Traditional banks have not kept up with what people want to use mobile options that come first before anything else and the ability to work with different currencies. They also lack tools that combine all your needs in one place.

Project Overview

Platform Overview

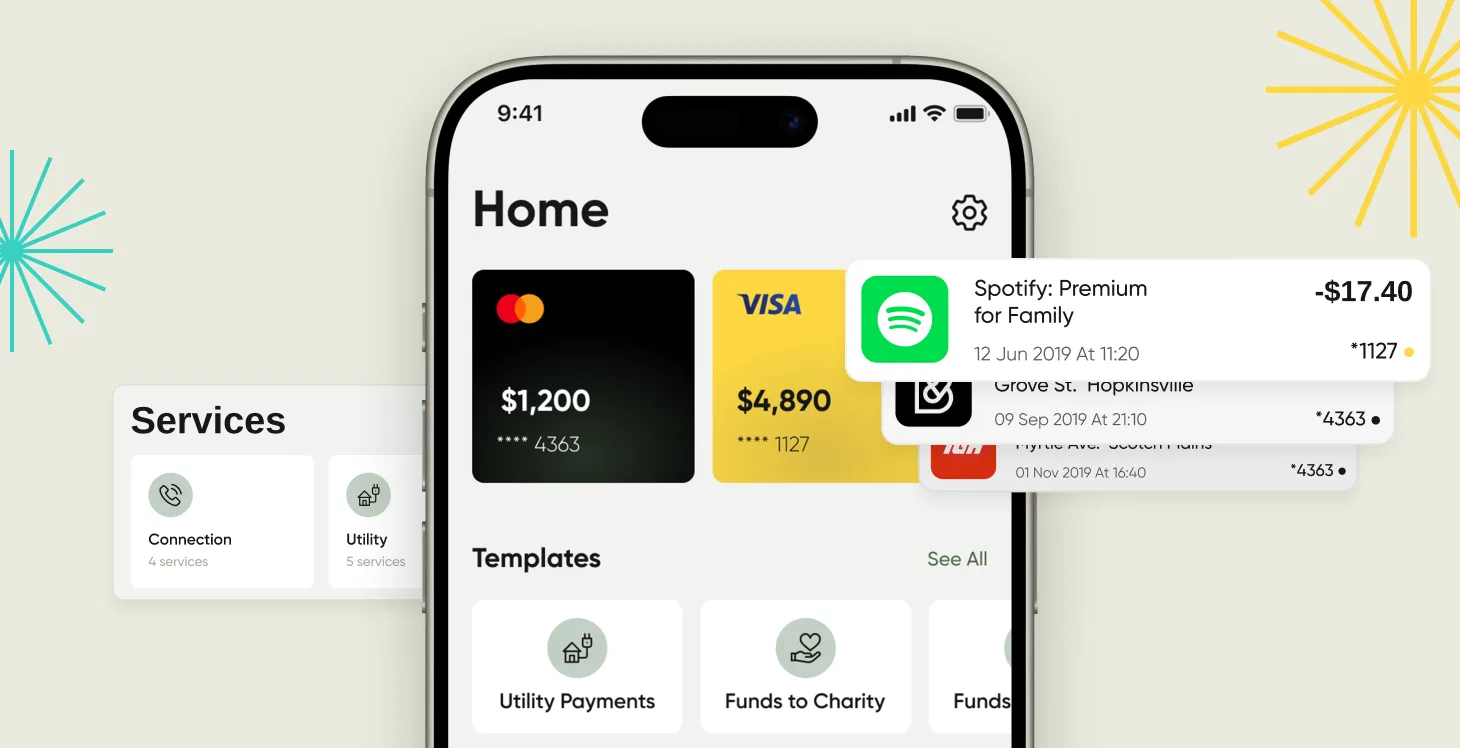

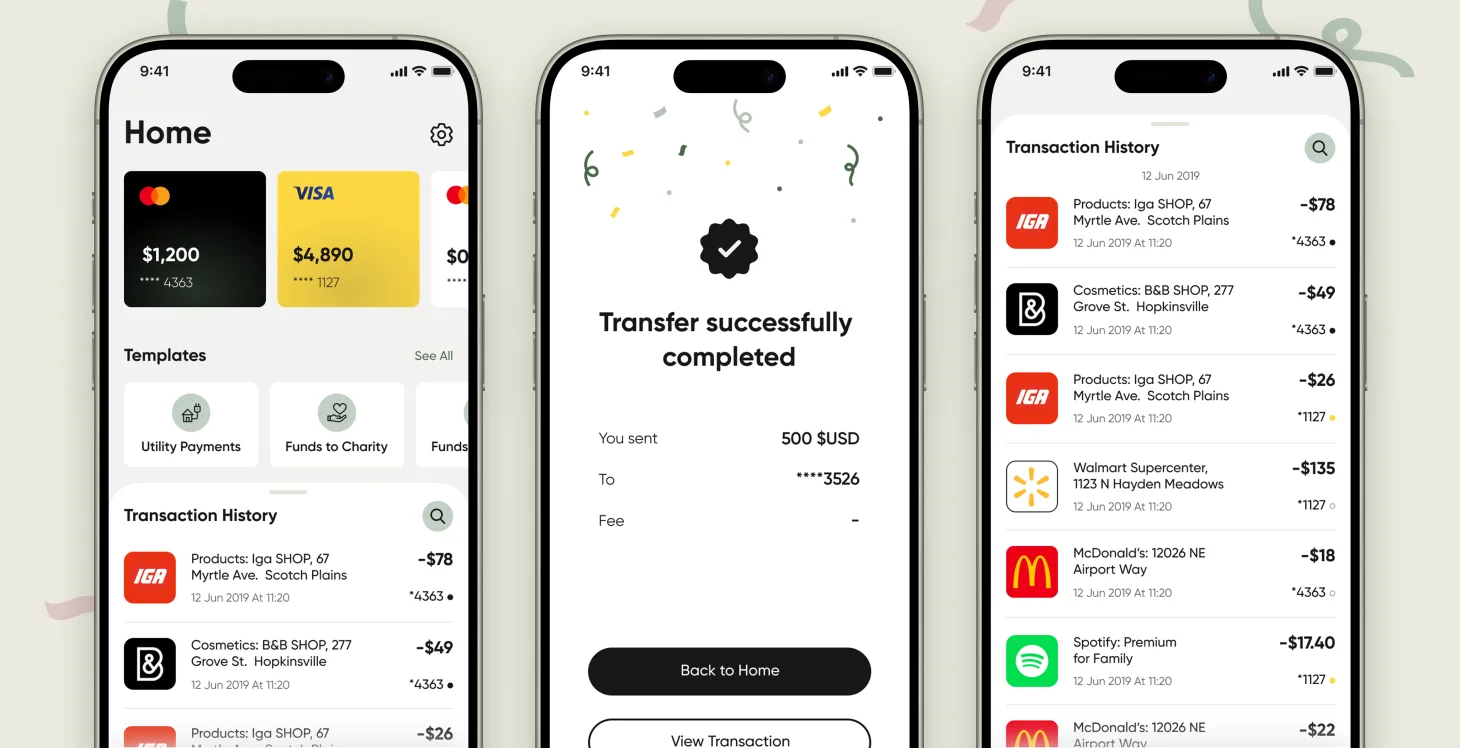

A complete neobanking platform was created with currency account options and real time payment processing. It also includes expense tracking and financial management features that're compliance ready.

Key Performance Metrics

The system managed to maintain uptime at 99.97%, shortened payment processing time by 78% and facilitated border transactions while complying with regulations, in 12 different regions.

Implementations led to a 45 percent decrease in expenses when compared to banking systems while accommodating 15,000 simultaneous transactions per minute.

The platform successfully brought on board 2,100,000 users in a span of 18 months all while upholding PCI DSS Level 1 certification and SOC 2 Type II compliance standards.

Market Challenges and Traditional Banking Limitations

Consumer Demands Evolution

The realm of services saw changes due to evolving consumer demands favoring quick and mobile centric experiences over traditional methods. With core banking systems in place for years, present day consumers seek a level of agility and usability that the current infrastructure struggles to deliver.

Legacy setups pose obstacles to innovation with their structures hindering the introduction of new functions and connectivity to modern payment systems.

Regulatory Compliance Complexity

Meeting standards across regions has introduced new layers of complexity that demand sturdy compliance structures to be in place while ensuring optimal system functionality remains intact. The necessity for transaction handling alongside the ability to support currencies and provide a wide range of financial management features has posed technical obstacles that current banking systems have struggled to effectively tackle.

Market Research Insights

The results from market research showed that customers wanted to use interfaces with fee information and features for financial planning all in one place. The rise in mobile device usage and the need for accessibility around the clock required cloud based systems that could operate globally while upholding security measures similar to those of traditional banks.

Traditional Banking System Limitations

Transaction Processing Delays

The traditional banking systems faced challenges that impacted how users embraced and enjoyed the services offered to them. The older core banking systems relied on batch processing approaches leading to delays in completing transactions and updating accounts. This lag in service frustrated customers who were used to quick interactions.

