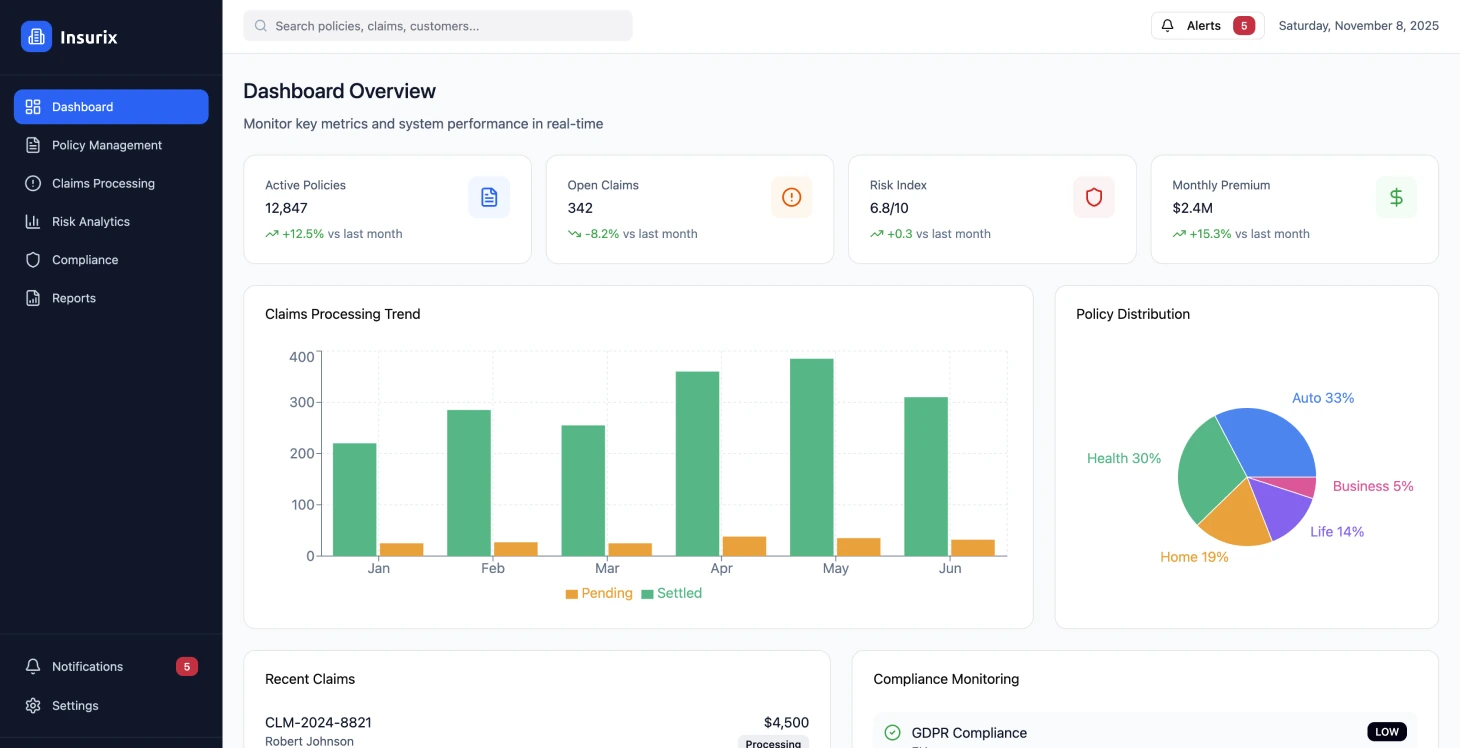

We transformed a traditional insurance company from legacy systems to a comprehensive digital platform, streamlining operations and enhancing customer experience. The project involved modernizing policy management, automating claims processing, and implementing real-time risk assessment capabilities while ensuring full regulatory compliance across multiple jurisdictions.

