Consolidating both cryptocurrency and traditional money management into a unified platform resolved the fragmented user experience found in various wallet applications. Successfully implemented seamless transitions for converting between fiat currency and digital assets while adhering to regulations in 15 different regions. This effort led to a 280 percent growth in the number of users onboarded.

Project Overview

Platform Consolidation

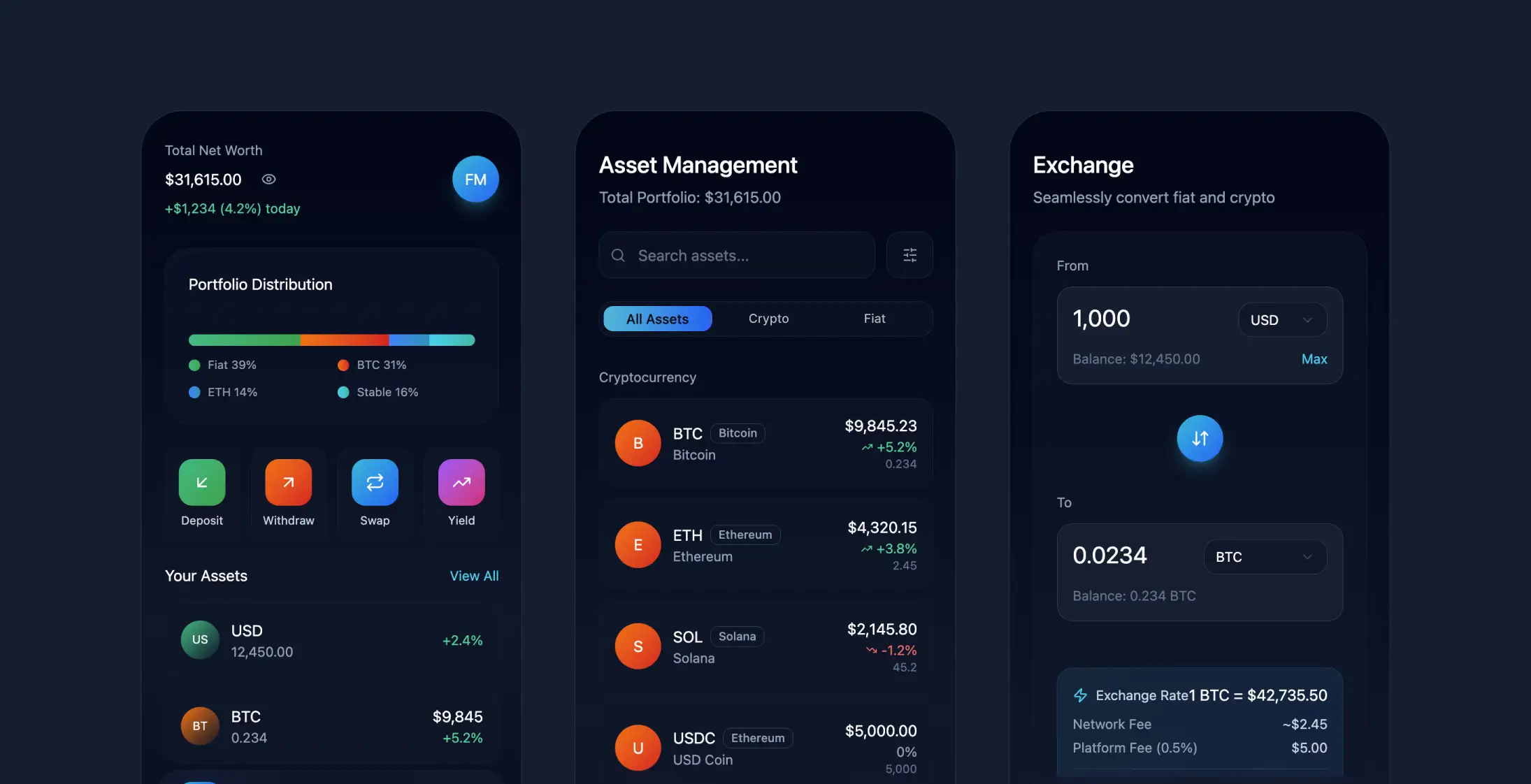

Consolidating both cryptocurrency and traditional money management into a unified platform resolved the fragmented user experience found in various wallet applications.

