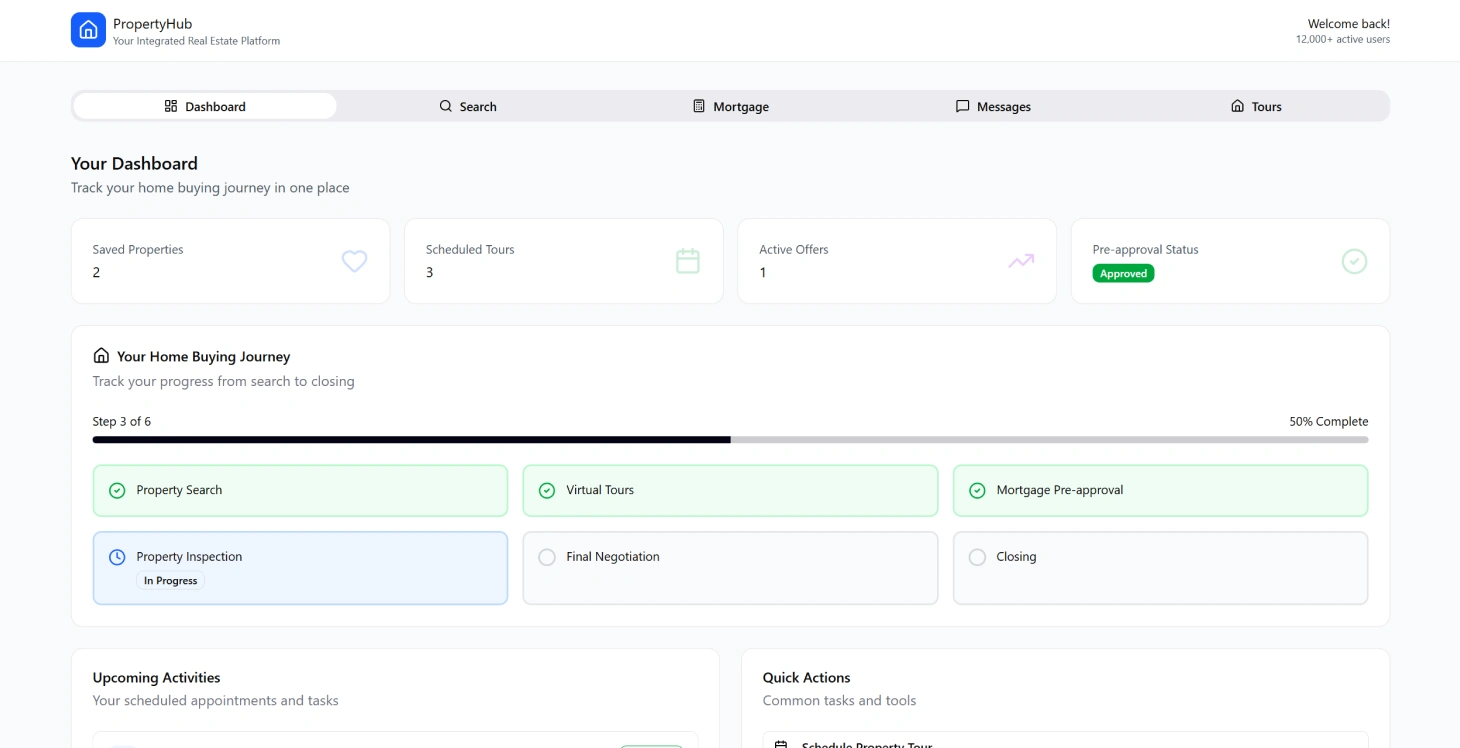

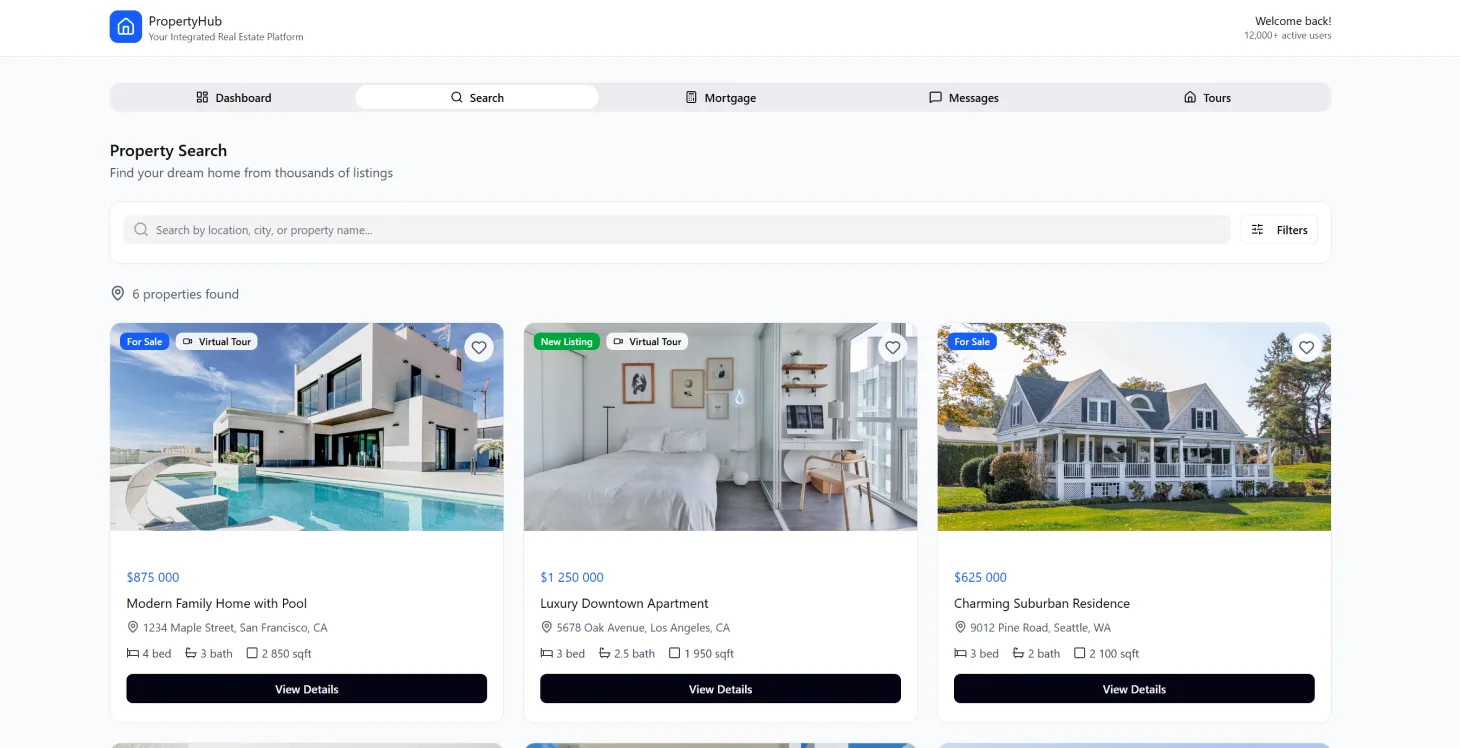

We created a revolutionary integrated platform that transforms the traditional fragmented real estate experience into a seamless journey from property discovery to transaction completion. By combining virtual property tours with mortgage prequalification tools and agent communication workflows, we eliminated the need for buyers to juggle multiple platforms and applications. The platform handles over 12,000 property interactions monthly with 99% uptime, delivering 71% faster transaction speeds and reducing abandonment rates by 38%.

Project Overview

The Challenge: Fragmented Real Estate Technology

Property purchasers used to count on tools spread across platforms which made searching for and buying homes a cumbersome process. The housing market for homes has usually involved systems where purchasers move through listing sites and mortgage lender platforms alongside tools for agent communication and scheduling appointments.

This separation causes challenges in discovering properties and completing transactions efficiently resulting in search times, unfinished paperwork and less than ideal matches between buyers and homes.

The difficulty expands beyond property browsing to encompass the journey of the buyer from the first exploration to financial arrangements and coordinated closing processes.