Cross-Border Payment Challenges

Dealing with payments across borders posed challenges in the past for banks due to their reliance on correspondent banking ties leading to delays in settlements lasting several days and unclear fee systems with limited currency options available to users.

Financial Management Tool Gaps

Users had to depend on apps due to the lack of built in financial management tools which led to data separation and security vulnerabilities. Conventional banks offered spending analysis and budgeting features without financial guidance tools for users to effectively manage their financial well being in full.

Mobile Experience Limitations

Experiences on devices from organizations often involved using mobile friendly websites instead of apps specifically designed for mobile interactions first hand. These approaches had issues with performance and lacked features when offline while also providing inconsistent user experiences across various devices and operating systems.

Solution Results and Improvements

Account Opening Efficiency

The time taken to open an account has been significantly decreased from 5 to 10 minutes using automated KYC processes and digital ID verification. This has led to a 340 percent surge in account sign ups.

Cross-Border Payment Enhancement

Improved cross border payment efficiency by connecting to payment networks and removing delays associated with correspondent banking. This change slashed the settlement time from 3 to 4 hours instead of waiting for 3 to 8 business days.

Cost Reduction

Successfully reduced per transaction processing costs by 45% surpassing banking technology by utilizing cloud based design and automated compliance procedures.

User Engagement Growth

The metrics for user engagement saw a boost with a 280 percent increase in active usage. This growth was achieved by incorporating financial management tools and providing real time transaction notifications.

Compliance Automation

Implemented automated tools for compliance monitoring and reporting led to a 65 percent reduction in compliance workload. This was achieved while ensuring the audit trail integrity was maintained across 12 jurisdictions.

Transform Your Financial Services Today

Discover how our neobanking platform can revolutionize your digital banking experience.

Technical Architecture

Cloud-Based Modular Structure

The digital banking system chose a cloud based and modular structure to overcome the shortcomings of banking setups efficiently and effectively by embracing an API approach for swift updates and seamless third party connections with a focus on robust security measures and regulatory compliance standards.

Microservices Architecture

The banking systems core functions were broken down into services that could scale independently:

- •Account management and transaction processing were handled separately

- •Payment orchestration and compliance monitoring

- •User experience layers

This separation of functionalities allowed for scaling based on demand and smooth implementation of features without interrupting the entire systems operation.

Multi-Currency Wallet System

The platform introduced a versatile wallet system supporting currencies and instant currency exchange features for users to manage money in more than 40 currencies efficiently and securely while ensuring smooth transactions across different networks and regions through strategic partnerships with payment providers and banks.

Financial Management Suite

The platform included a financial management suite that offered users:

- •Categorization of spending habits

- •Budget tracking tools

- •Features for setting savings goals

- •Predicting financial trends

Analyzing transaction patterns using machine learning algorithms was used to provide individuals with advice and insights while upholding high standards for data privacy.

Security Implementation

The security design implemented zero trust concepts along with factor authentication and behavioral analytics to identify and stop suspicious actions effectively in real time scenarios. Sensitive information was securely encrypted both when stored and during transmission using established methods in compliance with regulatory standards for key management systems.

System Components

Core Infrastructure

Integration Components

- •Payment Gateway Adapters: Provide interfaces for payment processors and card networks

- •Banking API Connectors: Integration with correspondent banks and financial institutions

- •Third Party Services: Identity verification, credit scoring, and fraud detection tools

Event-Driven Architecture

The system utilized event driven architecture with message queues to establish connections between services and facilitate asynchronous handling of financial transactions. Circuit breaker patterns were in place to safeguard against chain reactions of failures with monitoring and alert systems offering visibility into all components of the system.

System Architecture Components

| Component | Technology | Purpose |

|---|---|---|

| Payment Orchestration Layer | Custom routing logic | Payment provider routing and reconciliation |

| Compliance Engine | Automated monitoring | Transaction monitoring and audit trails |

| Database Clusters | PostgreSQL with read replicas | Transaction data integrity |

| Secure Storage | Encrypted systems | Compliance documents and user verification |

Implementation Phases

Phase 1: Foundation (Months 1-6)

During the initial stages of development, focus was on:

- •Setting up account management

- •Basic transaction processing systems

- •Complying with regulatory standards

- •Implementing security measures

- •Introducing CI/CD pipelines with automated security checks

- •Developing audit logs

Phase 2: Payment Processing (Months 7-12)

The second phase focused on:

- •Handling payments and providing support for currencies

- •Integration of payment processing features

- •Multi-currency wallet functionality

- •Global transfer services

- •Real-time exchange rate feeds

- •Fee calculation methods

Phase 3: Advanced Features (Months 13-18)

The final stage introduced:

- •Advanced financial management functionalities

- •Expense categorization and budget monitoring

- •Predictive analysis tools using machine learning

- •iOS and Android mobile applications

- •Personalized financial advice through machine learning algorithms

- •Data privacy protocol adherence

Third party security audits and penetration testing were conducted to verify compliance efforts during this phase.

