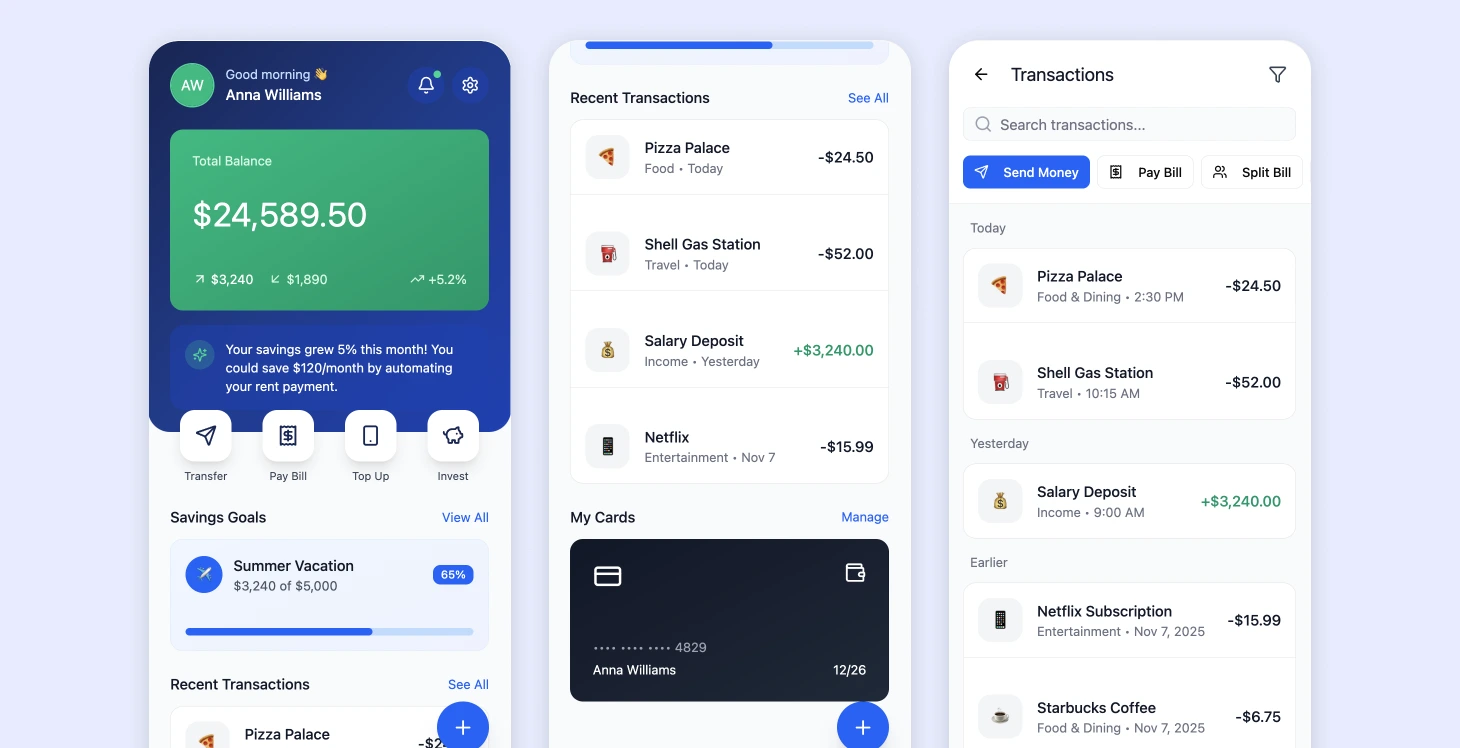

Navigation and Usability Issues

Legacy mobile banking apps posed problems that had an impact on customer satisfaction and operational efficiency with the main issues revolving around:

- •Intricate navigation structures leading to multiple taps for simple tasks

- •Users often giving up on transactions due to confusing processes

- •Unclear interface elements

Limited Personalization

The ability to personalize was quite restricted as many apps offered the experience regardless of:

- •A person's behavior or preferences

- •Financial objectives

- •User interaction patterns

Static interfaces did not adjust to how users interacted with them or offer tailored suggestions based on context which led to engagement levels and missed chances for selling products or services.