Key Problems Identified

- •Platform Fragmentation: Buyers had to manage accounts and interfaces for tasks like property search, virtual viewing, mortgage prequalification and agent communication which led to cognitive overload and higher rates of abandonment

- •Limited Virtual Property Viewing: Static photos and floor plans lack the details for an evaluation of the property, especially when viewing properties remotely or when physical showings are limited

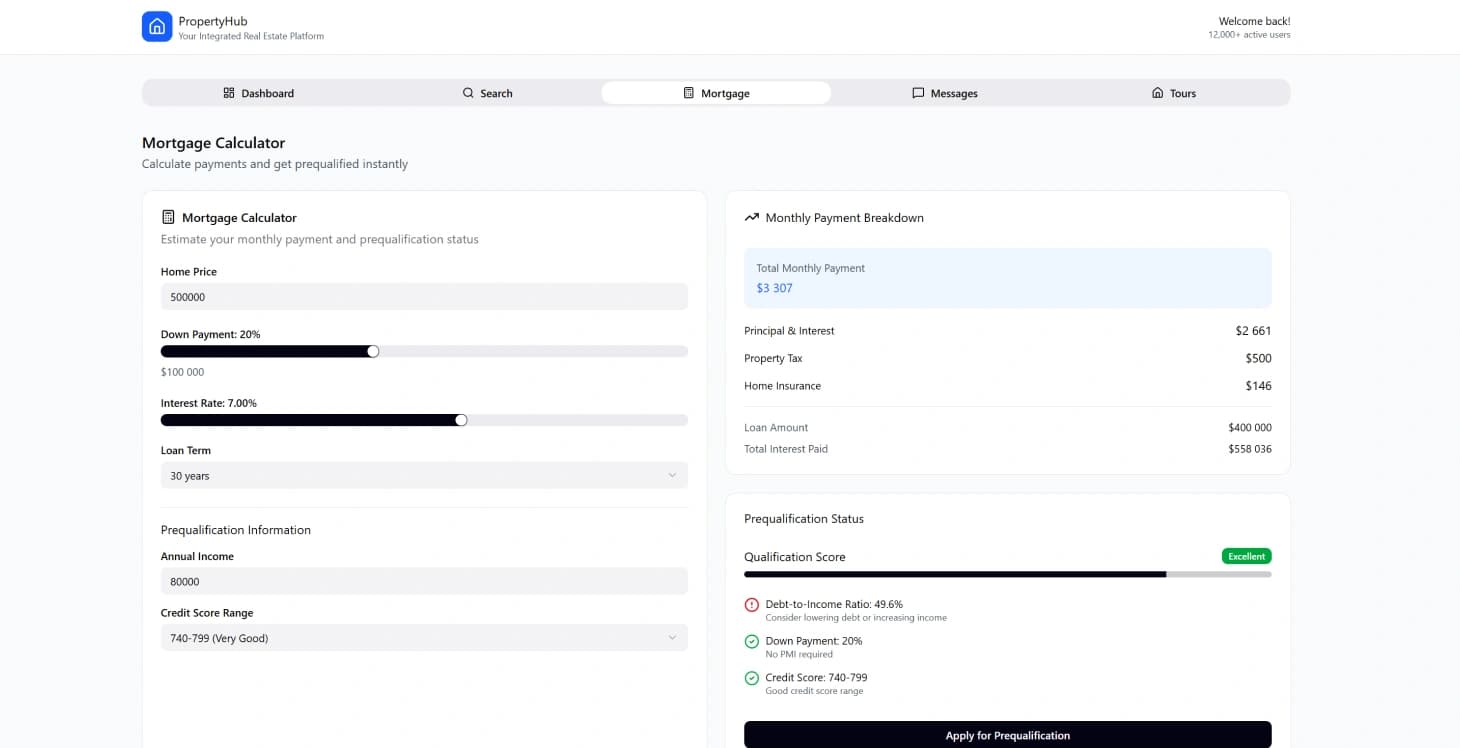

- •Disconnected Financing: Buyers frequently start their property search without an understanding of their financing options, resulting in unrealistic expectations and wasted effort on unsuitable properties