Project Overview

Legacy System Challenges

The old insurance processes faced challenges due to their systems and manual handling of claims. Customers had limited access to policy information and updates on their claims.

The insurance sector has traditionally depended on paperwork driven methods and outdated legacy systems along with underwriting practices that posed challenges for both clients and insurers alike. The usual processes in insurance entailed various isolated systems handling policy management tasks separately from claims handling processes and customer service efforts. This fragmented approach resulted in inconsistent service for customers, delay in resolving claims and substantial administrative burdens to manage efficiently.

Customer Expectations and Market Demands

Customers in todays insurance industry are looking for services just like those offered in banking and other financial sectors – think instant policy updates on mobile apps and easy to use interfaces for tracking claims status in real time! On the side of the coin though is the challenge for insurance companies to cut down on costs while stepping up their game in assessing risks and staying on top of changing regulations in various regions.

Regulatory and Technical Challenges

Navigating the insurance technology environment involves complying with data privacy laws and financial service regulations while meeting industry standards as well as dealing with challenges in system design related to data management and cross border activities.

System Integration Issues

The primary difficulties arose from standing debts and inefficiencies in procedures that built up over many years of gradual system expansions. Old policy management systems could not smoothly mesh with platforms which led to data silos hindering a complete customer perspective and prompt decision making.

Claims Processing Inefficiencies

The processing of claims heavily depended on involvement and took longer than industry standards due to using paper documents and multi step approval processes with automation capabilities for settlements. Claims processing workflows heavily depended on intervention which led to settling times surpassing industry benchmarks as a result of using paper based documentation and multi step approval procedures with automation capabilities.