Successfully implemented seamless transitions for converting between fiat currency and digital assets while adhering to regulations in 15 different regions. This effort led to a 280 percent growth in the number of users onboarded.

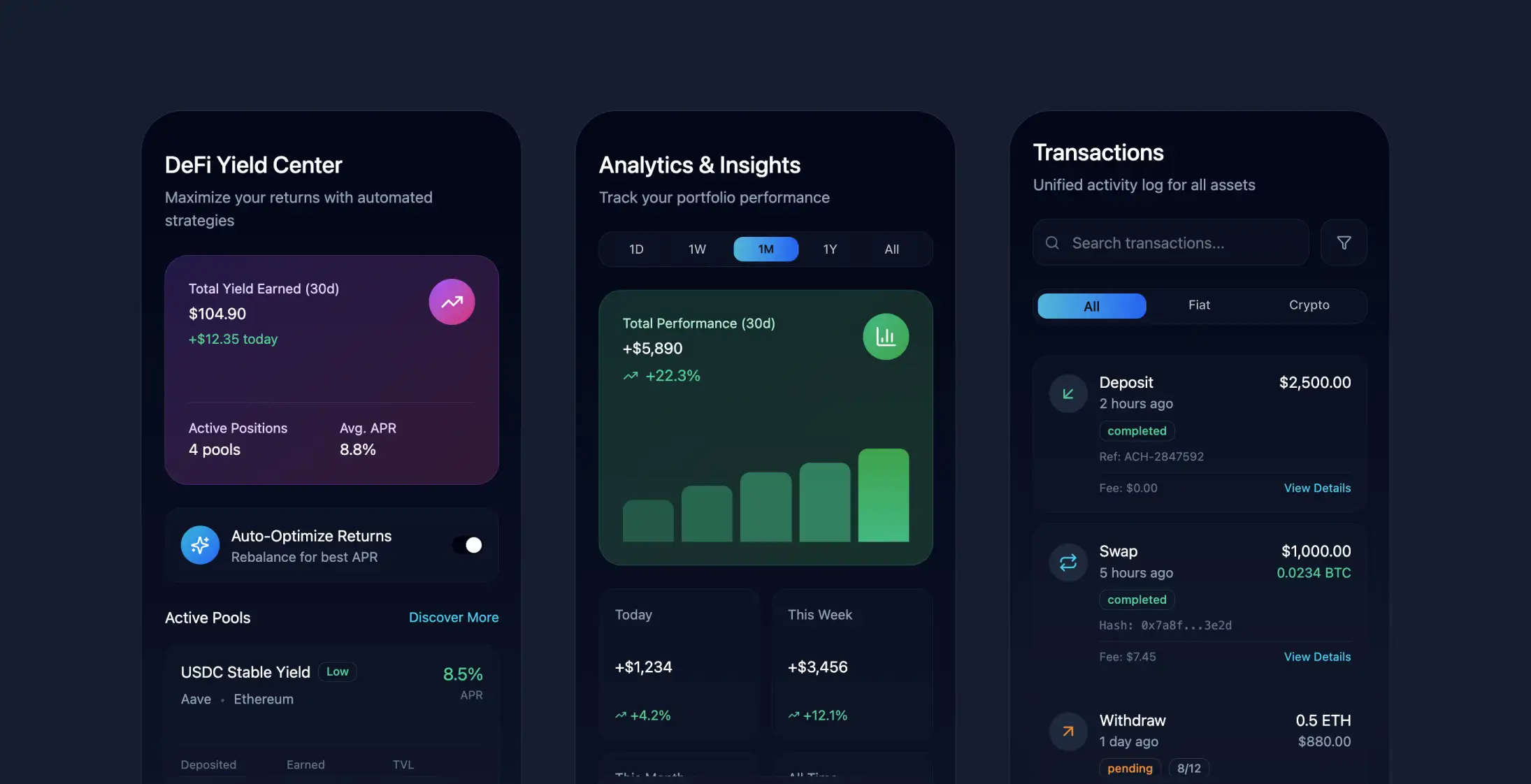

DeFi Integration Performance

The DeFi platform seamlessly combines decentralized finance protocol accessibility with automated yield optimization to deliver an annual percentage yield (APY) of 12.4%. All the while upholding top-tier security measures fit for institutions.