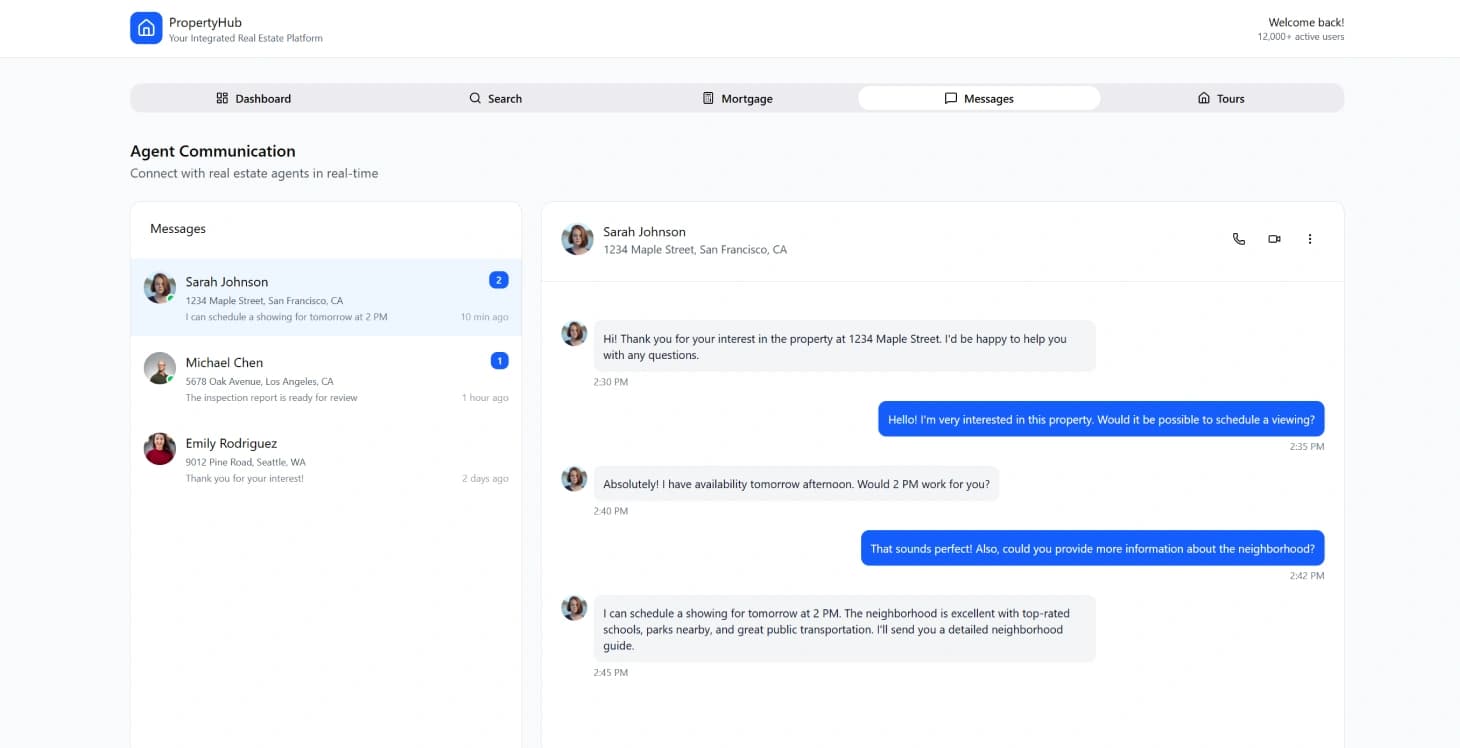

- •Communication Challenges: Buyers faced challenges in keeping communication organized with agents and tracking property suggestions while juggling showing schedules on different platforms

- •Poor Mobile Experience: Most platforms were designed for desktop use and not well suited for users who preferred browsing properties on the go

Homebuyers today anticipate experiences comparable to those in other significant buying sectors; however real estate technology has not kept pace with consumer anticipations.