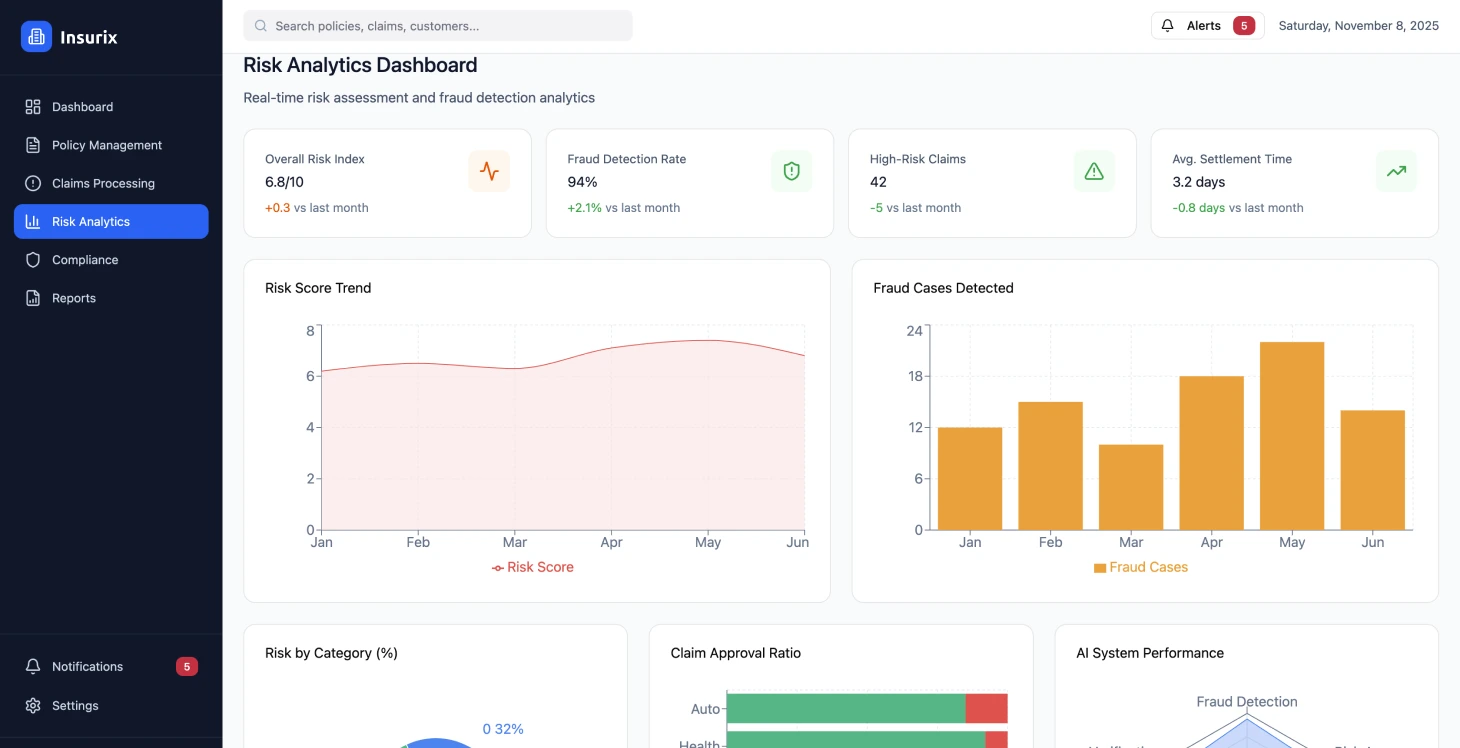

Risk assessment methods relied on models that lacked the ability to integrate real time data sources or advanced analytics techniques.

Customer Experience Limitations

The customer experience was impacted by touchpoints and varying information across channels with limited self service options available to users. The policyholders lacked visibility into their claim status and policy details along with access to services rendered which resulted in higher call center inquiries and lower satisfaction ratings for customers throughout the process.

Operational Inefficiencies

Issues with how things are done showed up as doing the data entry multiple times and relying on manual checks instead of planning ahead in customer relations maintenance tasks lately. The absence of an analytics system hindered the ability to improve pricing tactics and efficiently detect fraud or manage risks across portfolios.

Meeting requirements involved an amount of manual work to produce reports and uphold data security standards in different regions with diverse criteria to follow.