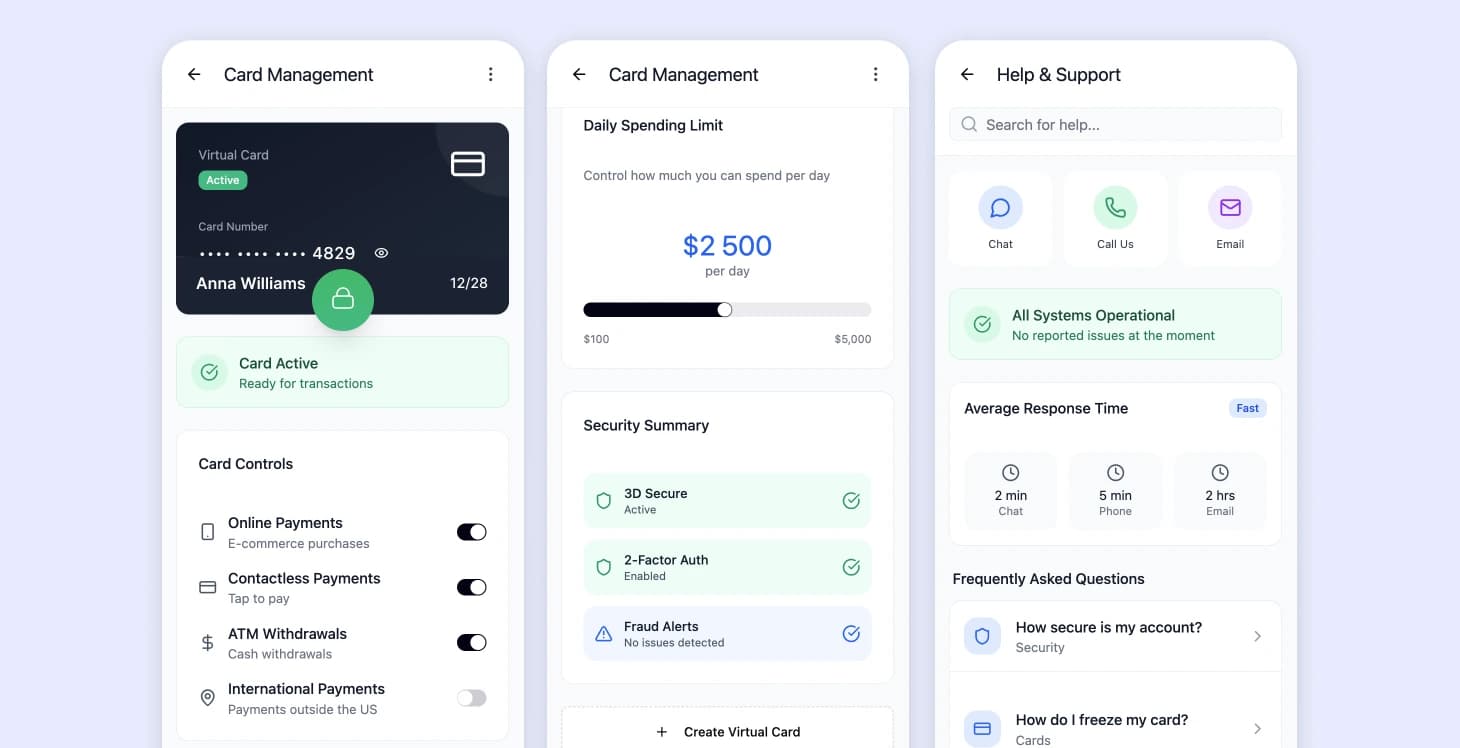

Technical Debt and Performance

Over time and through updates made over the years with the software system came a buildup of debt which resulted in:

- •Performance problems and reliability issues

- •Slow loading speeds

- •Frequent crashes on various devices and operating systems

- •Trust issues among customers

- •Added workload for support teams

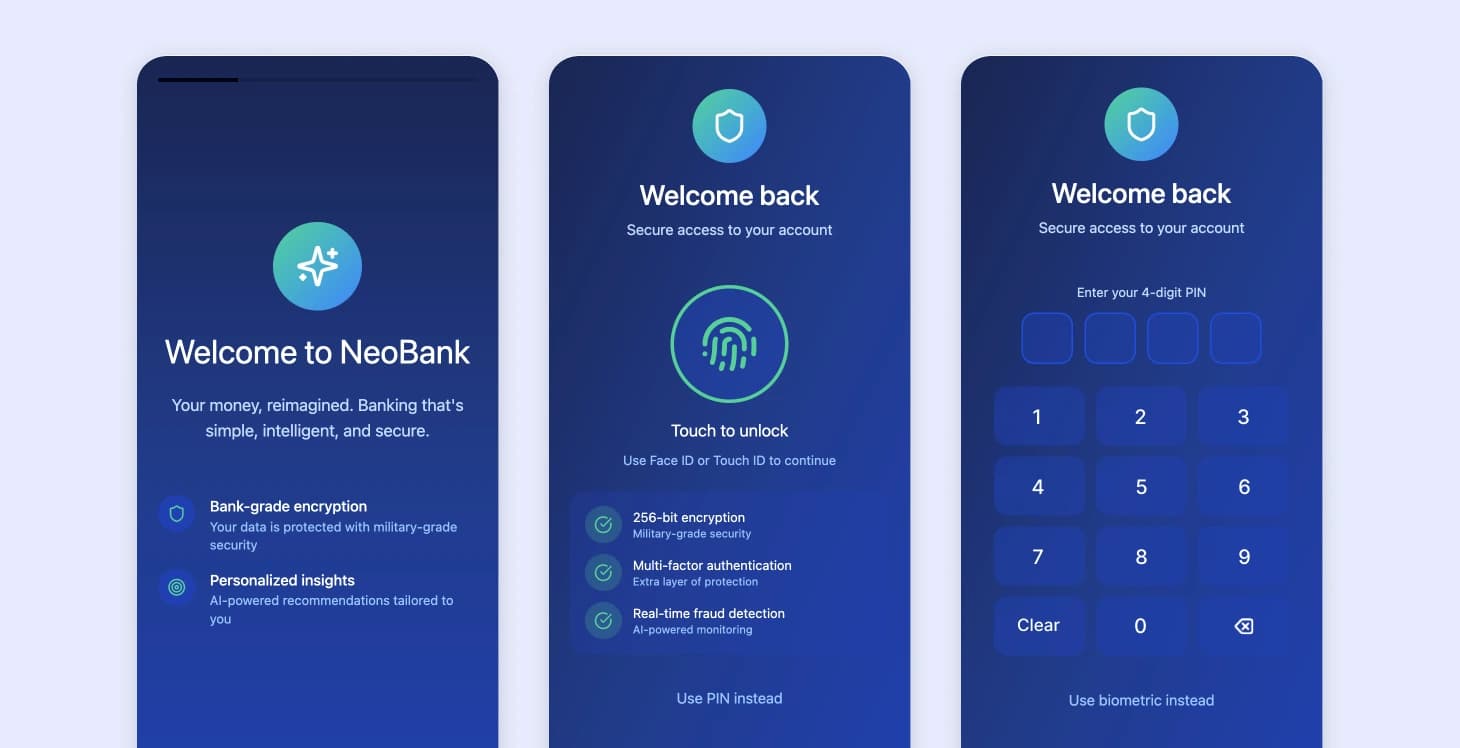

Security vs Usability Conflict

Security measures have historically leaned towards prioritizing protection at the expense of user friendliness. This approach led to:

- •Authentication processes

- •Intricate security protocols that irritate users

- •Potential security risks due to users resorting to workarounds

Integration Challenges

Challenges arose when trying to integrate third party payment processors and financial data providers with banking systems which led to:

- •Data silos

- •Hindered smooth transaction experiences

- •Delays and errors during financial transactions

- •Information gaps during account access attempts