By implementing intuitive user design and automated portfolio adjustments, we were able to decrease customer support inquiries by 67%.

The system achieved transaction confirmation times below 200 milliseconds and maintained a 99.97% uptime by utilizing distributed architecture and implementing real-time fraud detection techniques.

Market Evolution Challenges

The evolution of asset management has progressed beyond cryptocurrency storage to intricate financial ecosystems that demand advanced infrastructure setups.

- •Conventional financial establishments face challenges adapting to blockchain technology

- •Native crypto solutions often lack compliance and user experience standards for widespread acceptance

- •The general public requires more accessible solutions

Technical Integration Hurdles

The combination of traditional finance and decentralized finance presents technical hurdles concerning:

- •Key management security measures

- •Compliance with regulations

- •Seamless interaction across different blockchains

- •User-friendly experience design

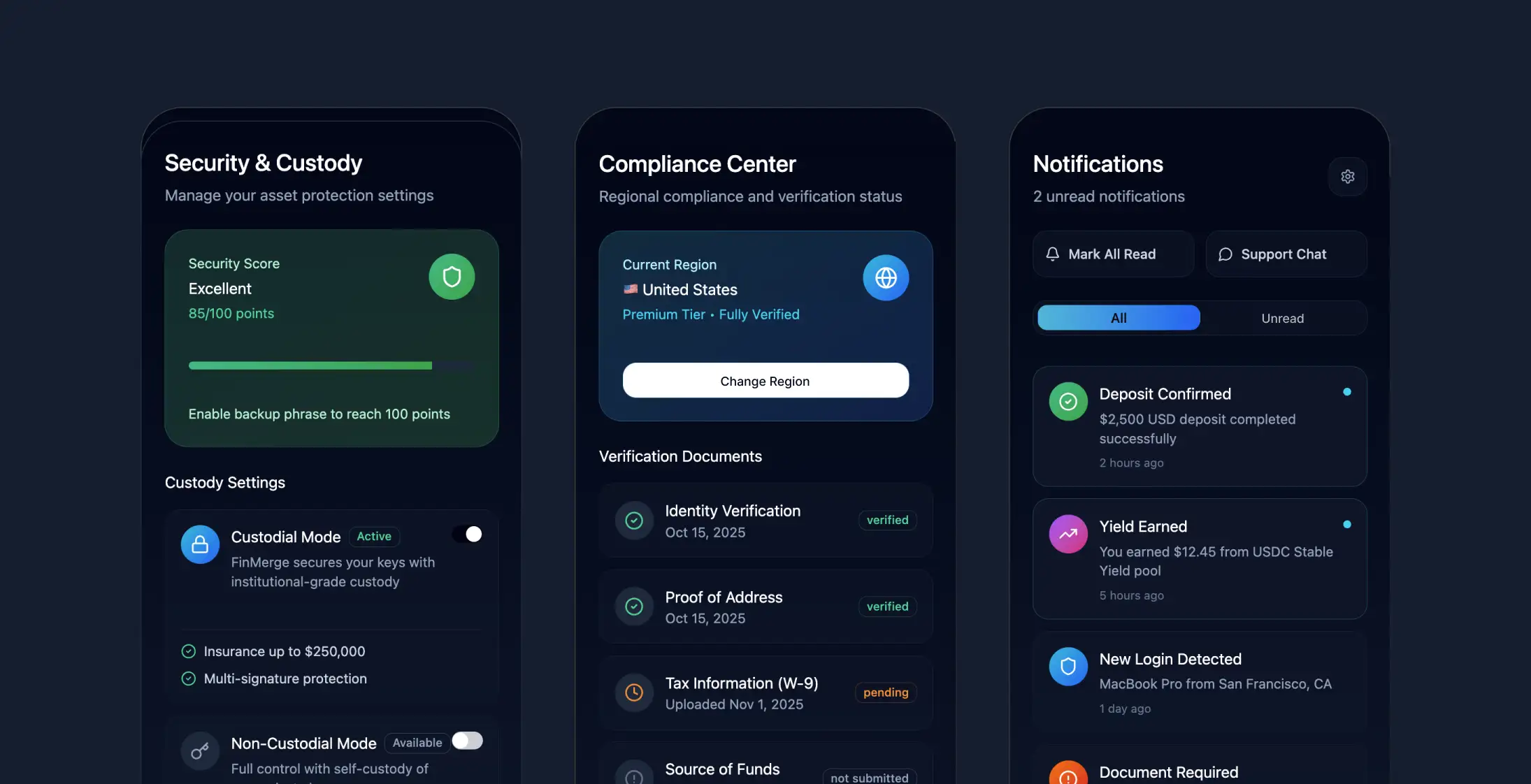

Security protocols must meet institutional standards for safekeeping as well as the demands of decentralized protocols while ensuring ease of access for users with varying levels of technical proficiency.

Regulatory Complexity

Regulations are constantly changing in various jurisdictions and demand adaptable compliance systems that can adjust to new requirements without sacrificing essential functions. The platform needs to manage both custodial and non-custodial assets while ensuring reliable security measures are in place.

User Experience Problems

Asset Management Fragmentation

Users encountered challenges in handling a variety of assets spread across different platforms that had:

- •Unique security measures