Solution Implementation

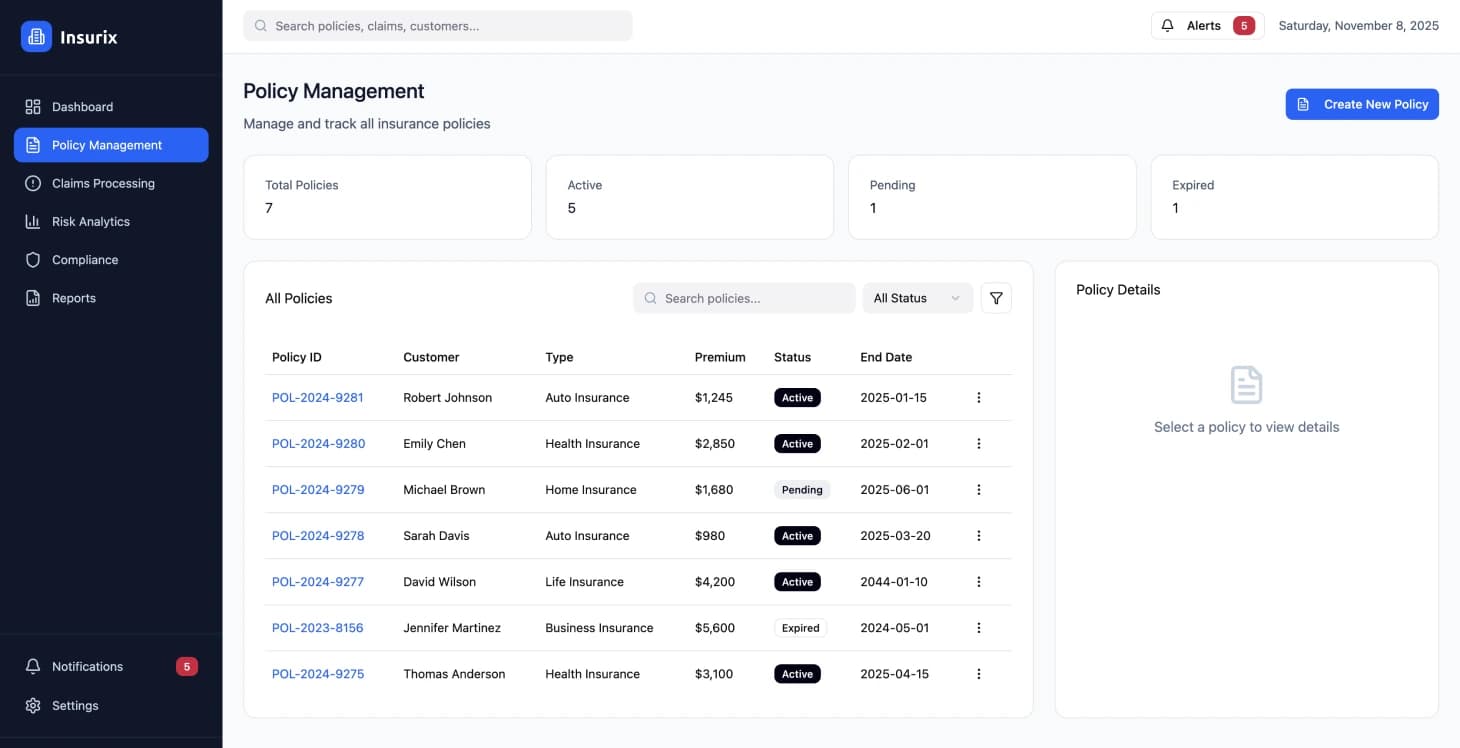

A integrated digital insurance platform was designed to streamline policy management processes and automate claims procedures while providing up to date risk analysis in compliance with regulations through enterprise blockchain solutions.

Transform Your Insurance Operations

Discover how digital transformation can revolutionize your insurance processes.

