not kept up with the demands of customers who prioritize digital services. This has led to challenges in transactions and international money transfers that require enterprise blockchain solutions.

Project Overview

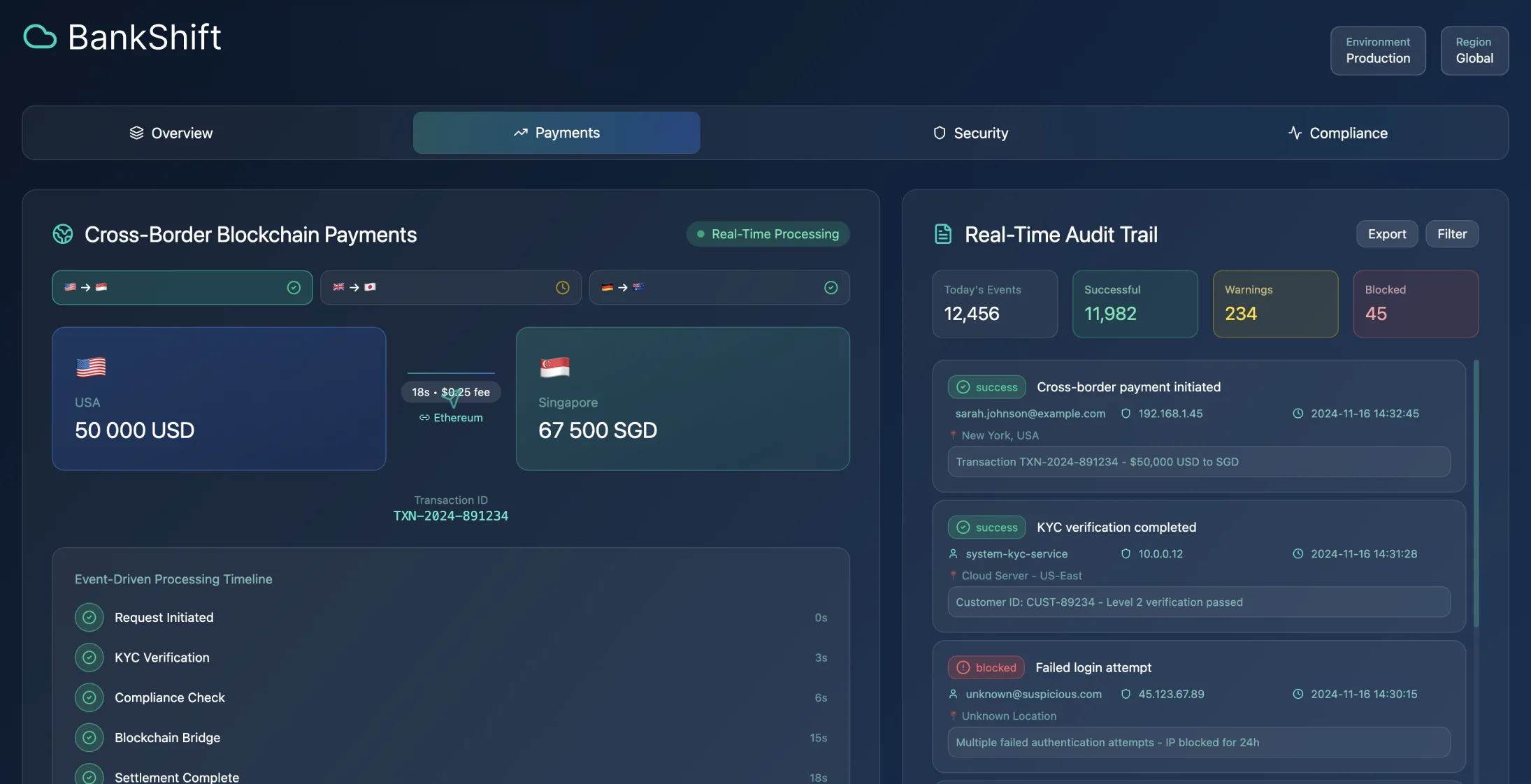

The time it takes to settle border payments has been reduced significantly from 3 to 4 days down to less than half a minute, boasting an impressive transaction success rate of 99.97%.

Legacy System Challenges

The finance sector has seen changes to evolving consumer preferences for digital-first interactions. The outdated core systems in banking are finding it hard to meet the fast-paced demands and expectations of today's customers.

Cross-Border Payment Issues

Handling payments across borders poses challenges due to the complexities of banking partnerships and regulatory obligations that often lead to delays and unclear fee structures for users. Additionally, managing personal finances efficiently is hindered by the nature of existing tools that make it difficult for individuals to have an understanding of their financial well-being.

Regulatory Framework Changes

Frameworks such as PSD in Europe and Open Banking efforts worldwide have opened doors for players to offer financial services while upholding rigorous regulatory standards. However, establishing a scalable foundation necessitates thoughtful choices regarding data control measures, audit trails, and risk mitigation strategies.