The Solution: An Integrated Platform

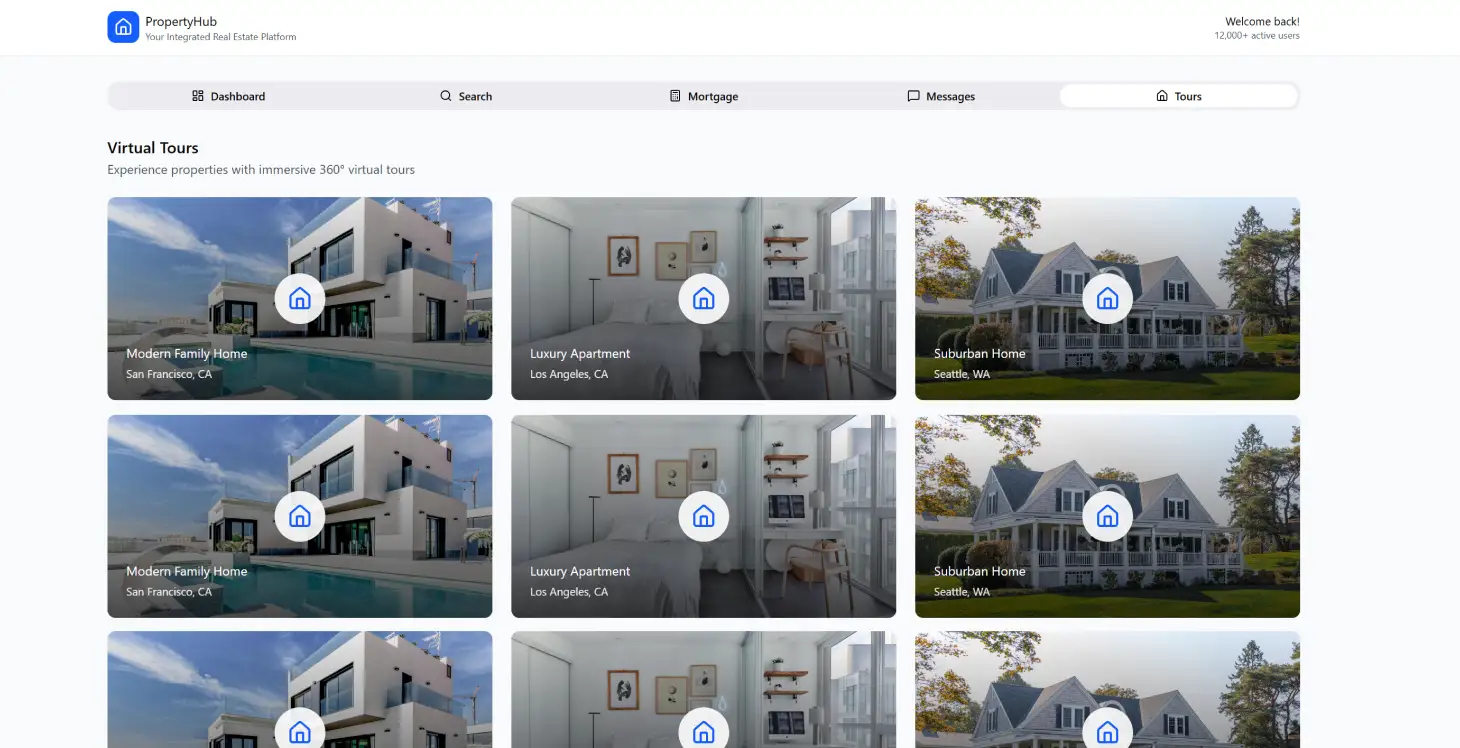

An integrated platform has been created that merges virtual property tours with mortgage prequalification tools and agent communication workflows.

Core Features

- •Unified Property Search: All property exploration tools in one interface

- •Virtual Tour Technology: 360-degree imaging with progressive web app frameworks

- •Real-time Mortgage Integration: Multiple mortgage providers integrated using API connections

- •Agent Communication Workflows: Streamlined scheduling and client management

- •Mobile-First Design: Optimized for on-the-go property browsing

Transform Your Real Estate Experience

Experience seamless property buying with our integrated platform - from search to closing.

Implementation Results

Performance Metrics

The platform currently handles more than 12k property interactions each month with an uptime of 99%.

Enhanced Agent Efficiency

Enhanced agent efficiency through integrated client management dashboards and automated lead assessment. The agents benefited from lead quality due to the inclusion of financial qualification tools, leading to a decrease in time spent on unqualified prospects.