Platform Performance Results

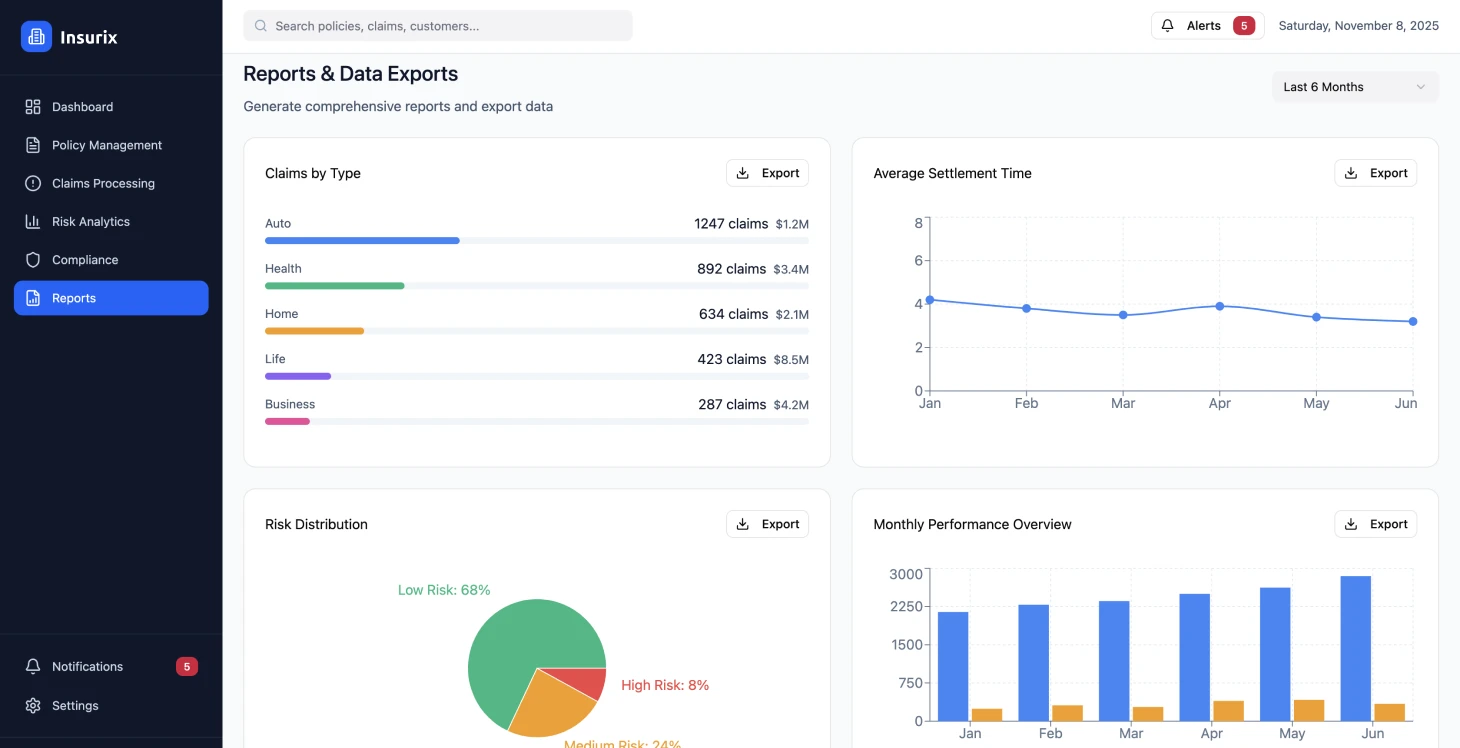

The platform maintained an uptime of 99.97% with response times under 200ms while handling more than 50,000 transactions across various insurance products. Regulatory requirements were met in areas using automated audit logs and customizable policy structures.