Traditional Banking Limitations

The conventional banking systems had shortcomings that impacted customer satisfaction and operational effectiveness greatly:

- •Core banking platforms that frequently operated on mainframe systems from decades ago contributed to technical debt and integration obstacles

- •These platforms handled transactions in batches which resulted in delayed fund availability and limited real-time visibility for customers

- •The cross-border payment system used correspondent banking networks involving middlemen entities that caused delays in processing

- •Authentication and adherence procedures predominantly operated in a manual manner necessitating the submission of documents and evaluation by individuals

- •Personal finance tools were either not available or came from apps that didn't connect well with transaction details

- •Mobile apps were frequently adapted to fit desktop interfaces instead of being crafted for mobile use

Transform Your Banking Experience

Discover how modern digital banking solutions can revolutionize your financial operations.

Implementation Results

Customer Experience Improvements

Improved Customer Acquisition Velocity by streamlining account opening process from 2-4 weeks to less than 10 minutes using automated KYC workflows and instant digital identity verification. This led to a 340 percent boost in customer acquisition.

Operational Enhancements

- •Reduced delays in border payments by setting up direct blockchain settlement channels

- •Shortened transfer durations from 3 days to 30 seconds

- •Decreased fees by 78%

- •The adoption of cloud architecture and automated compliance procedures led to a 68 percent decrease in operational costs

- •Integrated personal finance tools with live spending analysis boosted customer interaction by 156%

- •Led to a 43% reduction in customer turnover

- •Automated screening for Anti Money Laundering (AML) resulted in an 89% decrease in compliance violations

Technical Architecture

Cloud-Based Microservices Design

The structure focused on a cloud-based design that prioritized APIs and divided banking operations into microservices. This method allowed for feature enhancements, self-sufficient scalability, and easier adherence to regulations by establishing service limits.

Event-Driven Processing

Event-driven design strategies guaranteed transaction handling and uniform state control throughout the system elements with each monetary transaction producing event sequences for detailed audit trails and instant data analysis.