- •Different interface designs

- •Specific operational protocols to follow

Security Concerns

Private key management posed a significant security concern as users had to either trust third-party services or deal with intricate self-custody processes that often led to loss of assets.

Fiat Integration Challenges

Navigating through traditional banking demands is essential for integrating fiat currency, all while balancing:

- •Competitive transaction fees

- •Swift processing times

- •24/7 cryptocurrency trading operations

- •Global user demographics

- •Traditional banking limitations

DeFi Accessibility Barriers

Accessing DeFi protocols requires technical understanding that may exclude regular users from yield opportunities while also posing risks to experienced users due to:

- •Smart contract vulnerabilities

- •Potential impermanent losses

- •Complex multi-chain operations

- •Portfolio management challenges across the DeFi ecosystem

Transaction Inconsistencies

Transaction confirmations and fees differed widely among blockchain networks, leading to:

- •Inconsistent user experiences

- •Slower adoption rates

- •Trust issues from security breaches

- •Need for improved transparency

Simplify Your DeFi Experience

Access institutional-grade security with user-friendly design for optimal yield farming.

Solution Implementation

Unified Management Interface

The unified management interface streamlined the process by removing the necessity for multiple wallet applications. This change led to:

- •Decreased user cognitive load

- •Enhanced visibility of assets within portfolios

- •Improved overall user experience

Regulatory Compliance

Automated compliance with regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML) facilitated market expansion into 15 jurisdictions while sustaining a 94% user approval rating.