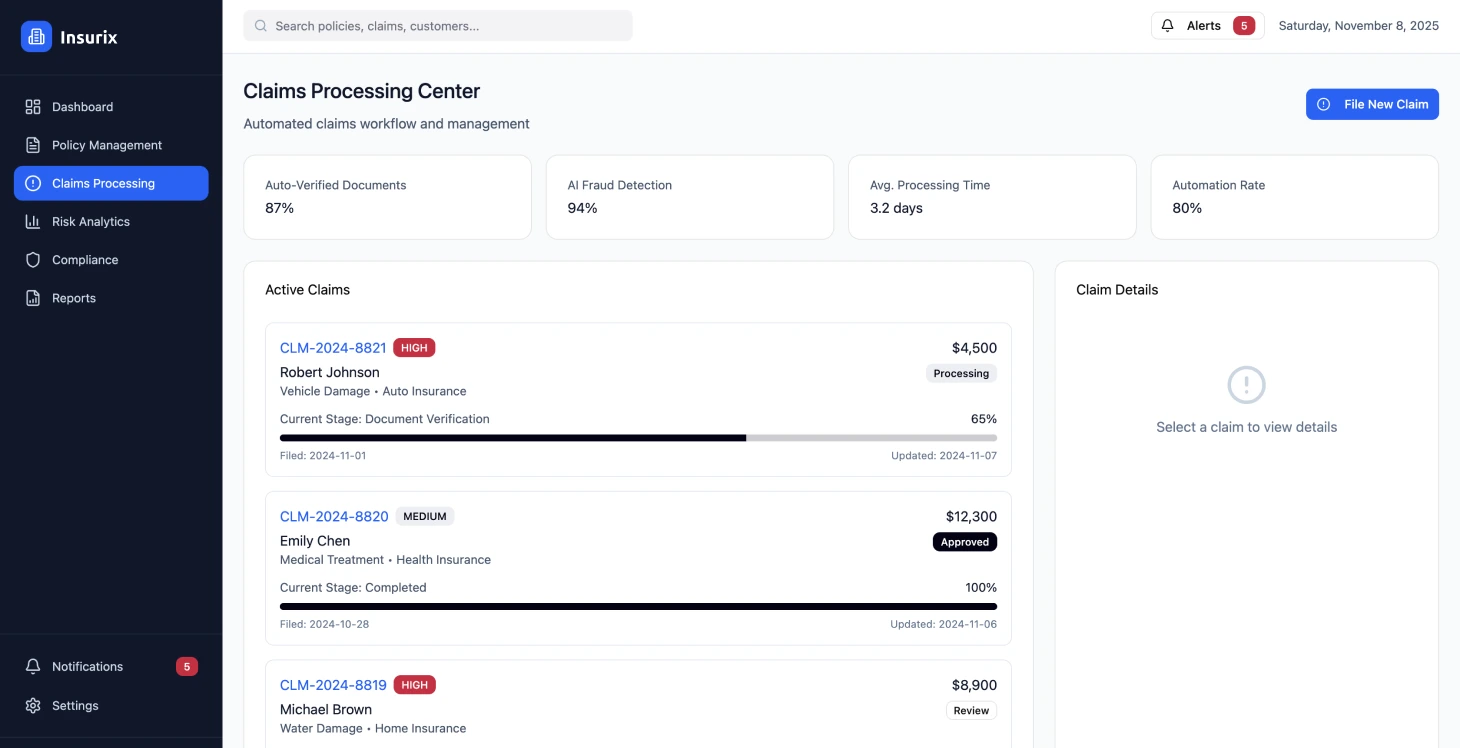

Claims Processing Improvements

The efficiency of processing claims has been enhanced through automated workflows leading to a decrease in the average claim settlement duration from 14 days to 4 days. This has positively impacted cash flow and customer satisfaction while also decreasing expenses by 42%.

Customer Satisfaction Enhancement

Self service features and the ability to access policies in time have boosted customer satisfaction ratings significantly jumping from 6.2 to 8.4 out of 10 and simultaneously cutting down call center inquiries by 35%.

Underwriting Accuracy

Real time data integration and advanced analytics have enhanced underwriting accuracy by 28% resulting in loss ratios and allowing for competitive pricing strategies.