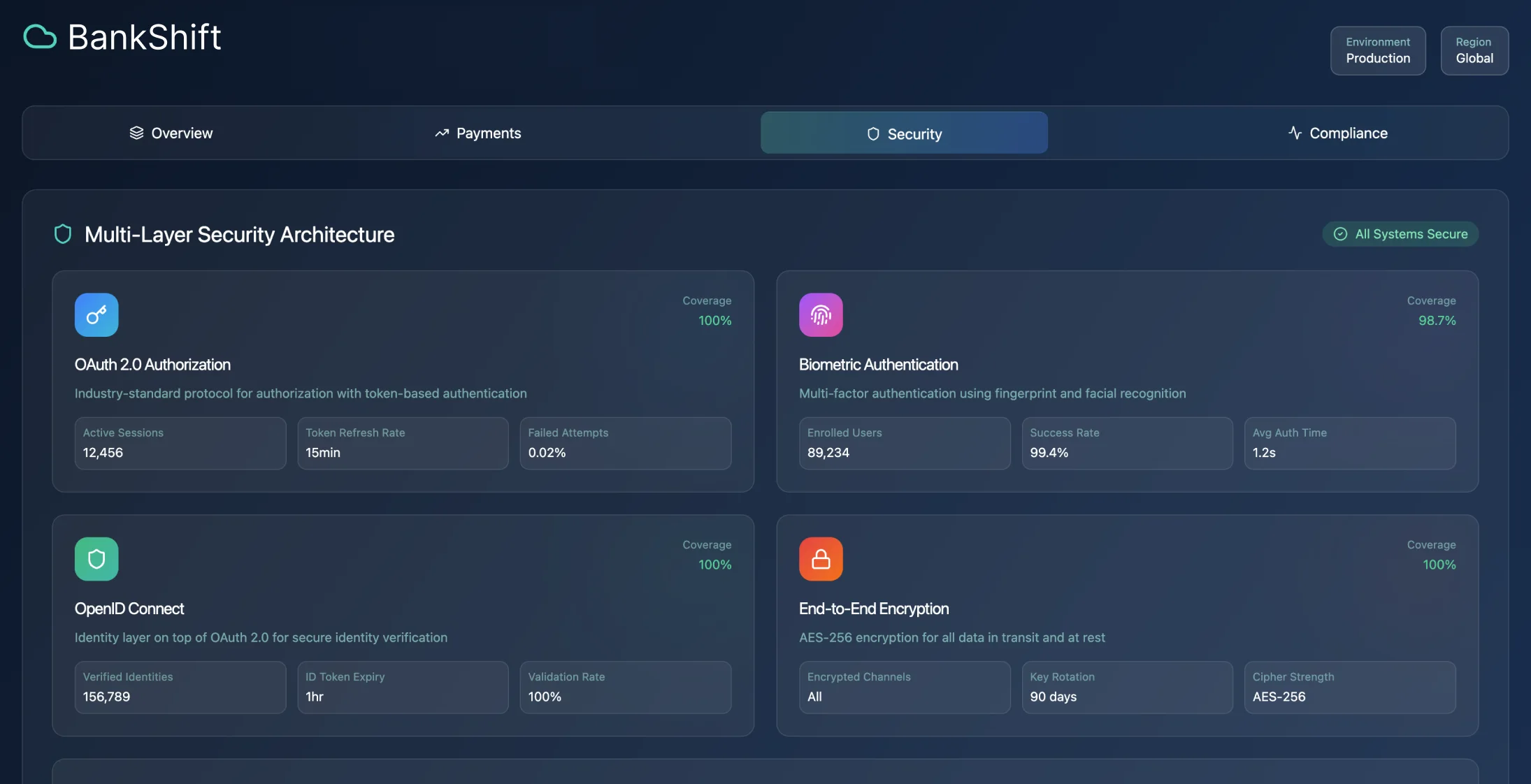

Security Implementation

The system utilized identity and access control standards such as OAuth 2 and OpenID Connect along with verification on mobile gadgets to enhance security to the level of traditional banking through regular security audits and enhance user satisfaction significantly.

Cross-Border Payment Solutions

Cross-border payment systems use a mix of banking methods to meet regulations and blockchain networks for more transparent transactions. Payment routes are chosen automatically based on factors like destination location and transaction costs to ensure efficiency and cost effectiveness.

Development and Deployment

DevSecOps Implementation

The project was developed following DevSecOps principles, incorporating security testing at every stage of the software development process. Individual deployment pipelines for each microservice allowed for releases without the need for coordination across the system.

Development Environment Strategy

Using infrastructure as code templates, development environments were set up that include test data to adhere to privacy regulations effectively. Gradual deployment of features was made possible through feature flags ensuring system stability throughout the process.

Quality Assurance

- •Automated unit and integration testing must meet the code coverage threshold of 85%

- •Testing contracts between microservices helped avoid integration issues

- •Performance tests validated system performance under transaction loads over 200% of anticipated capacity

- •End-to-end testing scenarios covered various customer interactions throughout the system operations

Migration Strategy

The transition of customers from legacy systems followed a method similar to the growth pattern of a strangler fig plant. Slowly shifting transaction types to new services while ensuring compatibility with the old system remained intact throughout the process.

Performance Metrics

System Performance Results

| Metric | Target | Achieved | Status |

|---|---|---|---|

| Payment Processing Uptime | >99.95% | 99.98% | ✓ Exceeded |

| KYC Completion Rate | >95% | 98% | ✓ Exceeded |

| Transaction Volume | 5,000 TPS | 8,000+ TPS | ✓ Exceeded |

| Response Time | <2 seconds | <1 second | ✓ Exceeded |

Business Impact

- •Customer acquisition cost reduced by 54%

- •Compliance work reduced by 81% through automated reporting

- •The system handled over 847 million transactions in its first year without any data breaches

- •Customer revenue increased by 127% thanks to enhanced transaction numbers and service fees

Technical Challenges and Solutions

Event-Driven Architecture Complexity

An intricate nature of event-driven architecture brought about challenges that necessitated resources for monitoring and troubleshooting tools implementation. Utilizing event sourcing techniques proved beneficial for ensuring audit compliance albeit calling for schema evolution approaches to avoid breaking alterations.

Data Localization Requirements

Data localization regulations led to limitations in how multiple regions were deployed, impacting strategic planning significantly. Collaborating closely with compliance teams from the start helped avoid alterations to the architecture later in the project implementation phase.

Mobile-First Design

Creating APIs tailored for mobile usage patterns instead of modifying desktop interfaces led to improved efficiency and user interaction levels. Offline functionality needs influenced caching and synchronization approaches that enhanced the system's overall robustness.

Financial Transaction Requirements

Financial transactions present different performance attributes compared to web applications and come with precise consistency demands that impact database choice and caching approaches significantly. Load testing using financial transaction patterns through smart contract development has been crucial for determining capacity requirements.

Infrastructure Components

Core Technologies

- •Container Orchestration: Kubernetes for automated scaling and health monitoring

- •Event Streaming: Message queue platform for real-time transaction processing

- •Cache Layer: In-memory data store to manage sessions and frequently accessed data

- •CI/CD Pipeline: Automated testing and deployment with security scanning

- •Payment Processing: Integration with multiple payment rails and intelligent routing

- •Document Management: Encrypted storage for KYC documents and audit tracking

- •Analytics Engine: Real-time stream processing for business intelligence

Disaster Recovery Planning

Financial institutions need disaster recovery plans that go beyond typical application needs. Regulatory standards for operational continuity might call for manual fallback procedures that impact system design choices.

Database Strategy

When dealing with financial data, it's crucial to plan database sharding strategies to ensure transaction consistency among account connections is upheld properly, especially in scenarios where ACID compliance is necessary for financial tasks that demand specific care beyond what typical horizontal scaling methods can offer.

Project Results

- 340% boost in customer acquisition

- 99.97% transaction success rate

- Cross-border payment time reduced from 3 days to 30 seconds

- 78% decrease in transaction fees

- 68% reduction in operational costs

- 156% increase in customer interaction

- 43% reduction in customer turnover

- 89% decrease in compliance violations

Key Performance Metrics

Customer Acquisition

Boost in acquisition rate

Transaction Success

Payment success rate

Cost Reduction

Operational cost savings

Processing Time

Cross-border payment time