Improved Buyer Experience

- •Faster Decision Making: Buyers were able to grasp their buying capacity quickly and make swift decisions on appropriate properties

- •Seamless Workflow: The smooth progression from expressing interest in a property to completing a mortgage application

- •Expanded Market Access: Virtual tour features enabled evaluation of properties across wider geographic areas

Key Performance Improvements

| Metric | Before | After | Improvement |

|---|---|---|---|

| Transaction Speed | 14 days | 4 days | 71% faster |

| Abandonment Rate | 47% | 29% | 38% reduction |

| Agent Time Savings | - | - | 31% reduction |

| Market Reach | - | - | 28% increase |

Technical Architecture

Platform Design Philosophy

The design of the platform focused on providing a unified user experience by combining property exploration with validation and transaction handling in a seamless manner through blockchain consulting. Instead of developing separate components, it was structured with shared state control and interconnected data transmission in mind.

Key Technical Strategies

- •Real-time Data Synchronization: Across property listings, mortgage rate calculations, and agent availability systems

- •Progressive Web App Framework: For optimal performance across various devices with quick loading speeds and offline functionality

- •API Integration: Various mortgage providers integrated using shared data models while maintaining data privacy through smart contract development

- •Content Delivery Network: Strategic image compression and CDN distribution for improved loading times

Development Process

Iterative Development Approach

The platform was created through an iterative development process that incorporated user feedback interaction into the design phase. The initial focus was on developing a minimum viable product (MVP) that emphasized core property search and virtual tour features.

Testing and Quality Assurance

- •Automated Testing: API connections, mortgage calculations, and cross-browser compatibility

- •User Acceptance Testing: Simulated transactions with real estate professionals and homebuyers

- •Performance Monitoring: Page loading times, API response speeds, and user journey completion rates

Security and Compliance

Security measures were taken to comply with PCI standards for handling sensitive data, ensuring encrypted data transmission and storage through security audits. Multi-factor authentication was implemented for high-value transactions, with additional API security protocols including rate limiting and request validation.

Business Impact

Growth Metrics

Property search sessions have seen growth in length and breadth, suggesting an improved user experience and relevant content availability. Mortgage application approval rates increased thanks to the incorporation and decreased barriers in the eligibility assessment phase.

Operational Benefits

- •Improved Lead Quality: Financial qualification tools resulted in higher-quality prospects for agents

- •Increased Conversion Rates: Streamlined workflow directly influenced lenders' conversion rates and revenue generation

- •Enhanced Market Reach: Virtual tours enabled agents to serve clients across broader geographic areas

Lessons Learned

Mobile-First Importance

Integration Complexity

The complexity of integrating finances was higher than expected due to varying APIs from mortgage providers. Review and refinement of data models and implementation of adapter layers at an early stage could have mitigated timeline delays.

User Experience Optimization

Optimizing the process for users was crucial as extensive features could be overwhelming at first glance. Introducing features gradually and providing guided onboarding steps turned out to be key for user engagement and retention.

Technology Adoption Challenges

Real estate professionals' adoption of technology varied greatly and necessitated comprehensive training programs and continuous support beyond just technical setup and implementation efforts.

Performance Monitoring Evolution

Designing with mobile in mind is crucial; initially overlooking mobile usage led to architectural changes later on. Moving forward, it's essential to prioritize mobile performance and offline features from the start.

The initial focus of performance monitoring was mainly on technical metrics; however it became equally crucial to track business outcomes to showcase platform value and inform feature prioritization decisions.

Future Considerations

Scalability Planning

When planning for growth, expanding to new locations highlighted issues with property search and virtual tour delivery, leading to the need for major infrastructure changes that could have been avoided by including multi-region deployment strategies in the original design.

Enhanced Testing Strategies

Extensive integration testing and utilization of chaos engineering methods would have helped uncover failure scenarios stemming from third-party service dependencies, which surpassed the scope of issues identified during unit testing.

Privacy and Personalization Balance

Balancing the need for personalization features with privacy requirements involved careful deliberation on how data is collected, stored and shared. Adopting privacy-by-design principles early on could have made compliance and user trust easier to manage.

Project Results

- 71% faster transaction speeds achieved

- 38% reduction in abandonment rates

- 99% platform uptime maintained

- 31% reduction in agent time spent on unqualified prospects

- 28% increase in market reach through virtual tours

Key Performance Metrics

Transaction Speed

Faster completion

Abandonment Rate

Reduction achieved

Platform Uptime

System availability

Agent Efficiency

Time savings