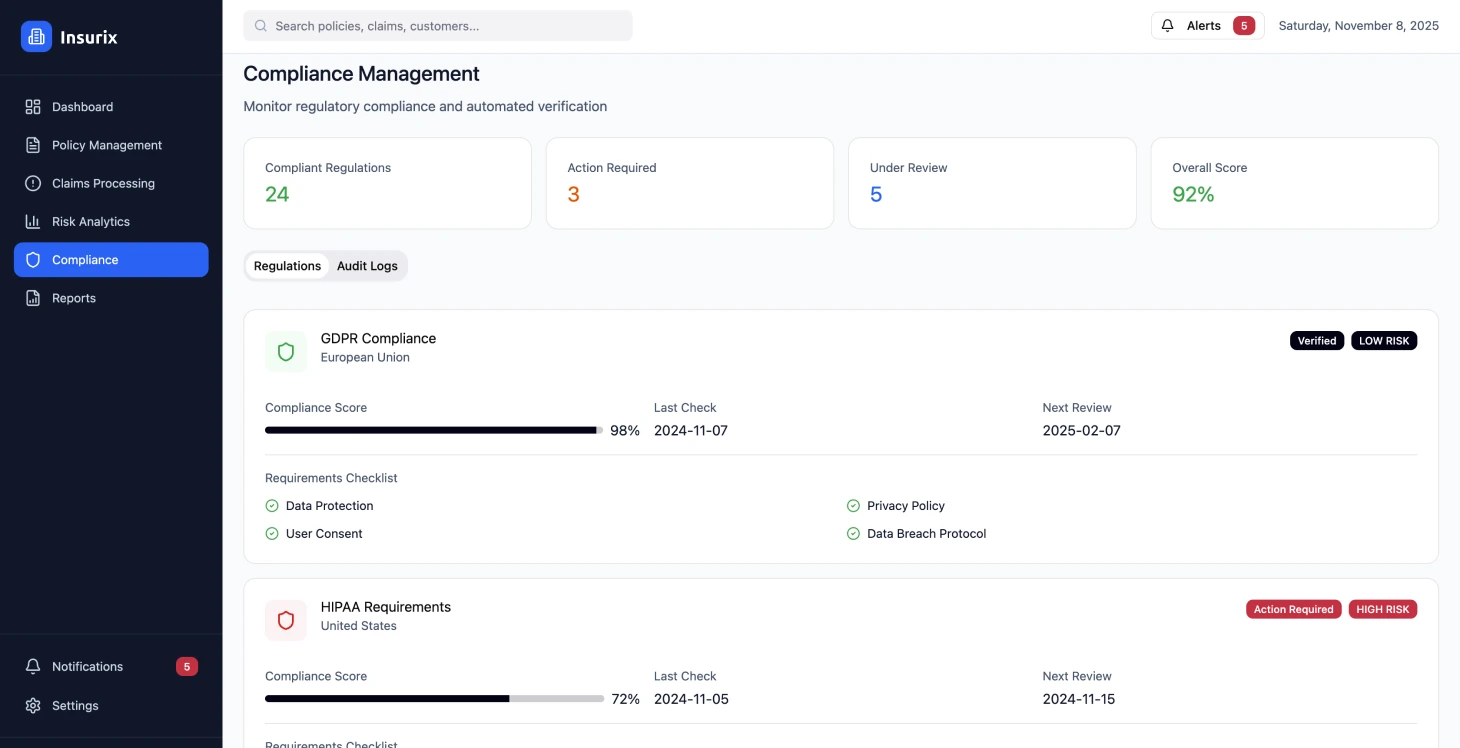

Regulatory Compliance

Utilizing automated systems for compliance monitoring and reporting has cut down audit preparation time by 60%. This process guarantees a commitment to standards across different locations.

Cost Reduction

The reduction in costs was achieved by consolidating platforms and automating processes resulting in a 45% decrease in expenses due to the removal of redundant systems and manual tasks.

Technical Architecture

Platform Design Principles

The online insurance platform embraced a microservices structure based on values to offer scalable and reliable insurance services compliant with regulations and standards. Its approach highlighted prioritizing APIs in design to facilitate integration with systems and allow room for growth in the future.

The main focus of the choices was on:

- •Using event driven communication patterns to maintain data consistency among services

- •Incorporating immutable audit logs for regulatory adherence

- •Real time processing capabilities for automating claims and analyzing risks efficiently

- •Containerization and orchestration to ensure better availability and resource management efficiency

Security and Compliance Framework

The need for security and adherence to regulations led to the establishment of a zero trust network framework that includes:

- •End to end encryption for information

- •Detailed access controls determined by role based permissions system

- •Data sovereignty regulations using deployment strategies across regions

- •Customizable data residency policies

User Experience Design

The design focused on principles and progressive web app features to enhance accessibility on various devices and network situations emphasizing integration with standard insurance industry protocols while allowing customization for partner system integrations.

Zero trust security architecture proved essential for meeting regulatory requirements across multiple jurisdictions.

Implementation Strategy

Phased Rollout Approach

The execution proceeded in stages to reduce interference with operations while ensuring continuous value delivery. The first phase concentrated on setting up the fundamental platform structure and transferring policy management capabilities.

Development teams used setups with infrastructure as code templates to maintain uniformity across various environments. Feature branches were automatically deployed to testing environments for development and thorough integration testing.

Quality Assurance

Unit tests covering 90% of the code were part of the automated testing process along with:

- •Integration tests that ensured service contracts

- •End to end tests that mimicked user workflows

- •Security scanning seamlessly integrated into the build process to identify vulnerabilities

Deployment and Migration

The company utilized green deployment approaches for updates without downtime during database migrations and had automated rollback protocols set up in case of any problems that may arise. The modifications to the schema were designed to be compatible with versions to facilitate a smooth transition of historical data to new systems.