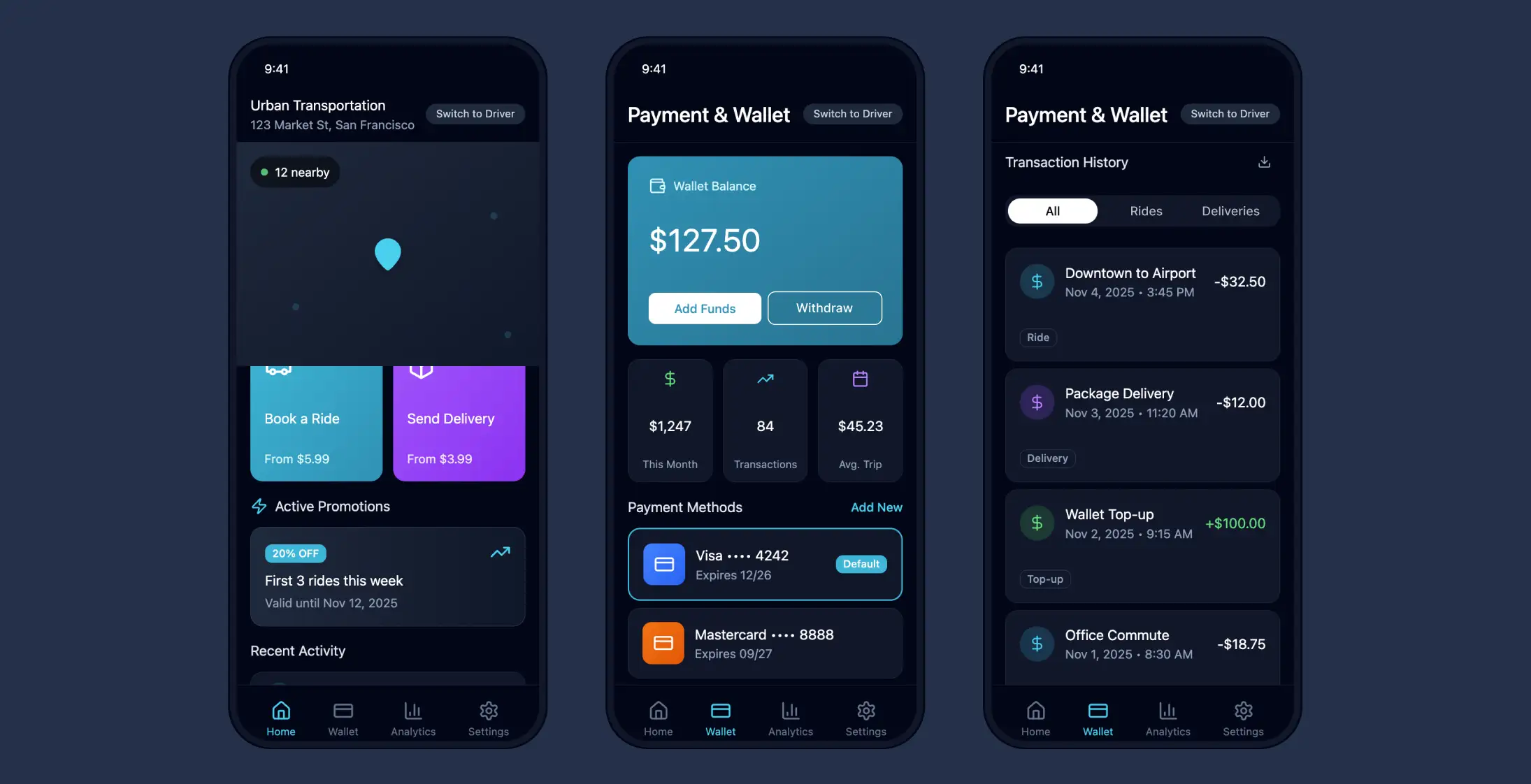

Fiat Integration

Integrated fiat on/off ramps provide enhanced access to liquidity offering spreads of around 0.75%. By eliminating the need for third-party exchanges, settlement times have been reduced significantly from 3-4 days down to 4-8 hours.

DeFi Optimization

Automated DeFi integration for yield optimization ensured optimal returns from yield farming while simplifying protocol complexities for users.

Performance Results

Key Performance Metrics

| Metric | Improvement | Impact |

|---|---|---|

| Customer Acquisition Cost | 43% decrease | Enhanced cost-effectiveness |

| User Retention (90 days) | 78% rate | Improved user satisfaction |

| Manual Intervention | 89% reduction | Automated portfolio management |

| Transaction Processing | 77% faster | Enhanced user experience |

Platform Architecture

Security Layer

The platform structure distinguishes security tasks from user interactions using a layered security approach:

- •Private keys are never stored in plain text within the application layer

- •Protection through secure enclaves and hardware security modules

- •All encryption processes utilize institutional-grade security

Microservices Design

Microservices architecture allows for scaling specific areas independently while maintaining strong security measures. The fiat integration layer simplifies banking complexities using APIs while ensuring adherence to regional regulatory standards.