Testing and Quality Assurance

Comprehensive Testing Strategy

Testing encompassed:

- •Unit testing with 95 percent code coverage rate

- •Integration testing spanning all service boundaries

- •Performance testing under anticipated peak workloads

- •Security testing including penetration testing

- •Compliance checks for safety measures and regulatory adherence

Automated testing pipelines were utilized to confirm each code alteration's alignment with security standards and regulatory mandates prior to implementation.

Launch Strategy

Phased Rollout Approach

The platform began its launch with a phased rollout approach:

- •Started with testing among staff and chosen partners

- •Geographic expansion focused on markets with defined structures

- •Existing payment systems integration

- •Automated user migration from legacy systems

- •Support teams for complex account transitions

Risk Management

Risk management involved:

- •Rollback protocols and continuous monitoring

- •Automated notifications

- •Round the clock assistance in early implementation stages

- •Regular disaster recovery testing

- •Recovery time objectives under 15 minutes

- •Zero data loss for transactions

Performance Results

User Acquisition and Engagement

The neobanking platform achieved significant enhancements in all performance metrics while upholding stringent security and compliance measures. User uptake surpassed expectations thanks to its user interface and wide-ranging financial management features.

Security and Compliance Metrics

The security setup demonstrated effectiveness with:

- •No security breaches

- •Fraud rates significantly lower than industry standards

- •Consistent high scores in compliance audits

- •65% reduction in manual compliance workload through automated reports

Financial Performance

The company's financial results exceeded expectations:

- •Revenue per customer 23 percent higher than traditional banking

- •Integrated management tools encouraged user participation

- •Premium services offered additional income streams

- •Enhanced revenue beyond usual transaction fees

Key Success Factors

Compliance-First Approach

Ensuring compliance from the start impacted development efficiency and speed to market significantly, making it integral to incorporate compliance features into the structure for swift geographic growth and minimized ongoing operational costs.

Microservices Architecture Benefits

The choice to use microservices architecture allowed for:

- •Scaling each component quickly

- •Rapid feature development

- •Enhanced adaptability and robustness during expansion

User Experience Focus

User adoption and engagement are primarily influenced by:

- •User experience quality

- •Integrated financial management tools

- •Intuitive interface design

- •Comprehensive functionality

These factors had greater impact than technical performance metrics alone.

Strategic Partnerships

Employment of multiple payment providers and banking partners from the start offered:

- •Backup and bargaining power

- •Protection against potential failures

- •Enhanced negotiation capabilities

- •Maintained user satisfaction and business operations

Privacy-by-Design Implementation

Implementing privacy controls and data minimization principles from the development phase made compliance with changing privacy laws much easier compared to restructuring existing systems later.

This decision necessitated substantial investments in operational tools and monitoring, but the advantages outweighed the increased operational complexity.

Technical Infrastructure Details

API Management

API Gateway: Implemented using Kong for managing request routing functionalities such as rate limiting and authentication. Also serves the purpose of providing API documentation.

Backend Services

Backend Services: Utilize Node.js microservices integrated with the Express framework to handle REST API endpoints.

Database Systems

- •PostgreSQL: Primary database with read replicas for handling transactional data and maintaining audit trails

- •Redis Clusters: System caches data for managing sessions and frequently accessed reference information

- •InfluxDB: Analytics database for storing time series transaction data and performance metrics

Container Orchestration

Kubernetes: Used for managing the deployment and scaling of microservices, providing container orchestration capabilities.

Monitoring and Analytics

- •Prometheus and Grafana: Monitoring and observability tools for collecting metrics and visualizing data

- •NGINX: Load balancing for SSL termination and directing traffic based on location

Platform Achievements

The platform successfully attracted 2.1 million users in 18 months, with 78 percent of these individuals utilizing the financial management features daily. At peak usage times, the system handled up to 15,000 transactions per minute without any performance quality dips.

The comprehensive solution addressed traditional banking limitations while delivering superior performance, security, and user experience in the competitive digital banking landscape.

Project Results

- 2.1 million users onboarded in 18 months

- 99.97% system uptime maintained

- 78% reduction in payment processing time

- 45% decrease in transaction costs

- 280% increase in user engagement

Key Performance Metrics

System Uptime

Platform availability

Processing Speed

Faster payment processing

Cost Reduction

Lower transaction costs

User Growth

Users in 18 months