The system was tested under loads to ensure scalability incorporating chaos engineering to assess resilience in failure scenarios along with security measures like penetration testing and compliance checks against industry standards.

Data Migration Strategy

The process of upgrading the system mimicked the growth pattern of a strangler fig tree by updating features while keeping data accuracy intact. Shifting customer data happened during scheduled maintenance times with verification processes in place. To maintain data consistency during the switch over phases real time synchronization links were put in place to bridge any gaps.

Database schema changes were designed for backward compatibility to ensure smooth historical data migration.

Results and Impact

The shift to an insurance platform brought enhancements in operational efficiency and customer satisfaction metrics while ensuring regulatory compliance standards were met. Performance improvements were evident after the platforms complete rollout and further enhancements were seen in the months.

Upon implementing changes to customers like quicker response times and better self help options along with clear claims tracking, internal operations also saw enhancements in efficiency and cost reductions across various departments.

The system effectively managed more than 1.1 million policy transactions during its year of operation while adhering to strict regulations in various regions. Automated claims handling dealt with 78% of claims without the need for involvement leading to notable decreases in operational costs and enhancements in customer satisfaction.

Cost Optimization Benefits

The advantages of cost optimization go beyond just saving money on operations to cover infrastructure expenses with cloud native design and better resource utilization capabilities. The platforms ability to scale up allows for managing peak loads during seasons without requiring investments in infrastructure.

Key Lessons Learned

Data Migration Challenges

Legacy data migration posed challenges than expected because of variations in data formats and missing records requiring more time for thorough data quality assessment and cleansing in future projects.

Compliance Integration

Early collaboration with teams and legal advisors played a role in embedding compliance standards into the platforms structure from the start rather than as last minute additions ensuring a seamless integration of regulatory requirements. Automated monitoring of compliance helped to avoid any oversights that could have occurred with checks.

Change Management Importance

To ensure user acceptance it was crucial to implement training initiatives and introduce features gradually to address any resistance to the updated processes effectively. Having the support of executives and clearly communicating the benefits played a role in achieving adoption.

Performance Testing at Scale

The load patterns in production were not what we expected based on our testing assumptions during peak seasons and crisis situations. It became essential to monitor performance and implement automated scaling strategies to ensure service levels were upheld.

Security First Approach

Starting with security as a foundation has shown to be more efficient and cost effective compared to adding security measures in the development process. Incorporating security audits and automated vulnerability scans has been effective in stopping problems before they impact production environments.

API Design Strategy

Creating APIs with evolution in mind by prioritizing compatibility has proven to facilitate seamless integration with current systems and minimize disruptive changes as the platform evolves over time. Proper planning of version management strategies is crucial and yields benefits when updates are implemented seamlessly and efficiently.

Regulatory Compliance Management

Staying on top of compliance is crucial as rules can shift quickly in reaction to market changes or new regulations. It's vital to have compliance structures and keep up to date with experts to prevent any gaps in compliance adherence.

Production load patterns often differ significantly from testing assumptions, especially during peak seasons and crisis situations.

Technical Implementation Details

Container Orchestration

Container Orchestration involves using Kubernetes to deploy and manage services effectively.

Event-Driven Architecture

In the realm of microservices utilizing an event driven framework alongside message queues is pivotal for operations.

CI/CD Platform

Automated testing and deployment pipelines are features of the CI/CD platform.

Project Results

- 99.97% platform uptime achieved

- Claims processing time reduced from 14 to 4 days

- Customer satisfaction improved from 6.2 to 8.4/10

- 45% reduction in operational expenses

- 78% of claims processed automatically

Key Performance Metrics

Platform Uptime

System availability

Claims Processing

Average settlement time

Cost Reduction

Operational expenses

Customer Satisfaction

Rating improvement