DeFi Integration Layer

DeFi integration happens using smart contract proxies that allow secure access to protocols while adding:

- •Security measures and automated risk management

- •User-friendly interfaces that simplify underlying protocol complexity

- •Transparent visibility into yield strategies and associated risks

Security Framework

Progressive Disclosure

The system focuses on progressive disclosure of functions to users:

- •Beginners can access essential features easily

- •Experienced users can utilize advanced capabilities

- •Security measures adjust based on user activity and asset worth

Core Security Components

Infrastructure Security

- •Service Mesh Integration: Kubernetes orchestration with automated load balancing

- •Smart Contract Proxies: Automated yield strategy execution with impermanent loss protection

- •Zero-Knowledge Architecture: Encrypted storage with privacy controls

- •Real-time Monitoring: Security event correlation and automated incident response

The central security structure incorporates multiple layers including hardware security modules for secure key storage, secure enclaves for transaction signing, and multi-party computation for recovery operations.

Development and Deployment

Security-First Approach

The project prioritized security from inception by:

- •Incorporating threat analysis early in the design process

- •Leveraging infrastructure as code for deployments

- •Implementing automated security checks in CI/CD pipelines

- •Maintaining strict environment separation

Deployment Pipeline

The deployment pipeline utilizes GitLab CI/CD for:

- •Automated security scanning

- •Dependency vulnerability assessment

- •Infrastructure drift detection

- •Automated rollbacks upon SLO violations

Testing Strategy

Comprehensive security testing involves:

- •Penetration testing and smart contract audits

- •Load testing with realistic transaction patterns

- •Network congestion scenario testing

- •Gradual feature rollout using feature flags

Risk Management

Comprehensive Security Program

- •Bug bounty programs with security experts

- •Tabletop exercises for incident response procedures

- •Automated compliance monitoring and reporting

- •Digital asset custody insurance coverage

Implementation Challenges and Solutions

Network Congestion Management

Handling blockchain network congestion during peak times required:

- •Advanced network optimization patterns

- •Distributed architecture implementation

- •Real-time performance monitoring

Multi-jurisdictional Compliance

Ensuring seamless user experience while complying with diverse regulatory requirements across various jurisdictions demanded:

- •Flexible compliance frameworks

- •Proactive engagement with regulatory authorities

- •Automated legal requirement adaptations

User Experience Optimization

Enhancing user experience involved:

- •Progressive disclosure of features to boost user acceptance

- •Preserving advanced functionalities for experienced users

- •Extensive testing with user focus groups

- •Identifying usability concerns before production implementation

Implementing security measures during early development stages proved more cost-effective than retrofitting them later, emphasizing the importance of thoughtful planning for hardware security module integration.

Technology Stack

Backend Services

- •Node.js with Express for core application logic

- •Python for data analysis and machine learning components

- •Kubernetes for container orchestration and scaling

Monitoring and Analytics

- •Prometheus for metrics collection

- •Grafana for dashboard visualization

- •ELK Stack for comprehensive logging

- •Distributed consensus for critical state management

Future Enhancements

Future developments could benefit from:

- •Incorporating formal verification methods for smart contracts earlier

- •Embracing broader chaos engineering strategies

- •Testing system resilience under challenging conditions

- •Expanding cross-chain interoperability features

The successful implementation demonstrates that combining traditional finance with DeFi capabilities requires careful attention to security, user experience, and regulatory compliance, but can deliver significant improvements in user adoption and platform performance.

Project Results

- 280% growth in user onboarding

- 12.4% annual percentage yield achieved

- 67% reduction in customer support inquiries

- 99.97% system uptime maintained

- 94% user approval rating

Key Performance Metrics

User Growth

Increase in user onboarding

Annual Yield

APY achieved

Support Reduction

Fewer support inquiries

System Uptime

Platform availability